How to calculate and use the interest coverage ratio?

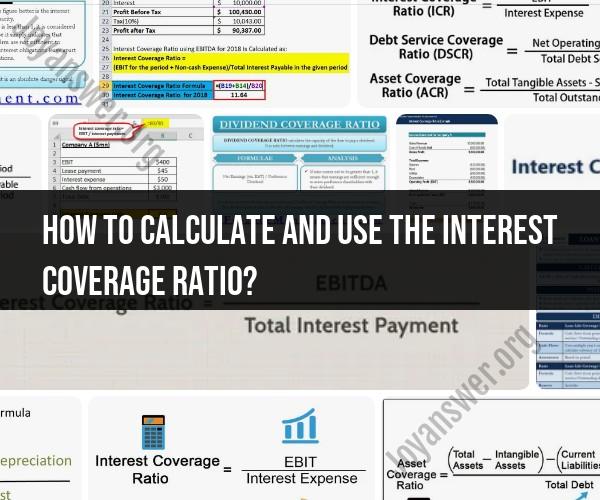

The interest coverage ratio is a financial metric used to assess a company's ability to meet its interest obligations on outstanding debt. It provides insight into the company's ability to handle its interest expenses with its operating income. The formula for calculating the interest coverage ratio is as follows:

Here's a step-by-step guide on how to calculate and use the interest coverage ratio:

Calculation:

Determine EBIT (Earnings Before Interest and Taxes):

- EBIT represents a company's operating income before deducting interest and taxes.

- Calculate EBIT using the formula:

Identify Interest Expense:

- Interest expense is the total cost of borrowing and is found on the company's income statement.

Apply the Formula:

- Use the formula to calculate the interest coverage ratio.

Interpretation and Use:

Higher Ratio (e.g., 3 or higher):

- A higher interest coverage ratio indicates that the company is more capable of meeting its interest obligations with its current level of earnings.

- Investors and creditors generally view a higher ratio as a positive sign of financial health.

Lower Ratio (e.g., less than 1):

- A lower interest coverage ratio suggests that the company may have difficulty covering its interest expenses with its current level of earnings.

- A ratio below 1 indicates that the company is not generating enough operating income to cover its interest expenses.

Industry Comparison:

- Compare the interest coverage ratio to industry benchmarks or competitors to assess how the company's financial health compares to others in the same sector.

Risk Assessment:

- A declining interest coverage ratio over time may signal increased financial risk, as it suggests that the company's ability to meet interest obligations is weakening.

Creditworthiness:

- Lenders and creditors often use the interest coverage ratio to evaluate a company's creditworthiness. A higher ratio may result in more favorable lending terms.

Investor Decision-Making:

- Investors use the interest coverage ratio as part of their analysis when making investment decisions. A strong interest coverage ratio can be an indicator of financial stability.

Example:

Let's say a company has an EBIT of $500,000 and an interest expense of $100,000. The interest coverage ratio would be:

This means that the company's operating income is five times greater than its interest expenses, indicating a healthy ability to cover its interest obligations.

It's important to note that the interpretation of the interest coverage ratio may vary by industry, and it should be considered alongside other financial metrics for a comprehensive analysis of a company's financial health.

The interest coverage ratio (ICR), also known as the times interest earned (TIE) ratio, is a financial metric that assesses a company's ability to meet its interest payments on outstanding debt. It indicates whether a company's earnings are sufficient to cover its interest expenses.

Formula for Calculating the Interest Coverage Ratio:

The interest coverage ratio is calculated using the following formula:

ICR = EBIT / Interest Expense

Where:

EBIT (Earnings Before Interest and Taxes): This is a measure of a company's operating profitability before interest and taxes are deducted.

Interest Expense: This is the total amount of interest a company pays on its debts during a given period.

Interpretation of the Interest Coverage Ratio:

A higher interest coverage ratio indicates that a company has more earnings available to cover its interest payments. A lower interest coverage ratio suggests that a company may have difficulty meeting its debt obligations.

Generally, a ratio of 1.5 or higher is considered acceptable for most companies. However, the acceptable range may vary depending on the industry and the company's specific financial situation.

Applications of the Interest Coverage Ratio:

The interest coverage ratio is used by various stakeholders, including:

Creditors: Creditors use the ICR to assess a company's creditworthiness and determine the risk associated with lending to the company.

Investors: Investors use the ICR to evaluate a company's financial health and make informed investment decisions.

Company Management: Company management uses the ICR to monitor the company's ability to meet its debt obligations and identify potential financial risks.

By analyzing the interest coverage ratio, investors and creditors can gain insights into a company's financial strength and its ability to manage its debt obligations. A high ICR indicates a company's ability to comfortably meet its interest payments, while a low ICR may raise concerns about its financial stability and creditworthiness.