What do you need to know about retirement plans?

Planning for retirement is a critical financial endeavor, and there are several key aspects you need to know about retirement plans to ensure a secure and comfortable retirement. Here is a comprehensive guide covering what you should know about retirement plans:

Types of Retirement Plans:

- There are various retirement plans available, including employer-sponsored plans like 401(k)s and pensions, as well as individual plans like IRAs (Individual Retirement Accounts). Each has its own rules, contribution limits, and tax advantages.

Contributions:

- Understand how contributions work for your retirement plan. Employer-sponsored plans often allow contributions through payroll deductions, while IRAs involve individual contributions.

Tax Benefits:

- Retirement plans offer tax advantages. Contributions to traditional 401(k)s and IRAs are often tax-deductible, while Roth 401(k)s and IRAs offer tax-free withdrawals in retirement. Know the tax implications of your chosen plan.

Employer Matching:

- Many employers offer matching contributions to 401(k) plans. It's important to contribute enough to receive the full match, as it's essentially free money.

Contribution Limits:

- Be aware of the annual contribution limits set by the IRS for retirement plans. These limits can change from year to year.

Investment Options:

- Retirement plans typically allow you to invest in a range of assets, such as stocks, bonds, and mutual funds. Understand your investment options and select investments that align with your risk tolerance and goals.

Vesting:

- Some employer-sponsored plans have vesting schedules, which determine when you become entitled to employer contributions. Make sure you understand your vesting schedule.

Rollovers:

- You can often roll over funds from one retirement plan to another without incurring taxes or penalties. This is important if you change jobs or want to consolidate your retirement accounts.

Required Minimum Distributions (RMDs):

- Know the age at which you must start taking RMDs from traditional retirement accounts (usually after age 72) to avoid penalties.

Early Withdrawal Penalties:

- Be aware of the penalties for early withdrawals from retirement accounts, which can be substantial. Consider the impact on your savings before taking funds out before retirement age.

Social Security:

- Understand how Social Security works and when you become eligible for benefits. Consider the best time to start receiving Social Security based on your retirement goals.

Medicare:

- Medicare provides health insurance for those aged 65 and older. Be aware of the enrollment process and how it works in conjunction with your retirement healthcare needs.

Long-Term Care Insurance:

- Consider whether you need long-term care insurance to cover potential nursing home or home healthcare costs during retirement.

Estate Planning:

- Estate planning involves preparing for the distribution of your assets after you pass away. Make sure your retirement accounts are aligned with your estate planning goals.

Professional Advice:

- Consult with a financial advisor or retirement specialist for personalized guidance. They can help you create and manage a retirement plan that suits your specific needs.

Regular Review:

- Continuously review and adjust your retirement plan as your financial situation and goals evolve. Retirement planning is an ongoing process.

By understanding these key aspects of retirement planning, you can make informed decisions to ensure a financially secure and enjoyable retirement. It's crucial to start planning early and stay engaged in the process throughout your working years.

Understanding Retirement Plans: Key Concepts and Types

A retirement plan is a financial plan that helps you save and invest money for your retirement. There are many different types of retirement plans available, but they all have the same goal: to help you live comfortably in retirement.

Key concepts:

- Retirement income: The money you will need to live on in retirement.

- Retirement savings: The money you save and invest for retirement.

- Investment risk: The potential for losses on your investments.

- Investment return: The amount of money you make on your investments.

Types of retirement plans:

- Defined benefit plans: These plans promise to pay you a specific benefit in retirement, based on your salary and years of service.

- Defined contribution plans: These plans allow you to save and invest money on a tax-deferred basis. Your employer may also contribute to your plan.

- Individual retirement accounts (IRAs): These plans allow you to save and invest money on a tax-deferred or tax-free basis.

Retirement Planning: Steps to Secure Your Future

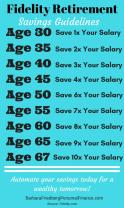

Retirement planning is a lifelong financial journey. There are a few key steps you can take to secure your future:

- Start early. The earlier you start saving and investing, the more time your money has to grow.

- Set retirement goals. What do you want to do in retirement? How much money will you need to live comfortably?

- Create a retirement budget. This will help you track your income and expenses and make sure you are on track to meet your goals.

- Choose the right investments. Consider your risk tolerance, time horizon, and financial goals when choosing investments.

- Review your plan regularly. Your financial situation and retirement goals may change over time, so it is important to review your plan regularly and make adjustments as needed.

The Role of Retirement Accounts in Financial Stability

Retirement accounts play an important role in financial stability. They can help you save money for retirement on a tax-deferred or tax-free basis. This means that you do not have to pay taxes on your contributions or earnings until you withdraw the money in retirement.

There are many different types of retirement accounts available, but some of the most popular include:

- 401(k) plans: These plans are offered by many employers and allow you to save a portion of your paycheck on a tax-deferred basis. Your employer may also match a portion of your contributions up to a certain percentage.

- Individual retirement accounts (IRAs): IRAs are available to everyone and allow you to save money on a tax-deferred or tax-free basis. There are two main types of IRAs: traditional IRAs and Roth IRAs.

- Simplified employee pension (SEP) IRAs: SEP IRAs are retirement savings plans for self-employed individuals and small businesses. They offer high contribution limits and tax-deductible contributions.

Retirement Plan Options and Their Benefits

There are many different retirement plan options available, each with its own benefits. Here are a few of the most popular options:

- Defined benefit plans: Defined benefit plans promise to pay you a specific benefit in retirement, based on your salary and years of service. These plans are less common today than they were in the past, but they can offer a high level of retirement income security.

- Defined contribution plans: Defined contribution plans allow you to save and invest money on a tax-deferred basis. Your employer may also contribute to your plan. These plans offer more flexibility than defined benefit plans, but you have more responsibility for your retirement savings.

- Individual retirement accounts (IRAs): IRAs are retirement savings plans that you can open on your own. They offer a variety of benefits, including tax-deferred growth, tax-free growth, and high contribution limits.

Planning for Retirement: A Lifelong Financial Journey

Retirement planning is a lifelong financial journey. It is important to start early and create a plan that is tailored to your individual needs and goals. With careful planning, you can achieve financial security and enjoy a comfortable retirement.

Here are some tips for lifelong retirement planning:

- Review your plan regularly. Your financial situation and retirement goals may change over time, so it is important to review your plan regularly and make adjustments as needed.

- Rebalance your investment portfolio regularly. As you get closer to retirement, you may want to rebalance your investment portfolio to reduce your risk.

- Consider working with a financial advisor. A financial advisor can help you create a retirement plan and choose investments that are right for you.

By following these tips, you can ensure a comfortable and financially secure retirement.