How to calculate the funded status of a pension?

The funded status of a pension plan represents the financial health of the plan by comparing its assets to its liabilities. To calculate the funded status of a pension plan, you need to consider several key factors and perform the following steps:

Gather Information:

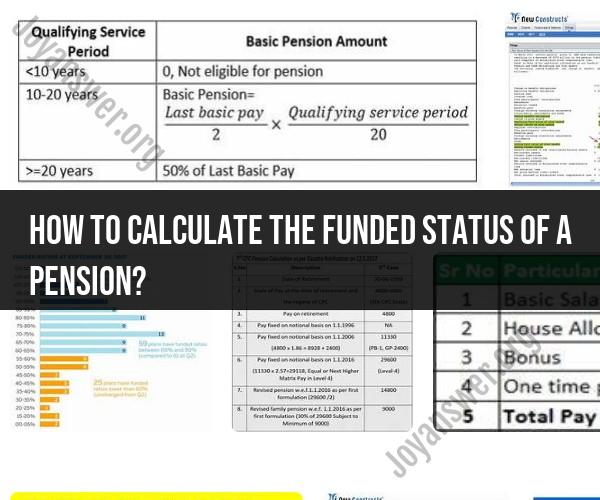

- Collect detailed information about the pension plan, including the current market value of plan assets and the plan's projected benefit obligation (PBO) or accumulated benefit obligation (ABO). The PBO or ABO represents the present value of the future pension benefit payments owed to plan participants.

Calculate the Plan's Assets:

- Determine the current market value of all assets held within the pension plan. These assets typically include investments such as stocks, bonds, real estate, and cash.

Calculate the Plan's Liabilities:

- Calculate the present value of the future pension benefit payments owed to plan participants. This involves estimating the expected future cash flows associated with pension benefits and discounting them to their present value using an appropriate discount rate. The discount rate is often based on the plan's assumed rate of return or a corporate bond rate.

Determine the Funded Status:

The funded status of the pension plan is calculated as follows:Funded Status = (Plan Assets) - (Projected Benefit Obligation)

- "Plan Assets" refers to the total market value of the pension plan's investments.

- "Projected Benefit Obligation" (PBO) represents the present value of future benefit payments owed to plan participants.

If the result is positive, it indicates that the plan's assets exceed its liabilities, suggesting that the plan is overfunded.

If the result is negative, it indicates that the plan's liabilities exceed its assets, suggesting that the plan is underfunded.

Interpret the Result:

- A positive funded status (overfunded) may suggest that the plan has more than enough assets to meet its pension obligations.

- A negative funded status (underfunded) indicates that the plan's assets fall short of its pension obligations. In such cases, the plan sponsor (typically an employer) may be required to make additional contributions to the plan to improve its funding status.

Review Plan Documents and Regulations:

- It's important to be aware of any legal or regulatory requirements governing pension plans, as these can impact the funded status and the actions that must be taken in case of underfunding.

Calculating the funded status of a pension plan is a complex process that may involve actuarial assumptions and professional expertise. Many organizations rely on actuaries and financial professionals with expertise in pension fund management to perform these calculations accurately and in compliance with relevant regulations. If you are a plan sponsor or participant seeking to understand the funded status of a pension plan, it's advisable to consult with qualified professionals who can provide detailed analysis and guidance.

Pension Funding Status: How to Calculate and Assess It

Pension funding status is a measure of the financial health of a pension plan. It is calculated by subtracting the plan's liabilities from its assets. If the plan's assets are greater than its liabilities, the plan is overfunded. If the plan's liabilities are greater than its assets, the plan is underfunded.

To calculate pension funding status, you will need to know the following:

- The plan's liabilities: These are the benefits that the plan has promised to pay to its participants and beneficiaries.

- The plan's assets: These are the investments that the plan owns.

Once you have this information, you can use the following formula to calculate pension funding status:

Pension funding status = (Plan assets) - (Plan liabilities)

For example, if a pension plan has $1 billion in assets and $900 million in liabilities, then the plan's funding status is 100%. This means that the plan has enough assets to cover all of its liabilities.

Evaluating Your Pension Plan's Financial Health: Funded Status

A pension plan's funded status is an important indicator of its financial health. A well-funded pension plan is more likely to be able to meet its obligations to its participants and beneficiaries.

However, it is important to note that funded status is just one factor to consider when evaluating a pension plan's financial health. Other factors to consider include the plan's investment strategy, its actuarial assumptions, and its governance structure.

Understanding Pension Plan Viability: Funded Status Analysis

Pension funding status analysis is the process of evaluating a pension plan's financial health. This analysis typically involves comparing the plan's assets to its liabilities and assessing the plan's investment strategy, actuarial assumptions, and governance structure.

Pension funding status analysis can be used to identify potential risks to a pension plan. For example, if a plan is underfunded, it may be at risk of running out of money before it can meet its obligations to its participants and beneficiaries.

Pension funding status analysis is an important tool for employers, participants, and beneficiaries. It can help to ensure that pension plans are able to meet their obligations and that participants and beneficiaries receive the benefits that they have earned.

Here are some tips for assessing pension funding status:

- Compare the plan's assets to its liabilities. A well-funded plan will have assets that are greater than or equal to its liabilities.

- Consider the plan's investment strategy. A diversified investment strategy is less likely to be exposed to market volatility.

- Evaluate the plan's actuarial assumptions. Actuarial assumptions are used to estimate the plan's future liabilities. Conservative actuarial assumptions will result in a higher funding status.

- Assess the plan's governance structure. A well-governed plan will have a board of trustees that is responsible for overseeing the plan's operations.

If you have any concerns about the funding status of your pension plan, you should speak with your plan administrator or a financial advisor.