What makes a good accounting firm?

An excellent accounting firm possesses a combination of professional expertise, ethical standards, client-focused service, and effective communication. Here are some key qualities that contribute to making a good accounting firm:

Expertise and Competence:

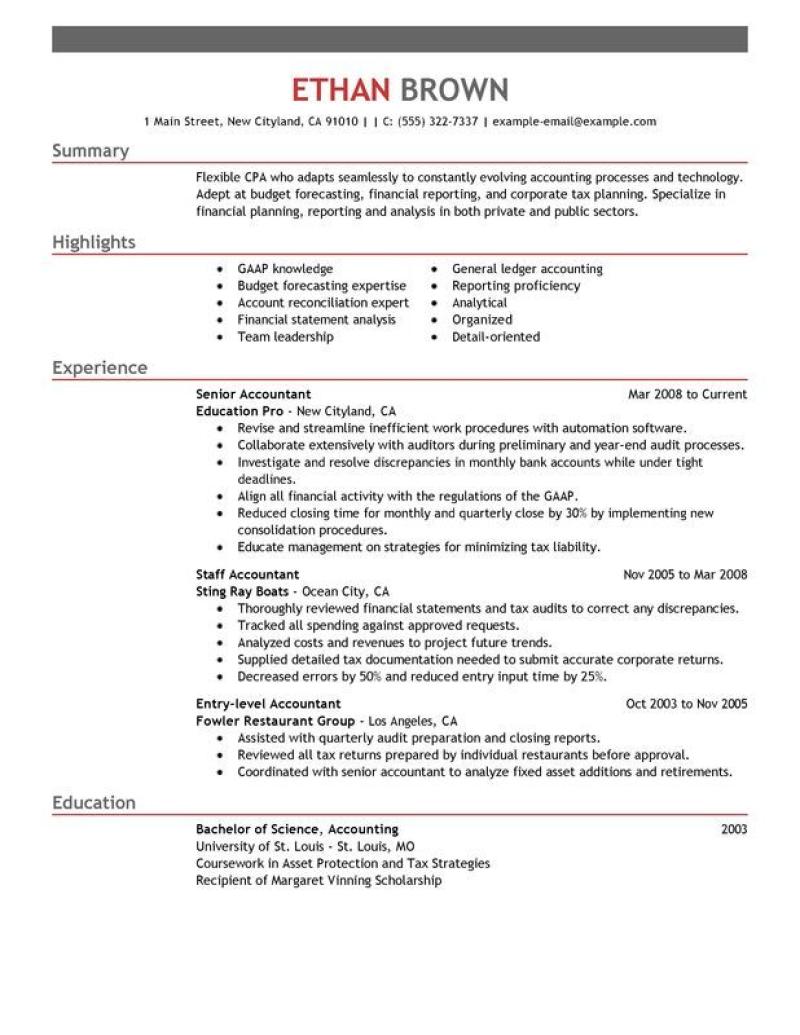

- Professional Qualifications: The firm's professionals, including Certified Public Accountants (CPAs), should have relevant qualifications, certifications, and a strong educational background.

- Technical Competence: A good accounting firm should stay updated on changes in accounting standards, tax laws, and regulations, demonstrating technical proficiency in their field.

Ethical Standards:

- Integrity: Upholding high ethical standards is essential. Clients trust accounting firms with their financial information, and integrity is crucial for maintaining that trust.

- Independence: Independence and objectivity are critical, especially in audit and assurance services. Firms should avoid conflicts of interest and maintain independence in their assessments.

Client-Focused Service:

- Understanding Client Needs: A good accounting firm listens and understands the unique needs and challenges of each client. Tailoring services to meet specific client requirements is key.

- Timely and Responsive: Being responsive to client inquiries, providing timely deliverables, and meeting deadlines are essential components of excellent client service.

Effective Communication:

- Clear Communication: Good communication skills are vital. Firms should be able to explain complex financial matters in a clear and understandable way for clients who may not have a background in accounting.

- Proactive Communication: Keeping clients informed of relevant changes, updates, or potential issues ensures a proactive and transparent relationship.

Technological Proficiency:

- Use of Technology: Embracing technology for efficient financial management, data analysis, and reporting is important. A good accounting firm should leverage software and tools that enhance their services.

Customized Solutions:

- Tailored Approach: Recognizing that each client is unique, a good accounting firm provides customized solutions that address the specific needs and goals of individual clients.

Attention to Detail:

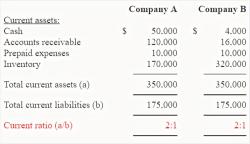

- Accuracy: The ability to maintain high levels of accuracy in financial reporting and analysis is crucial. Attention to detail helps avoid errors and ensures the reliability of financial information.

Strategic Guidance:

- Advisory Services: Beyond traditional accounting services, a good firm provides strategic financial advice, helping clients make informed decisions to achieve their long-term goals.

Reputation and Trust:

- Reputation: A solid reputation within the industry and positive client testimonials contribute to the trustworthiness of an accounting firm.

- Client Confidentiality: Respecting and maintaining client confidentiality builds trust and confidence in the firm's handling of sensitive financial information.

Continuous Improvement:

- Commitment to Learning: A good accounting firm is committed to ongoing learning and professional development, ensuring that its team stays informed about industry trends and best practices.

By embodying these qualities, an accounting firm can establish itself as a trusted advisor and partner in the financial success of its clients.

Qualities and characteristics that define a high-quality accounting firm

Determining a "high-quality" accounting firm can be subjective, as needs and priorities differ. However, several key qualities and characteristics generally contribute to a firm's excellence:

Technical Expertise and Qualifications:

- CPA credentials: Look for firms with a significant number of CPAs on their team, signifying thorough knowledge and adherence to professional standards.

- Industry specialization: Expertise in your specific industry can be crucial for tailored advice and understanding of specific regulations and challenges.

- Continuous professional development: Commitment to keeping skills current through ongoing training and certification ensures they adapt to evolving regulations and best practices.

Service and Professionalism:

- Responsiveness and communication: Timely responses to inquiries and proactive communication regarding progress and potential issues are essential.

- Client focus and understanding: The firm should prioritize your needs, listen to your concerns, and tailor their services to your specific situation.

- Transparency and ethical conduct: Clear fee structures, honest communication, and adherence to ethical codes build trust and confidence.

Technology and Efficiency:

- Utilization of technology: Modern accounting software, secure data management systems, and efficient communication tools streamline processes and enhance accuracy.

- Data analysis and insights: Beyond basic accounting, the firm should provide valuable insights into your financial data to inform decision-making.

- Scalability and flexibility: The firm should adapt to your growing needs and adjust their services as your business evolves.

Additional factors to consider:

- Reputation and client testimonials: Positive reviews and references from satisfied clients indicate a track record of successful service.

- Fees and value proposition: Compare fees but also consider the value proposition, ensuring the services justify the cost.

- Cultural fit and personal rapport: Feeling comfortable and confident communicating with your accountant is essential for a long-term partnership.

Remember, no single firm ticks all boxes. Evaluating your specific needs and prioritizing the relevant qualities can help you find the high-quality accounting firm that aligns best with your goals and values.

I hope this information helps you in your search for the perfect accounting partner! Feel free to ask if you have any further questions.