How to solve compound interest problems with a calculator?

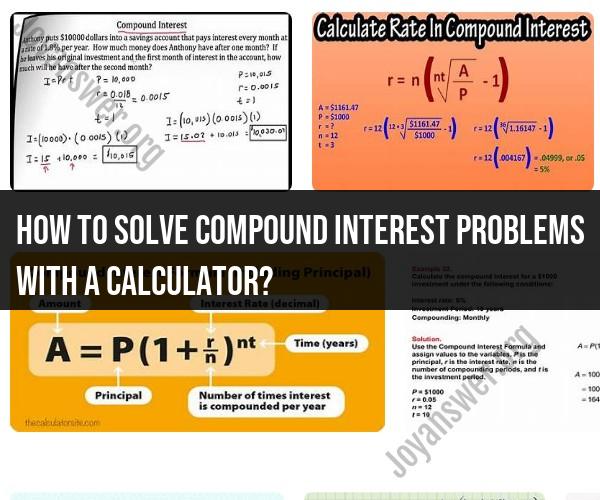

Solving compound interest problems with a calculator involves using the compound interest formula and plugging in the appropriate values. The formula for compound interest is:

Where:

- is the future value of the investment or loan, including interest.

- is the principal amount (initial investment or loan amount).

- is the annual interest rate (decimal form).

- is the number of times that interest is compounded per year.

- is the number of years the money is invested or borrowed for.

Here's a step-by-step guide on how to solve compound interest problems with a calculator:

Understand the Problem:

- Read the problem carefully and identify the values provided, such as the principal (P), interest rate (r), compounding frequency (n), and time period (t). Also, determine whether you are calculating the future value (A) or any other component of the formula.

Convert the Annual Interest Rate:

- If the interest rate is provided in percentage form, convert it to decimal form by dividing it by 100. For example, if the interest rate is 5%, convert it to 0.05.

Plug Values into the Formula:

- Substitute the known values into the compound interest formula. Make sure that your calculator is set to use the proper order of operations.

- Input , , , and into the formula.

Calculate the Future Value (A):

- Use your calculator to perform the calculations step by step. Start by calculating , then add 1, and raise this value to the power of . Finally, multiply this result by to find the future value (A).

Round the Result:

- Depending on the context and the number of decimal places given in the problem, round your answer to the appropriate level of precision.

Interpret the Result:

- The calculated future value (A) is the amount of money you will have at the end of the specified time period, including interest.

Check Your Work:

- Double-check your calculations and make sure you've correctly used the formula and the values provided in the problem.

Keep in mind that some financial calculators have dedicated functions or built-in formulas for calculating compound interest. If your calculator has these features, you can use them for more efficient calculations.

Additionally, make sure to be consistent with the units of time (years) when entering values into the formula. If the interest rate is annual and the time is in years, ensure that they match. If the interest rate is different from the time period, you may need to adjust the values accordingly before using the formula.

Solving Compound Interest Problems with a Calculator: Step-by-Step

To solve compound interest problems with a calculator, you will need to know the following information:

- The principal amount (the amount of money you are investing)

- The interest rate (the rate of return that you expect to earn on your investment)

- The compounding period (the frequency at which interest is compounded)

- The time period (the number of compounding periods)

Once you have this information, you can follow these steps to solve the problem:

- Enter the principal amount into the calculator.

- Enter the interest rate into the calculator.

- Enter the compounding period into the calculator.

- Enter the time period into the calculator.

- Press the "calculate" button.

The calculator will display the final value of your investment, which includes the principal amount and the compound interest.

Here is an example:

Suppose you invest $1,000 at an interest rate of 5% per year, compounded annually. After 10 years, the final value of your investment will be $1,628.89.

To calculate this using a calculator, you would enter the following information:

- Principal amount: 1000

- Interest rate: 0.05

- Compounding period: 1

- Time period: 10

The calculator would then display the final value of your investment, which is $1,628.89.

Compound Interest Calculation Made Easy with a Calculator

Calculators can make it very easy to calculate compound interest. Most calculators have a built-in compound interest function, which can be used to solve compound interest problems quickly and easily.

To use the compound interest function on your calculator, simply enter the principal amount, interest rate, compounding period, and time period. The calculator will then display the final value of your investment.

Crunching Numbers: Using a Calculator for Compound Interest

Calculators can be used to crunch numbers for compound interest problems of all sizes. Whether you are investing a small amount of money or a large amount of money, a calculator can help you to determine the final value of your investment.

If you are planning to invest money, it is a good idea to use a calculator to estimate the future value of your investment. This will help you to create a financial plan and reach your financial goals.

Here are some additional tips for using a calculator to solve compound interest problems:

- Make sure that you are entering the correct information into the calculator. Double-check your entries to avoid making mistakes.

- Use a scientific calculator if you need to calculate compound interest for a large number of compounding periods. Scientific calculators can handle more complex calculations than basic calculators.

- If you are not sure how to use the compound interest function on your calculator, consult the calculator's manual.