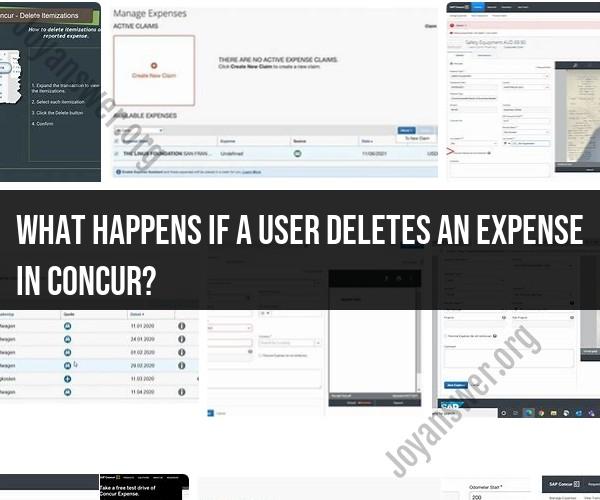

What happens if a user deletes an expense in concur?

In Concur, the ability to delete an expense entry is typically granted to users as part of their permissions. When a user deletes an expense in Concur, several consequences and actions may occur, depending on the system's configuration and the organization's policies. Here are some common outcomes when a user deletes an expense:

Reversal of the Expense Entry: The primary consequence of deleting an expense is that the expense entry is removed from the user's expense report or list of expenses. This means that the expense will no longer be considered for reimbursement, and it will not appear in any associated reporting.

Impact on Reporting: Deleting an expense can affect the accuracy of expense reporting, as the deleted expense will not be included in any reports generated for auditing, budgeting, or other financial purposes.

Audit Trail: Concur often maintains an audit trail or history of user actions within the system. When an expense is deleted, the action is typically recorded in the system's audit trail. This can include information about who deleted the expense, when it was deleted, and the reason provided by the user.

Notifications: Depending on the organization's policies and configurations, deleting an expense may trigger notifications or alerts. These notifications could be sent to administrators, managers, or other relevant parties to inform them of the deletion.

Manager or Administrator Review: Some organizations configure Concur to require manager or administrator approval before expenses are deleted. In such cases, deleting an expense may require justification, and the manager or administrator may need to review and approve the deletion request.

Policy Violations: Deleting expenses may be subject to the organization's expense policies. If the deletion of an expense violates policy rules or thresholds, it may require additional scrutiny or explanation.

Data Recovery: In some cases, organizations may have mechanisms in place to recover deleted expenses, especially for auditing or compliance purposes. Deleted expenses may be stored in a backup or archive for a certain period.

It's essential for Concur users to be aware of their organization's policies and procedures regarding expense deletion. Many organizations have specific guidelines and controls in place to ensure the integrity of their expense management processes.

Additionally, users should exercise caution when deleting expenses and provide appropriate justifications when required. Deleting an expense should not be taken lightly, as it can impact financial records, reporting accuracy, and compliance with company policies and regulations. If you are uncertain about the consequences of deleting an expense in Concur or have questions about your organization's policies, it's advisable to consult with your company's Concur administrator or finance department for guidance.