Are dividends received taxable?

Yes, dividends received are generally taxable income. Dividends are distributions of a company's earnings to its shareholders, and they are considered a form of income for the recipient. The taxation of dividends depends on various factors, including the type of dividend, the investor's tax bracket, and the tax laws of the jurisdiction.

Here are key points regarding the taxation of dividends:

Ordinary Dividends:

- Ordinary dividends, which are the most common type of dividends, are typically taxed at ordinary income tax rates. These rates vary depending on the investor's overall income and tax bracket.

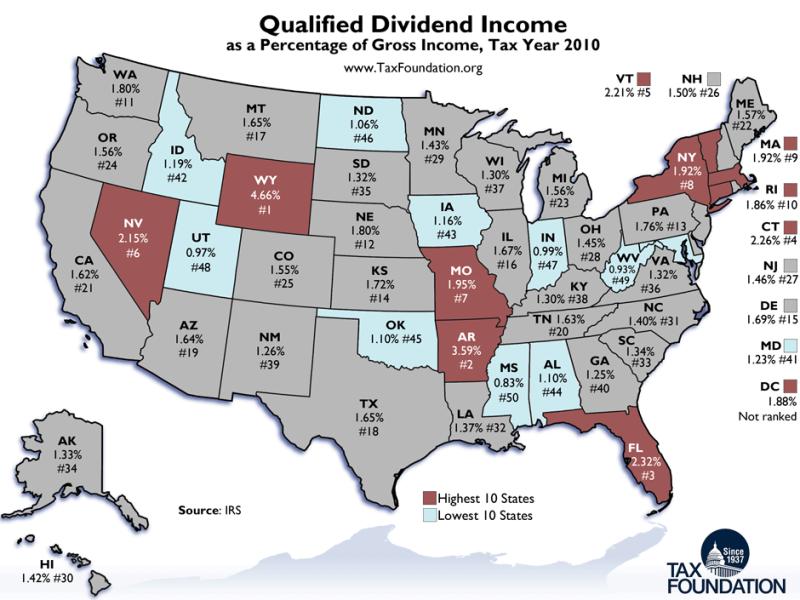

Qualified Dividends:

- Qualified dividends are a specific type of dividend that may be eligible for lower tax rates. qualified dividends are subject to long-term capital gains tax rates, which are generally lower than ordinary income tax rates. To qualify for this lower tax rate, certain conditions must be met, including holding the stock for a specific period.

Tax-Deferred and Tax-Exempt Accounts:

- Dividends received in tax-deferred accounts, such as traditional Individual Retirement Accounts (IRAs) or 401(k) accounts, are generally not immediately taxable. However, taxes may be applicable when funds are withdrawn from these accounts. Dividends received in tax-exempt accounts, such as Roth IRAs, are often tax-free if certain conditions are met.

Foreign Dividends:

- Dividends received from foreign companies may have different tax implications, and investors should be aware of any applicable tax treaties between their country of residence and the country where the company is based.

Tax Forms:

- Investors receive tax forms, such as Form 1099-DIV in the United States, from brokerage firms or financial institutions detailing the amount of dividends received during the tax year. This information is used when filing income tax returns.

Reinvestment Programs:

- Dividends that are reinvested through dividend reinvestment programs (DRIPs) are still considered taxable income, even though they are used to purchase additional shares rather than being received as cash.

It's important for investors to be aware of the tax implications of dividends and to consider these factors when making investment decisions. Tax laws may change, and individual circumstances can vary, so consulting with a tax professional or financial advisor is recommended for personalized advice based on current regulations and the investor's specific situation.

Navigating the tax implications of dividends is crucial for investors. Here's a breakdown of different types, tax rates, and strategies for optimization:

1. Taxable vs. Non-Taxable Dividends:

- Taxable dividends: The majority of dividends distributed by corporations are considered taxable income. These include most common and preferred stock dividends.

- Non-taxable dividends: Certain types of dividends may be exempt from taxes, such as:

- Municipal bond dividends: Interest income from municipal bonds issued by state or local governments is generally tax-exempt at the federal level and may also be exempt in specific states.

- Stock dividends from certain mutual funds: Some mutual funds reinvest their earnings instead of paying out dividends. When you sell your shares in the fund, any capital gains realized may be eligible for lower tax rates compared to ordinary income.

- Dividends from qualified retirement accounts: Dividends earned within tax-advantaged accounts like IRAs and Roth IRAs grow tax-free until withdrawal.

2. Taxation of Qualified Dividends:

- Qualified dividends: Certain dividends meet specific holding period requirements (generally held for more than 60 days out of the 121 days surrounding the ex-dividend date) and qualify for preferential tax treatment compared to ordinary income.

- Tax rates: Qualified dividends are taxed at lower rates than ordinary income, depending on your taxable income bracket:

- 0% for single filers with taxable income below $45,975 or joint filers below $89,250 (2024 tax year).

- 15% for income above those thresholds but below $276,925 for single filers or $553,850 for joint filers.

- 20% for income exceeding those upper limits.

3. Tax-Free Dividends:

While some income from dividends can be exempt from taxes under specific circumstances, completely tax-free dividends are rare. Municipal bond dividends are a notable exception, but come with limitations like potential illiquidity and lower overall returns compared to taxable investments.

4. Impact on Income Tax Returns:

- Reporting dividends: All taxable dividends received annually must be reported on your tax return, usually on Schedule B.

- Tax liability: Dividend income adds to your overall taxable income and can potentially increase your tax liability depending on your tax bracket and deductions.

5. Minimizing Taxes on Dividend Income:

- Focus on qualified dividends: Investing in stocks paying qualified dividends can significantly reduce your tax burden.

- Utilize tax-advantaged accounts: Holding dividend-paying stocks in IRAs or Roth IRAs allows dividends to grow tax-free until withdrawal.

- Tax-loss harvesting: Offset gains from dividend income with losses from other investments to lower your taxable income.

- Consult a tax professional: Seek personalized advice from a qualified tax professional for optimal tax strategies based on your specific circumstances and investment goals.

Remember, tax laws can be complex and subject to change. Always stay informed about current regulations and consult a tax professional for personalized guidance to navigate the tax implications of dividend income effectively.