What is margin utilization and how is it calculated?

Margin utilization is a financial metric that represents the percentage of your available margin that is currently being used. It is commonly used in trading and investing, particularly in margin trading accounts. Margin trading allows investors to borrow money from a broker to buy more assets (e.g., stocks, bonds, or other securities) than they could with their own capital alone. Margin utilization is important because it helps traders and investors understand how much of their borrowed funds they are using, and it can impact their risk exposure and potential profits or losses.

To calculate margin utilization, you need to know two key values:

Total Margin Used: This is the amount of money you have borrowed or used to trade on margin.

Total Available Margin: This is the maximum amount of margin your broker has allowed you to use.

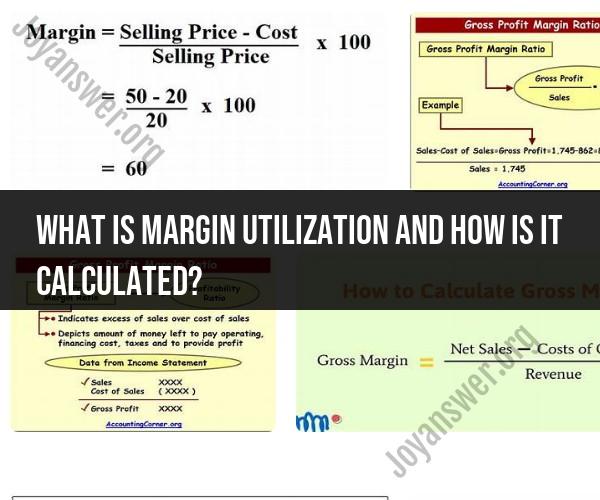

The formula for margin utilization is:

Margin Utilization (%) = (Total Margin Used / Total Available Margin) × 100

Here's how to calculate margin utilization with an example:

Suppose you have a margin trading account with a total available margin of $50,000, and you have used $20,000 of that margin to purchase securities. To calculate your margin utilization:

Margin Utilization (%) = ($20,000 / $50,000) × 100 = 40%

In this example, your margin utilization is 40%, which means you have used 40% of the margin available to you, and you have 60% of your margin still available for additional trades.

Importance of Margin Utilization:

Risk Management: Monitoring margin utilization is crucial for risk management. When margin utilization is high, it indicates that you have a significant portion of your trading capital borrowed, which can amplify both gains and losses. High margin utilization can increase the risk of a margin call, where your broker demands that you deposit more funds to cover potential losses.

Capital Efficiency: Margin utilization allows traders to assess how efficiently they are using their available capital. It helps them strike a balance between leveraging their investments for potential higher returns and managing the associated risks.

Decision-Making: Understanding your margin utilization can influence your trading decisions. If it's high, you might consider reducing your exposure or adding more funds to your account to lower the risk of a margin call. On the other hand, if it's low, you may have room to take on additional positions.

Profit Potential: Margin utilization can impact your profit potential. By knowing how much margin you have used, you can determine whether you have the capacity to take advantage of trading opportunities or if you need to be cautious to avoid potential losses.

Regulatory Compliance: Margin utilization is subject to regulations, and brokers often have specific requirements and rules regarding margin levels. Staying within regulatory limits is essential to avoid penalties or account restrictions.

In summary, margin utilization is a critical metric for traders and investors engaged in margin trading. By calculating and monitoring it, individuals can better manage risk, make informed trading decisions, and optimize the use of their capital. However, it's important to use margin cautiously and be aware of the associated risks, including the potential for significant losses.