How to calculate years until retirement?

Calculating the number of years until retirement involves determining the time remaining between the current date and the expected retirement date. Here are the steps to calculate the years until retirement:

Determine Retirement Age:

- Decide on the age at which you plan to retire. This is the age at which you expect to stop working and transition into retirement.

Identify Current Age:

- Determine your current age. This is your age at the time of the calculation.

Calculate Years Until Retirement:

- Subtract your current age from your planned retirement age. The formula is:

Consider Retirement Timing:

- Some individuals may choose to retire early, while others may continue working past their initially planned retirement age. Adjust the calculation based on any changes to your retirement timing.

Here's a simple example:

- If your planned retirement age is 65, and your current age is 45, the calculation would be:

Keep in mind that this is a basic calculation, and individual circumstances may vary. It's also important to consider factors such as financial preparedness, health, and lifestyle goals when planning for retirement.

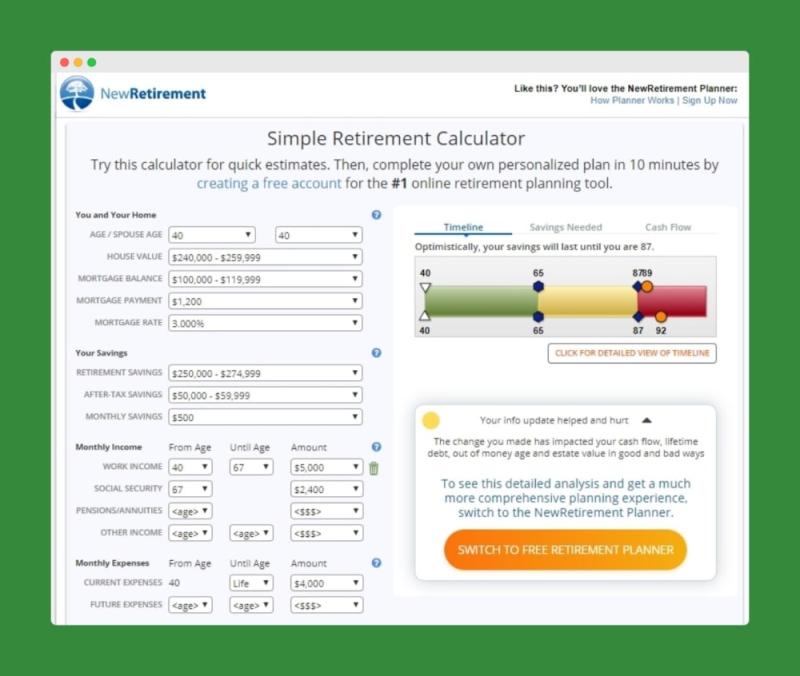

Additionally, if you're looking for a more accurate and personalized calculation, you may want to use financial planning tools, retirement calculators, or consult with a financial advisor. These tools can take into account factors such as savings, investments, expenses, and expected retirement income to provide a more comprehensive estimate of the years until retirement.

Calculating Your Retirement Timeline: A Guide

1. Calculating Years Until Retirement:

There are two main approaches to calculate your years until retirement:

a) Based on Age and Desired Retirement Age:

- If you know your current age and your desired retirement age, simply subtract your current age from your desired retirement age. For example, if you're 40 and want to retire at 65, you have 25 years left until retirement.

b) Based on Social Security Full Retirement Age and Personal Circumstances:

- The Social Security Administration (SSA) determines your full retirement age (FRA) based on your birth year. For those born between 1943 and 1954, the FRA is 66. People born after 1954 have F RAs that gradually increase up to 67 for those born in 1960 or later.

- You can then compare your FRA to your desired retirement age. If you want to retire earlier, you'll have fewer years until retirement but may receive lower Social Security benefits. Conversely, retiring later would mean more years to accumulate savings and potentially higher benefits.

2. Factors to Consider for Your Retirement Timeline:

Determining your ideal retirement timeline involves more than just numbers. Consider these factors:

- Financial Health: Assess your current income, savings, investments, and debts. How much do you need to save annually to reach your retirement goals?

- Desired Lifestyle: What do you envision in retirement? Travel, hobbies, living expenses – factor in these costs to estimate your retirement needs.

- Health and Life Expectancy: Consider your family's health history and potential longevity to gauge your retirement timeframe.

- Social Security and Other Benefits: Understand your expected Social Security benefits, pension plans, or other potential sources of income in retirement.

- Personal Aspirations: Do you want to work after retirement? Pursue volunteer opportunities? Align your retirement age with your desired lifestyle.

3. Financial Planning Tools:

Numerous online and offline tools can help you calculate your retirement needs and timeline:

- Online Retirement Calculators: These tools (offered by financial institutions, governmental websites, or financial blogs) typically ask for your age, income, desired retirement age, and savings goals to estimate your financial needs and recommend saving strategies.

- Retirement Planning Software: More comprehensive software offers budgeting tools, investment trackers, and scenario planning, allowing you to model different retirement scenarios and adjust your plans accordingly.

- Financial Advisors: Seek professional guidance from a certified financial planner (CFP) who can analyze your specific situation and develop a personalized retirement plan.

Remember, your retirement timeline is a flexible goal. Regularly review your plan, adjust as needed, and seek professional advice if necessary. By actively planning and being mindful of your evolving needs, you can establish a solid foundation for a successful and fulfilling retirement.

I hope this information helps! Feel free to ask any further questions you may have.