How to calculate cost of revenue?

Calculating the cost of revenue involves several essential steps. Here's how to do it:

Identify Direct Costs: Start by identifying all the direct costs associated with generating revenue. These costs are directly tied to the production or delivery of goods or services. Examples include the cost of raw materials, labor directly involved in production or service delivery, and any direct overhead costs associated with production facilities.

Calculate Cost of Goods Sold (COGS): For businesses that sell products, the primary component of the cost of revenue is the cost of goods sold (COGS). To calculate COGS, add up all the direct costs associated with producing or acquiring the goods that were sold during a specific period. This typically includes the beginning inventory, purchases or production costs incurred during the period, and subtracting the ending inventory.

COGS = Beginning Inventory + Purchases or Production Costs - Ending Inventory

Include Direct Costs for Services: For service-based businesses, calculate the direct costs associated with delivering services. This may include labor costs for service providers, materials used in providing the service, and any other direct expenses incurred in the process.

Add Other Direct Costs: Depending on the nature of your business, there may be other direct costs that need to be included in the calculation. These could include shipping costs, packaging costs, or any other expenses directly tied to the revenue-generating activities.

Exclude Indirect Costs: It's important to exclude indirect costs, such as administrative expenses or marketing costs, from the calculation of the cost of revenue. These costs are not directly tied to the production or delivery of goods or services and are typically accounted for separately.

Calculate Total Cost of Revenue: Once you have identified and calculated all the direct costs associated with generating revenue, sum them up to find the total cost of revenue for the specific period.

Total Cost of Revenue = COGS + Direct Costs for Services + Other Direct Costs

By following these steps, you can accurately calculate the cost of revenue, which is crucial for understanding the profitability of your business operations.

Deep Dive into Cost of Revenue: Factors, Differences, and Optimization

1. Factors in Cost of Revenue:

Calculating cost of revenue goes beyond a simple price tag. Here are key factors to consider:

- Direct Costs:

- Manufacturing: Raw materials, labor, production overheads (utilities, depreciation)

- Services: Materials, personnel costs, freelance fees, equipment rentals

- Distribution: Shipping, warehousing, logistics

- Indirect Costs:

- Marketing & Sales: Advertising, commissions, salaries, travel

- Customer Service: Support staff, training, returns processing

- Research & Development: Product innovation, testing, prototyping

- Other Expenses:

- Taxes, depreciation of assets used in production, quality control costs

2. Cost of Revenue vs. Other Metrics:

While all financial metrics measure different aspects of a business, here's how cost of revenue stands out:

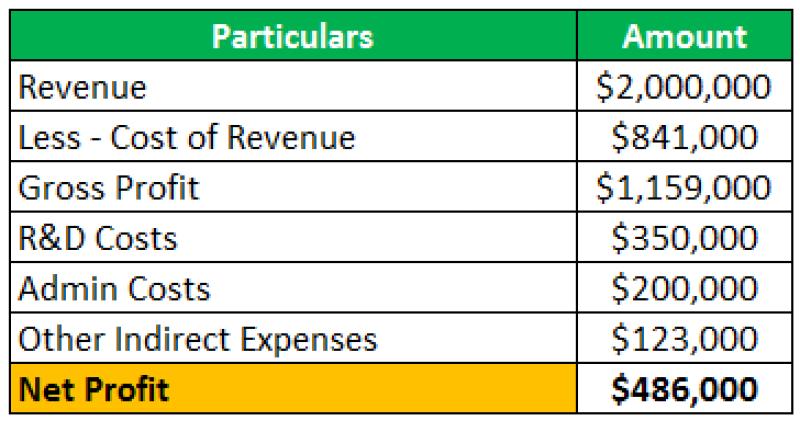

- Focus: Cost of revenue reflects the direct and indirect expenses incurred to deliver products or services, impacting gross profit and profitability.

- Comparison: Unlike revenue, which represents income, cost of revenue is an expense. It's compared to revenue to calculate gross profit margin, a key profitability indicator.

- Management: Optimizing cost of revenue directly affects the bottom line, making it crucial for cost management and efficiency.

3. Optimizing and Reducing Cost of Revenue:

Finding the right balance between cost and quality is key. Here are some strategies:

- Negotiate better prices: Seek discounts from suppliers and vendors.

- Improve production efficiency: Streamline processes, minimize waste, and leverage technology.

- Optimize inventory management: Reduce carrying costs and avoid stockouts.

- Outsource non-core functions: Consider outsourcing specific tasks for cost savings.

- Negotiate lower shipping costs: Explore volume discounts or alternative carriers.

- Reduce returns and allowances: Implement stricter quality control and clear return policies.

- Automate tasks: Use technology to automate manual processes and reduce labor costs.

Additional Tips:

- Regularly analyze cost of revenue by product, service, or channel to identify areas for improvement.

- Benchmark your cost of revenue against industry competitors to identify potential gaps.

- Invest in employee training and development to improve efficiency and reduce errors.

- Continuously review and adjust your cost management strategies based on market changes and business needs.

By understanding the factors involved and employing these optimization methods, you can effectively manage your cost of revenue and boost your business's profitability.