Do credit unions charge a fee to become a member?

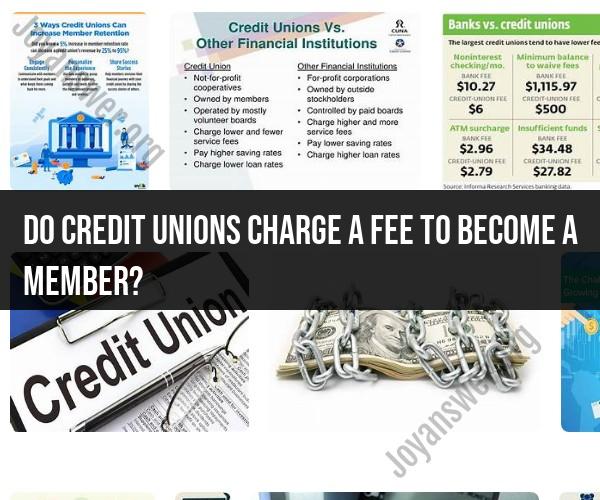

Credit unions typically require individuals to become members by meeting certain eligibility criteria, such as living in a specific geographic area, working for a particular employer, or belonging to a particular organization or group. While credit unions may charge fees for various services, such as overdraft fees or wire transfer fees, they generally do not charge a fee simply to become a member.

Here's how membership fees typically work at credit unions:

Eligibility Requirements: To join a credit union, you must meet the eligibility requirements established by that credit union. These requirements can vary widely from one credit union to another.

Membership Application: To become a member, you'll need to complete a membership application provided by the credit union. The application will ask for information to verify your eligibility, such as your address, employer, or affiliation with an organization.

Initial Deposit: Some credit unions may require you to deposit a small amount of money into a savings account when you become a member. This deposit is often referred to as your "share" in the credit union and may be as low as $5 or $10.

No Membership Fee: In most cases, credit unions do not charge a fee simply for the privilege of becoming a member. The primary goal of credit unions is to provide affordable financial services to their members, and charging a membership fee would run counter to that mission.

Service Fees: While credit unions do not typically charge membership fees, they may charge fees for specific services or transactions, such as overdraft fees, wire transfer fees, or fees for using out-of-network ATMs. These fees vary from credit union to credit union and are typically disclosed in the credit union's fee schedule.

Annual Dues: Some credit unions may charge annual dues, but this is relatively rare and usually applies to specialized or affinity credit unions, such as those associated with professional organizations or trade unions. These dues are usually modest and may be required to maintain membership in those specific credit unions.

It's important to read the terms and conditions and fee schedules provided by the credit union you're interested in to understand any fees that may apply. However, in general, becoming a member of a credit union should not involve a significant upfront fee simply for membership. Instead, credit unions focus on offering competitive rates, lower fees, and personalized service to their members as a benefit of membership.

Membership Fees and Credit Unions: Do They Charge to Join?

Most credit unions do not charge a membership fee. However, some credit unions do charge a small fee to open an account. This fee is typically around $5-$25.

Joining a Credit Union: Understanding Membership Costs

There are a few things to keep in mind when considering the membership costs of credit unions:

- Some credit unions have membership requirements. For example, you may need to live or work in a certain area to qualify for membership.

- Some credit unions charge a minimum deposit to open an account. This deposit is typically used to open a share savings account, which is required for membership in most credit unions.

- Some credit unions charge monthly maintenance fees on certain types of accounts. For example, you may be charged a monthly maintenance fee on a checking account if you do not maintain a minimum balance.

Membership Access: Examining Potential Fees to Join Credit Unions

When choosing a credit union, it is important to compare the membership fees and other costs of different credit unions. You should also consider the credit union's membership requirements and the services that it offers.

To find a credit union that is right for you, you can use the Credit Union Locator on the National Credit Union Administration (NCUA) website.

Here are a few tips for choosing a credit union:

- Compare membership fees and other costs.

- Consider the credit union's membership requirements.

- Read reviews of different credit unions.

- Talk to people you know who are members of credit unions.