What is the formula to calculate the cost of preferred stock?

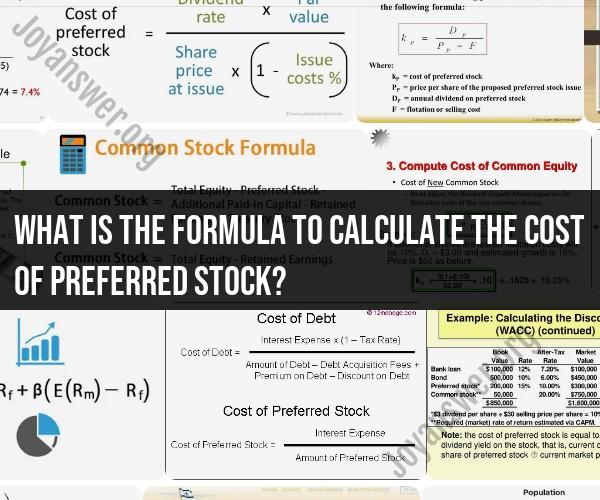

The cost of preferred stock, also known as the preferred stock dividend rate, can be calculated using the following formula:

Cost of Preferred Stock (%) = Preferred Dividends / Preferred Stock Price

Here's a breakdown of the components of the formula:

Preferred Dividends: This represents the annual dividend payments made to preferred stockholders. Preferred dividends are typically expressed as a fixed percentage of the face value (par value) of the preferred stock. For example, if a preferred stock pays a 5% annual dividend on a $100 par value stock, the preferred dividends would be $5 per share annually.

Preferred Stock Price: This is the current market price of one share of preferred stock. It represents the price investors are willing to pay for the stock in the open market.

The result of this calculation will give you the cost of preferred stock as a percentage. This percentage represents the rate of return that investors expect to earn on their investment in preferred stock. It's important to note that the cost of preferred stock is not tax-deductible for the issuing company because preferred stock dividends are typically not tax-deductible.

Keep in mind that preferred stock dividends are typically fixed, meaning they are specified when the stock is issued and do not change. This is unlike common stock dividends, which can vary based on the company's performance and board decisions. The cost of preferred stock is an essential component in the calculation of the weighted average cost of capital (WACC), which is used to assess the overall cost of financing for a company.

Preferred Stock Cost Calculation: Unveiling the Formula

The cost of preferred stock is the rate of return that investors require in order to be willing to invest in preferred stock. It is calculated using the following formula:

Cost of preferred stock = Preferred dividend / Market price per share

The preferred dividend is the annual dividend payment that is paid to preferred shareholders. The market price per share is the current price of the preferred stock on the open market.

For example, if a preferred stock pays a dividend of $1.75 per share and is currently trading at $25 per share, the cost of preferred stock would be 7%.

Evaluating the Cost of Preferred Stock: Financial Analysis Techniques

Financial analysts use a variety of techniques to evaluate the cost of preferred stock. One common technique is to compare the cost of preferred stock to the cost of other types of investments, such as bonds and common stock.

Another common technique is to use the dividend discount model. The dividend discount model calculates the present value of all future dividend payments. The cost of preferred stock is then calculated as the discount rate that makes the present value of all future dividend payments equal to the current market price per share.

Understanding the Factors Affecting the Cost of Preferred Stock

A number of factors can affect the cost of preferred stock, including:

- Credit risk: The credit risk of the company that issued the preferred stock affects its cost. Companies with a higher credit risk are more likely to default on their dividend payments, so investors will require a higher return in order to invest in their preferred stock.

- Interest rates: Interest rates also affect the cost of preferred stock. When interest rates are low, investors are more likely to invest in preferred stock, which can drive down the cost of preferred stock.

- Market demand: The market demand for preferred stock also affects its cost. When there is a high demand for preferred stock, the cost of preferred stock will tend to be lower.

Conclusion

The cost of preferred stock is an important factor for investors to consider when making investment decisions. By understanding the factors that affect the cost of preferred stock, investors can make informed decisions about whether or not to invest in preferred stock.