How do you estimate your retirement?

Estimating your retirement involves assessing various financial aspects, including your current savings, expected expenses, and potential income sources during retirement. Here's a comprehensive guide on how to estimate your retirement:

1. Determine Retirement Goals:

- Identify your retirement lifestyle and goals. Consider factors such as where you want to live, travel plans, healthcare needs, and other potential expenses.

2. Assess Current Financial Situation:

- Review your current financial status, including savings, investments, and other assets. Calculate your net worth.

3. Estimate Retirement Expenses:

- List your expected expenses during retirement. Consider categories like housing, healthcare, transportation, food, and leisure activities.

- Account for potential inflation when projecting future expenses.

4. Calculate Social Security Benefits:

- Obtain an estimate of your Social Security benefits by using the Social Security Administration's online tools. Understand how the age at which you claim benefits affects the amount.

5. Evaluate Pension Benefits:

- If you have a pension, determine the expected amount you'll receive during retirement.

6. Analyze Retirement Accounts:

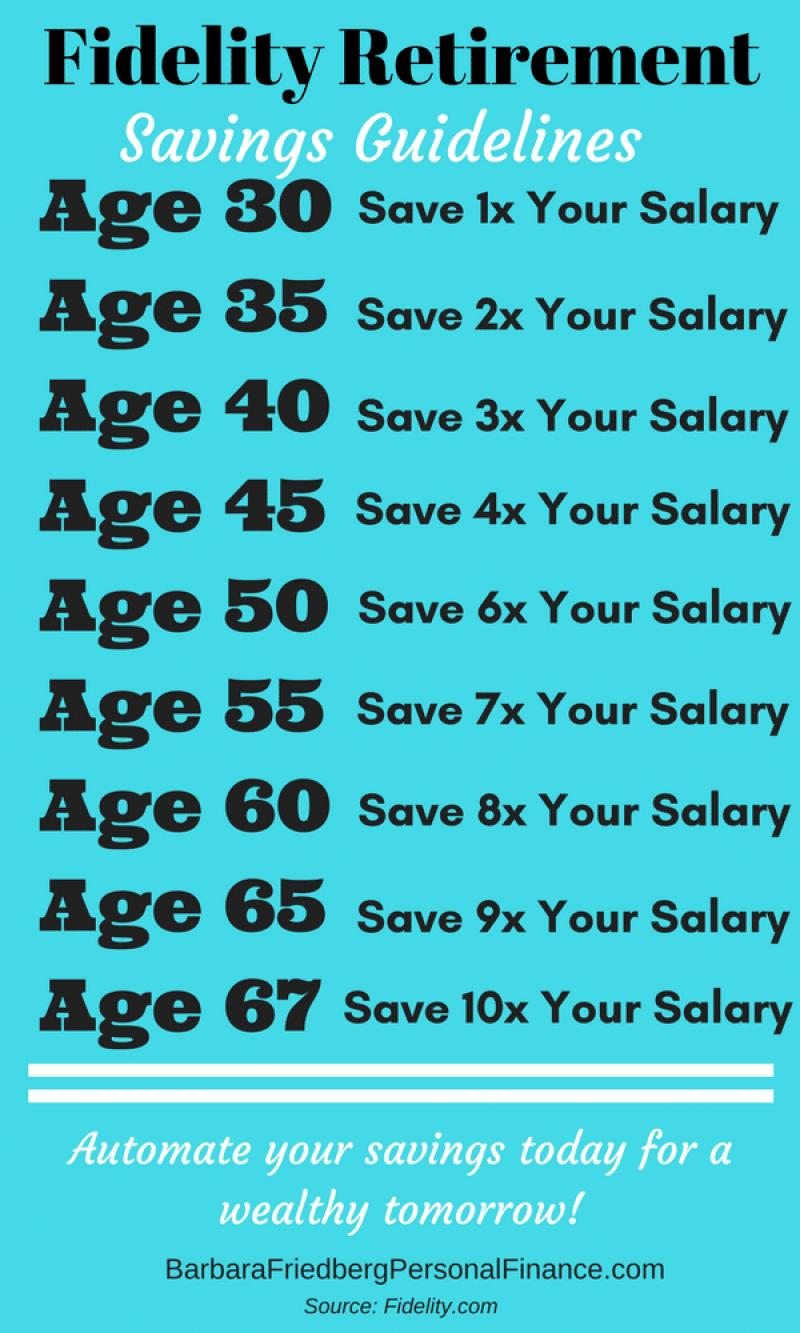

- Review your retirement accounts, such as 401(k)s, IRAs, and other savings. Consider factors like contribution rates, investment returns, and withdrawal strategies.

- Utilize retirement calculators to estimate the future value of your investments.

7. Consider Other Income Sources:

- Identify any additional sources of income during retirement, such as rental income, part-time work, or dividends from investments.

8. Calculate Required Savings:

- Determine the amount of savings needed to generate the income required to cover your estimated expenses.

- Consider the 4% rule, which suggests withdrawing 4% of your retirement savings annually, adjusted for inflation.

9. Evaluate Healthcare Costs:

- Estimate healthcare expenses during retirement, including insurance premiums, out-of-pocket costs, and long-term care considerations.

10. Factor in Taxes:

- Understand how taxes will impact your retirement income. Consider the tax implications of withdrawals from different types of retirement accounts.

11. Adjust for Inflation:

- Account for inflation when estimating future expenses and income. This helps ensure that your estimates reflect the changing cost of living.

12. Seek Professional Advice:

- Consult with a financial advisor to get personalized advice based on your unique circumstances. They can help refine your estimates and provide strategies for achieving your retirement goals.

13. Regularly Review and Adjust:

- Periodically revisit your retirement estimates and adjust them based on changes in your financial situation, goals, or economic conditions.

14. Emergency Fund:

- Maintain an emergency fund to cover unexpected expenses during retirement without tapping into your long-term investments.

15. Test Different Scenarios:

- Use financial planning tools to simulate different retirement scenarios. Explore the impact of early retirement, delayed Social Security claiming, or changes in investment strategy.

16. Retirement Planning Tools:

- Take advantage of retirement planning tools and calculators available online. Many financial institutions and websites offer tools to help individuals estimate their retirement needs.

Remember that estimating retirement involves making assumptions about the future, and unforeseen events may impact your plans. Regularly reassess your estimates and adjust your financial strategy accordingly. Working with a financial advisor can provide valuable insights and guidance throughout the retirement planning process.

Accurately Estimating Your Retirement Needs: A Financial Road Map

Accurately estimating your retirement needs is crucial for ensuring a comfortable and financially secure post-work life. Here's how you can effectively calculate your expenses and plan for a fulfilling retirement:

1. Key Factors to Consider:

- Desired Lifestyle: Envision your ideal retirement. Do you plan to travel, pursue hobbies, relocate, or maintain your current lifestyle? Factor in these aspirations and their associated costs.

- Housing Expense: Will you stay in your current home, downsize, relocate, or move to a retirement community? Estimate your future housing costs, including maintenance, property taxes, and potential mortgages.

- Healthcare Costs: Healthcare expenses tend to increase with age. Consider potential medical insurance premiums, out-of-pocket costs, and long-term care needs.

- Living Expenses: Factor in everyday expenses like groceries, utilities, transportation, clothing, and entertainment. Account for potential inflation while calculating future costs.

- Debt Management: Assess any outstanding debts and develop a plan to pay them off before or throughout retirement.

- Taxes: Understand your future tax situation in retirement, including income taxes on investment income and Social Security benefits.

2. Financial Resources:

- Income Sources: Evaluate your expected retirement income streams, including Social Security benefits, pensions, annuities, investment returns, and part-time income.

- Savings and Investments: Calculate your current savings and potential investment returns to estimate their contribution to your retirement income.

- Inheritance or Other Windfalls: Consider any potential inheritances or windfalls that might impact your retirement planning.

3. Online Tools and Resources:

- Retirement Calculators: Numerous online retirement calculators (offered by financial institutions, governmental websites, or financial blogs) can help you estimate your needs based on your current financial situation and retirement goals.

- Budgeting Apps: Utilize budgeting apps to track your current expenses and project future costs, allowing you to adjust your lifestyle and saving plans accordingly.

- Financial Advisors: Seek professional guidance from a certified financial planner (CFP) who can analyze your specific situation, develop a personalized retirement plan, and recommend tailored strategies.

Remember:

- Regularly Review and Adjust: Your retirement needs and financial situation can evolve over time. Regularly review your plan, adjust for changes, and seek professional advice when necessary.

- Prepare for Unexpected Expenses: Factor in a contingency fund for unforeseen expenses like major repairs, medical emergencies, or family support needs.

- Maintain Flexibility: Avoid being rigid in your retirement plan. Have some flexibility to adapt to changing circumstances and ensure a fulfilling and enjoyable post-work life.

By carefully estimating your needs, considering all financial factors, and utilizing available resources, you can confidently navigate the road to retirement and embrace a financially secure and fulfilling future.

I hope this information helps! Feel free to ask any further questions you may have about retirement planning or estimating your specific needs.