How are amortization schedules calculated?

Calculating an amortization schedule involves breaking down a loan's repayment into a series of fixed payments that cover both the principal amount borrowed and the interest accrued over time. Here's a step-by-step guide on how to calculate an amortization schedule:

Gather Loan Details: Collect the necessary loan details, including the loan amount, interest rate, and loan term (number of years or months).

Determine the Loan Period: Decide on the loan term, whether it's in years or months. Convert the loan term into the total number of payment periods.

Calculate Monthly Interest Rate: Divide the annual interest rate by 12 to get the monthly interest rate. For example, if the annual rate is 6%, the monthly rate would be 0.06 divided by 12, which equals 0.005 (or 0.5%).

Compute Monthly Payment: Use a loan amortization formula to calculate the monthly payment. The formula is:

where:

- = Monthly payment

- = Loan principal amount

- = Monthly interest rate

- = Total number of payments

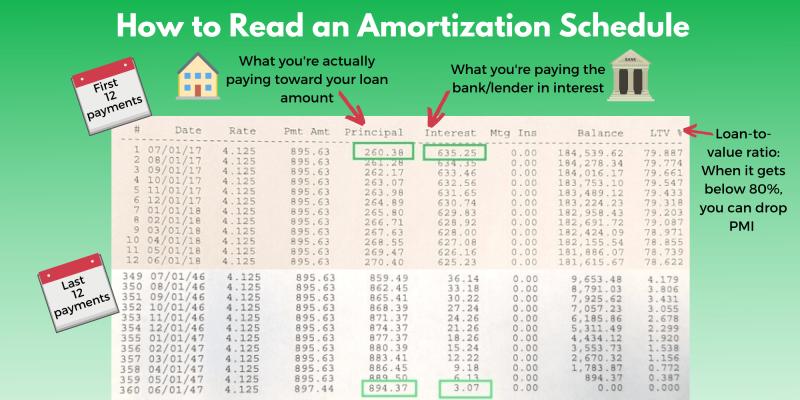

Create the Amortization Schedule: Begin by listing the payment number, starting from 1 up to the total number of payments. For each payment:

- Calculate Interest: Multiply the outstanding loan balance at the beginning of the period by the monthly interest rate to determine the interest portion of the payment.

- Determine Principal Repayment: Subtract the interest from the total monthly payment to find the portion that goes toward reducing the loan balance (principal repayment).

- Update Loan Balance: Subtract the principal repayment from the outstanding loan balance to get the new balance for the next period.

Repeat for Each Period: Continue this process for each payment period until the loan is fully paid off.

By following these steps, you can create an amortization schedule that outlines each payment's breakdown into principal and interest components. Many financial calculators and spreadsheet software also offer built-in functions to automate this process, making it easier to generate an amortization schedule with accurate figures.

1. Formulas and Methods for Creating an Amortization Schedule

There are two main formulas used to create an amortization schedule:

- Formula 1:

Payment = (P * r * (1 + r)^n) / ((1 + r)^n - 1)

where:

P is the principal amount of the loan

r is the monthly interest rate (annual interest rate / 12)

n is the number of monthly payments

Formula 2:

Payment = (Ending Balance * r) + (Principal Payment)

where:

- Ending Balance is the outstanding balance of the loan at the beginning of each month

- r is the monthly interest rate

- Principal Payment is the portion of the payment that goes towards reducing the principal balance of the loan

The following steps can be used to create an amortization schedule using either of these formulas:

Calculate the monthly payment using either Formula 1 or Formula 2.

Create a table with the following columns:

- Date

- Payment

- Principal Payment

- Interest Payment

- Ending Balance

Enter the following information into the table:

- Date: The date of each payment

- Payment: The amount of each payment

- Principal Payment: The portion of each payment that goes towards reducing the principal balance of the loan

- Interest Payment: The portion of each payment that goes towards paying interest

- Ending Balance: The outstanding balance of the loan at the end of each month

Calculate the principal payment and interest payment for each month using the following formulas:

Principal Payment = Payment - Interest Payment

Interest Payment = Ending Balance * r

- Calculate the ending balance for each month using the following formula:

Ending Balance = Beginning Balance - Principal Payment

- Continue calculating until the ending balance is zero.

2. Impact of Varying Loan Terms on Amortization Schedule Structure

The structure of an amortization schedule can be affected by a number of loan terms, including the principal amount, interest rate, and loan term.

- Principal Amount: The larger the principal amount of the loan, the higher the monthly payment and the longer it will take to pay off the loan. This is because a larger principal amount means that more interest is paid each month.

- Interest Rate: The higher the interest rate, the higher the monthly payment and the longer it will take to pay off the loan. This is because a higher interest rate means that more interest is paid each month.

- Loan Term: The longer the loan term, the lower the monthly payment but the longer it will take to pay off the loan. This is because a longer loan term means that the total amount of interest paid over the life of the loan is higher.

The following table shows how varying loan terms can affect the structure of an amortization schedule:

| Principal Amount | Interest Rate (%) | Loan Term (Years) | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|

| $100,000 | 5 | 30 | $526.50 | $77,950 |

| $100,000 | 5 | 15 | $724.81 | $43,725 |

| $200,000 | 5 | 30 | $1,053.00 | $155,900 |

| $200,000 | 5 | 15 | $1,449.62 | $87,450 |

As you can see, the monthly payment and total interest paid both increase as the principal amount and interest rate increase. Additionally, the monthly payment decreases and the total interest paid decreases as the loan term decreases.