How to calculate pension annuity?

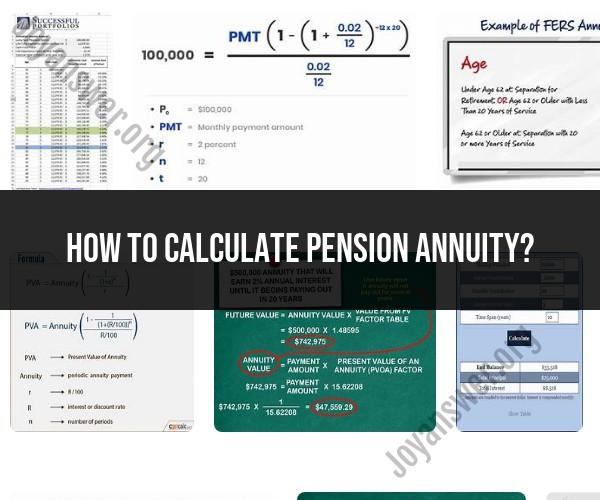

Calculating a pension annuity involves determining the periodic payments you will receive from your pension plan during retirement. The calculation depends on various factors, including your years of service, average salary, and the specific terms of your pension plan. Below is a step-by-step guide to calculating a pension annuity:

Gather Information:

- Collect essential information, including your years of service, average salary (often based on high-earning years), and any other factors that your pension plan considers in its formula.

Review Your Pension Plan's Formula:

- Examine your pension plan's official documents or consult with the plan administrator to understand the specific formula used to calculate your pension annuity. Pension plans vary in their formulas, but most follow a similar structure.

Calculate Your Pension Benefit:

Use the formula provided by your pension plan to calculate your pension benefit. The general formula often looks like this:Pension Benefit = (Years of Service) x (Average Salary) x (Multiplier)

- "Years of Service" represents your total years of service or credited service in the plan.

- "Average Salary" is typically the average of your highest-earning years, such as the high-three or high-five years.

- "Multiplier" is a percentage determined by the plan (e.g., 2% or 1.5%). It represents the portion of your average salary you'll receive for each year of service.

Factor in Any Early or Late Retirement Adjustments:

- Determine if your pension plan provides adjustments for retiring before or after the normal retirement age. Early retirement may lead to a reduced pension, while delaying retirement could increase it.

Consider Optional Forms of Payment:

- Some pension plans offer various payment options, such as joint and survivor annuities or lump-sum payments. The choice of payment option can affect the amount of your pension annuity.

Apply Government Regulations:

- Be aware of any government regulations or laws that may impose limits on pension annuity calculations, especially if your plan is subject to government oversight or protection.

Consult a Financial Advisor:

- Given the complexity of pension calculations and the importance of retirement planning, it's often advisable to consult with a financial advisor who specializes in retirement planning. They can help you understand your options, optimize your pension benefit, and plan for a secure retirement.

Remember that the exact method and factors used to calculate your pension annuity can vary from one pension plan to another. Therefore, it's crucial to refer to your specific plan's documentation and, if necessary, consult with the plan administrator or a financial professional to ensure accurate calculations and informed retirement decisions.

To calculate your pension annuity, you will need to consider the following factors:

- Your pension benefit

- Your age

- Your spouse's age (if applicable)

- Your desired payout option

Your pension benefit is the amount of money you will receive each month from your pension plan. Your age and your spouse's age will determine your life expectancy, which is used to calculate the number of payments you will receive. Your desired payout option will determine how the annuity payments are calculated.

There are two main types of pension annuities: single life annuities and joint life annuities.

- Single life annuities pay out to you for the rest of your life.

- Joint life annuities pay out to you and your spouse for the rest of your lives, or until the death of the second spouse.

Once you have this information, you can use the following formula to calculate your pension annuity:

Annuity payment = (Pension benefit) / (Life expectancy)

For example, if your pension benefit is $2,000 per month and your life expectancy is 20 years, then your annuity payment would be $100 per month.

It is important to note that this is just a basic formula. There are a number of other factors that can affect your pension annuity, such as your health, your occupation, and your investment choices. You should speak with your pension plan administrator or a financial advisor to get an accurate estimate of your pension annuity.

Here are some tips for calculating your pension annuity:

- Use a reliable pension annuity calculator. There are a number of free and paid pension annuity calculators available online.

- Consider your desired payout option. Single life annuities and joint life annuities have different benefits and drawbacks. Choose the payout option that is right for you and your family.

- Get professional advice. A financial advisor can help you to calculate your pension annuity and develop a retirement income plan that meets your individual needs.

By following these tips, you can help to ensure that you are getting the most out of your pension annuity.