What features does STCU Mobile Banking have?

Spokane Teachers Credit Union (STCU) offers a range of mobile banking features that provide convenient services for its members. These features are designed to make banking easier, more efficient, and accessible on-the-go. Keep in mind that specific features and capabilities may vary, and I recommend checking directly with STCU or their official website for the most up-to-date information. Here are some common mobile banking features that STCU may offer:

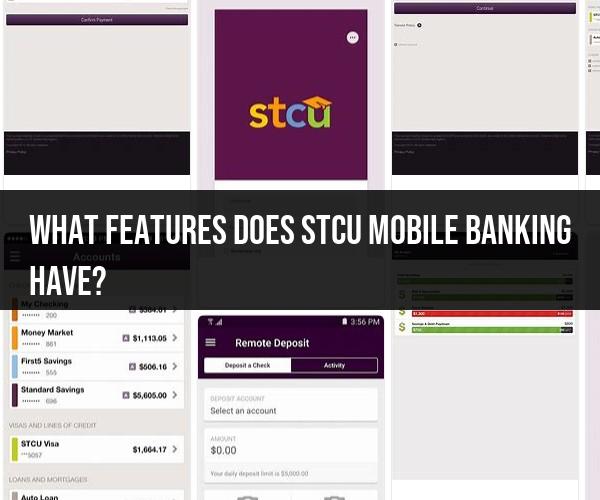

1. Account Access:View your account balances, transaction history, and recent activity from your mobile device.

2. Mobile Check Deposit:Deposit checks by taking photos of the front and back of the check using your mobile device's camera. This feature eliminates the need to visit a branch or ATM.

3. Bill Payment:Pay your bills conveniently through the mobile app. You can set up one-time or recurring payments, manage payees, and schedule payments in advance.

4. Fund Transfers:Transfer funds between your STCU accounts or to other accounts, both internally and externally. This includes transferring money to other STCU members or external accounts at different financial institutions.

5. Mobile Wallet Integration:Link your STCU debit or credit card to mobile wallet services like Apple Pay, Google Pay, or Samsung Pay for secure and contactless payments.

6. Account Alerts:Set up customizable alerts to receive notifications about important account activities, such as low balances, large transactions, or upcoming bill due dates.

7. eStatements:Access and view your account statements electronically through the mobile app, reducing paper clutter.

8. Branch and ATM Locator:Locate STCU branches and ATMs using your mobile device's GPS or search functionality. This feature helps you find nearby locations for in-person banking needs.

9. Secure Messaging:Communicate securely with STCU's customer service team through the mobile app, allowing you to ask questions, report issues, or receive assistance.

10. Loan and Credit Card Management:Monitor your loans and credit card accounts, make payments, and view transaction details directly from the mobile app.

11. Budgeting and Spending Analysis:Some mobile banking apps provide tools to help you track your spending, categorize transactions, and create budgets to manage your finances effectively.

12. Quick Balance Preview:Check your account balances without fully logging into the app by using a quick balance preview feature.

Remember that security is paramount when using mobile banking features. Make sure to keep your device's operating system and the mobile banking app up to date, use strong and unique passwords, enable biometric authentication if available, and avoid using public Wi-Fi networks for sensitive transactions.

Since features and offerings can evolve, I recommend visiting STCU's official website or contacting their customer support to get the most current and detailed information about their mobile banking features.