How to calculate continuous compounding?

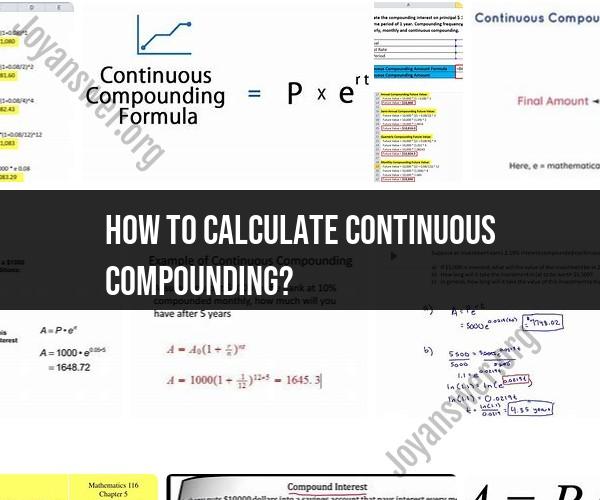

Continuous compounding is a method of calculating the future value of an investment or the present value of a sum of money when interest is compounded continuously, rather than at specific intervals. It involves using the mathematical constant "e" (approximately equal to 2.71828). The formula for continuous compounding is as follows:

Future Value (FV) with Continuous Compounding:

Where:

- FV is the future value of the investment or sum of money.

- P is the principal amount (the initial amount of money).

- e is the mathematical constant approximately equal to 2.71828.

- r is the annual interest rate (in decimal form).

- t is the time the money is invested for, in years.

Present Value (PV) with Continuous Compounding:

Similarly, you can calculate the present value (the value of a future sum of money in today's dollars) using continuous compounding with the formula:

Where:

- PV is the present value.

- FV is the future value.

- e is the mathematical constant approximately equal to 2.71828.

- r is the annual interest rate (in decimal form).

- t is the time in years.

Here's a step-by-step guide on how to calculate continuous compounding:

Step 1: Convert the Annual Interest Rate to Decimal Form

- If the annual interest rate is given as a percentage, divide it by 100 to convert it to decimal form. For example, if the interest rate is 5%, convert it to 0.05.

Step 2: Determine the Time Period (t) in Years

- Determine the time the money is invested for in years. For example, if you're calculating the future value of a 3-year investment, t = 3.

Step 3: Use the Continuous Compounding Formula

- Plug the values into the appropriate formula (future value or present value) based on what you want to calculate.

- Calculate the future value or present value using the formula and the values of P, r, t, and e.

Step 4: Calculate the Result

- Perform the calculations using a calculator or spreadsheet software to find the future value or present value.

Continuous compounding is often used in financial mathematics and investment calculations when interest is compounded continuously, such as in the case of continuously paying interest on a bank account or continuously compounded interest in investment portfolios. It provides a more precise calculation compared to periodic compounding, especially for short-term investments or when interest is compounded frequently.