What percent of your salary should go toward retirement?

Determining the ideal percentage of your salary to allocate toward retirement depends on various factors, including your financial goals, lifestyle, age, and the time you have until retirement. While there isn't a one-size-fits-all answer, financial experts often suggest general guidelines to help individuals plan for retirement. One commonly cited guideline is the 15% rule, which suggests allocating 15% of your gross income toward retirement savings. Here's a breakdown:

15% Rule:

- Recommendation: Allocate 15% of your gross income toward retirement savings.

- Example: If your gross income is $60,000 per year, you would aim to contribute $9,000 annually to your retirement savings.

Employer Contributions:

- If your employer offers a retirement savings plan, such as a 401(k) with a matching contribution, take full advantage of this benefit. Employer contributions can significantly boost your retirement savings.

Age-Related Guidelines:

- In Your 20s and 30s: Financial experts recommend starting early and contributing a smaller percentage, gradually increasing it over time. Consider contributing at least enough to get any employer match.

- In Your 40s: Aim to contribute 10-15% of your income.

- In Your 50s and Beyond: Consider contributing more, up to the maximum allowed by retirement account limits. Catch-up contributions are available for those aged 50 and older.

Personal Circumstances:

- Debt and Expenses: If you have high-interest debt, such as credit card debt, prioritize paying it off. Once high-interest debt is managed, you can allocate more toward retirement savings.

- Living Expenses: Consider your current lifestyle and anticipated retirement lifestyle. If you plan to maintain a similar lifestyle in retirement, you may need to save more.

Financial Goals:

- Retirement Lifestyle: Consider the kind of lifestyle you want in retirement. If you have specific goals or anticipate higher expenses, you may need to adjust your savings accordingly.

- Retirement Age: The age at which you plan to retire can influence the percentage you allocate. Planning to retire earlier may require higher contributions.

Professional Advice:

- Consult with a financial advisor to assess your unique situation. They can provide personalized guidance based on your financial goals, risk tolerance, and other factors.

Emergency Fund:

- Prioritize building an emergency fund before or simultaneously with retirement savings. This fund can cover unexpected expenses and prevent the need to dip into your retirement savings prematurely.

Remember that these are general guidelines, and individual circumstances vary. Regularly review and adjust your retirement savings plan as your income, expenses, and financial goals evolve. Consistency and starting early are key factors in building a sufficient retirement nest egg. Always seek personalized financial advice to create a retirement plan that aligns with your specific needs and circumstances.

Recommended Percentage for Retirement Savings:

1. General Recommendations:

The most common recommendation for retirement savings is 10-15% of your pre-tax income. This is a good starting point for many people, but the ideal percentage can vary depending on several factors.

2. Factors Impacting Percentage:

- Income Level: Higher earners may be able to save a higher percentage, while those with lower incomes may need to start lower and gradually increase over time.

- Lifestyle: People with simpler lifestyles can potentially save more than those with higher expenses.

- Age: The younger you start saving, the more time your money has to grow through compound interest, so you can contribute a lower percentage initially.

- Debts: Having significant debt can make it challenging to save for retirement, but prioritizing paying off high-interest debt can free up funds for future savings.

- Retirement Goals: Some people may want to retire earlier or maintain a more luxurious lifestyle in retirement, which will require higher savings rates.

3. Benchmarks and Guidelines:

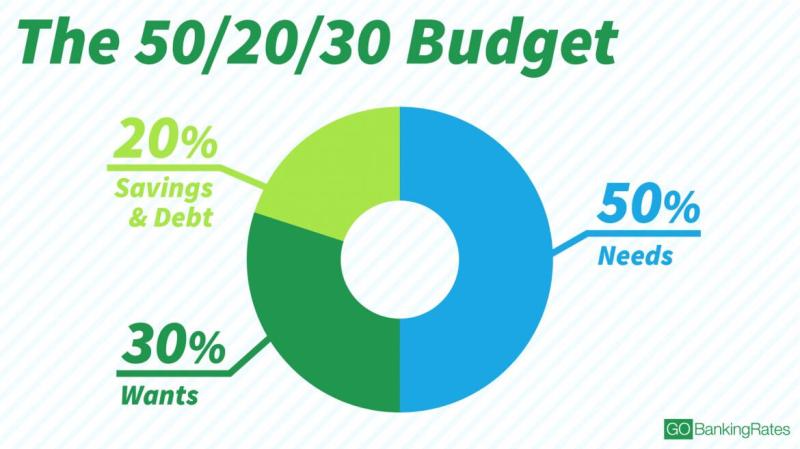

- 50/30/20 Rule: This popular rule suggests allocating 50% of your income to essential needs, 30% to wants and discretionary spending, and 20% to savings and debt repayment. The 20% can be further divided, with a portion specifically dedicated to retirement savings.

- Retirement Calculators: Many online retirement calculators can help you estimate your ideal savings rate based on your age, income, desired retirement age, and estimated retirement expenses. These calculators can be a helpful tool to personalize your savings plan.

Additional Tips:

- Maximize employer contributions: If your employer offers a match, be sure to contribute enough to reach the full match. This is free money that can significantly boost your retirement savings.

- Invest your savings: Don't just let your retirement savings sit in a low-interest savings account. Invest your money in a diversified portfolio of assets to potentially grow your nest egg over time.

- Review and adjust your plan: Regularly review your retirement savings plan and adjust your contributions as your income, expenses, and goals change.

Remember, the most important thing is to start saving for retirement early and consistently. Even small contributions can add up significantly over time with the power of compound interest.

I hope this information helps! Let me know if you have any other questions.