How do I set up direct deposit for my account?

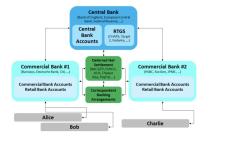

Setting up direct deposit for your account is a convenient way to receive payments, such as your salary or government benefits, electronically. To set up direct deposit, follow these general steps:

1. Contact Your Employer or Payer:

- If you're setting up direct deposit for your salary or workplace payments, contact your employer's human resources department or payroll administrator. They will provide you with the necessary forms and instructions.

2. Obtain the Direct Deposit Authorization Form:

- Your employer or payer will give you a direct deposit authorization form to complete. This form may also be available online through your employer's HR portal.

3. Complete the Authorization Form:

- Fill out the direct deposit authorization form accurately and completely. You will need to provide the following information:

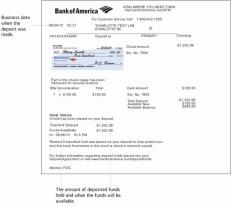

- Your bank's routing number: This nine-digit number identifies your bank or credit union. You can find it on your checks or by contacting your bank.

- Your bank account number: This is your unique account number provided by your bank.

- Account type: Specify whether your account is a checking or savings account.

- Your name and contact information.

- Your employee or identification number (if required).

- Any other information requested by your employer or payer.

4. Attach a Voided Check or Deposit Slip (if required):

- Some employers or payers may request that you attach a voided check or deposit slip to the authorization form to verify your bank account information. This helps ensure that the funds are deposited into the correct account.

5. Review and Sign the Form:

- Carefully review all the information on the form for accuracy. Ensure that your bank account and routing numbers are correct. Sign and date the form where required.

6. Return the Form to Your Employer or Payer:

- Follow your employer's or payer's instructions for returning the completed form. This may involve submitting it to your HR department, payroll administrator, or a designated contact.

7. Wait for Confirmation:

- Your employer or payer will typically need some time to process the direct deposit request. During this period, you may continue to receive paper checks or other forms of payment until direct deposit is set up.

8. Verify Deposits:

- After the direct deposit is activated, monitor your bank account to ensure that payments are being deposited correctly. You should see the funds in your account on the scheduled deposit date.

9. Keep Records:

- It's essential to keep records of the direct deposit authorization form and any communication related to your direct deposit setup.

Setting up direct deposit is a straightforward process, but the specific steps may vary slightly depending on your employer or payer. Be sure to follow their instructions and provide accurate information to ensure a smooth transition to electronic payments.