What are the advantages of a pension lump sum over an annuity?

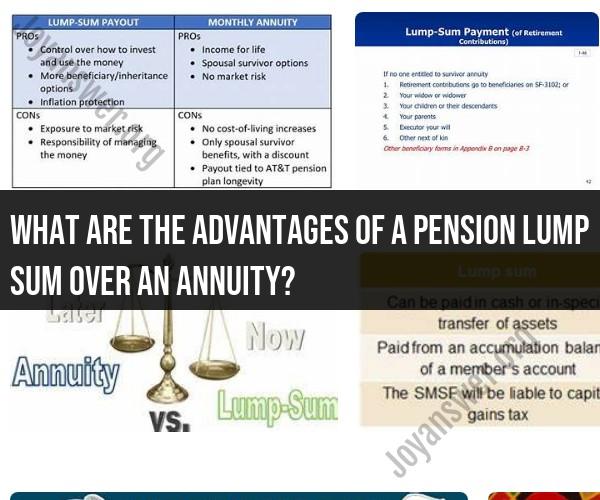

Opting for a pension lump sum over an annuity comes with several advantages, particularly in terms of financial flexibility and control. Here are some of the key advantages of choosing a pension lump sum:

1. Immediate Access to Funds:

- One of the most significant advantages is that you gain immediate access to a lump sum of money. This can be particularly valuable if you have pressing financial needs or goals.

2. Investment Control:

- With a lump sum, you have complete control over how you invest the money. You can choose the investment vehicles and strategies that align with your financial goals and risk tolerance. This flexibility allows you to potentially achieve higher returns than what a fixed annuity might offer.

3. Flexibility in Withdrawals:

- A lump sum allows you to determine how much you withdraw and when you withdraw it. This flexibility can be essential for managing your income to cover specific expenses or adapt to changing financial circumstances.

4. Legacy Planning:

- If you pass away, any remaining assets from your lump sum can be passed on to your heirs or beneficiaries, providing a potential legacy. With some annuities, the remaining funds may not be available to your heirs.

5. Inflation Protection:

- While annuities may offer inflation-adjusted options, you have more control over addressing inflation with a lump sum. You can choose to invest in assets that have the potential to outpace inflation.

6. No Insurance Company Risk:

- Annuities are typically provided by insurance companies. By choosing a lump sum, you avoid the risk associated with the financial stability of the insurance company. In some cases, you may prefer not to have your retirement income dependent on the financial health of a single entity.

7. Avoiding Annuity Fees and Charges:

- Some annuities come with fees and charges, including management fees and administrative expenses. With a lump sum, you can avoid these costs.

8. Customization:

- A lump sum approach allows you to tailor your retirement income strategy to your specific needs and goals. You can design an investment and withdrawal plan that suits your preferences.

9. No Long-Term Commitment:

- When you choose a lump sum, you're not locked into a long-term commitment. You have the freedom to make financial decisions that align with your changing circumstances.

It's important to note that the decision between a pension lump sum and an annuity should be based on your individual financial situation, goals, and risk tolerance. There are also potential disadvantages and risks associated with taking a lump sum, such as investment risk and the need for disciplined financial management.

Before making a decision, it's advisable to consult with a financial advisor who can provide personalized guidance and help you assess the pros and cons of each option in the context of your retirement plan.