How to calculate compound or average annual growth rate?

The Compound Annual Growth Rate (CAGR) is a measure of the annual growth rate of an investment or asset over a specified period, assuming that the investment has been compounding over that time frame. It provides a smoothed annualized rate of return, which takes into account the compounding effect. Here's a step-by-step guide on how to calculate CAGR:

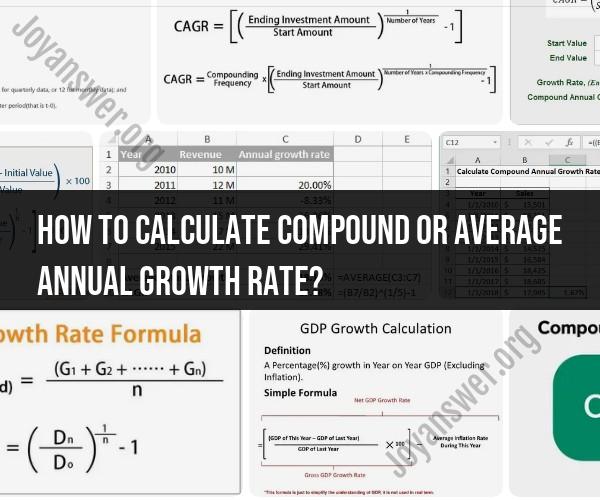

Formula for CAGR:

The formula for calculating CAGR is as follows:

Where:

- CAGR is the Compound Annual Growth Rate.

- EV is the ending value or the final value of the investment or asset.

- BV is the beginning value or the initial value of the investment or asset.

- n is the number of years over which the growth occurred.

Step-by-Step Calculation:

Determine the Beginning and Ending Values:

- Identify the initial value (BV) of the investment or asset at the beginning of the period.

- Determine the final value (EV) of the investment or asset at the end of the period.

Determine the Number of Years (n):

- Calculate the number of years (n) over which the growth occurred. This is the time period between the initial and final values.

Apply the CAGR Formula:

- Plug the values of EV, BV, and n into the CAGR formula.

- Calculate the expression inside the parentheses first (), and then raise the result to the power of .

- Subtract 1 from the result to get the CAGR.

Example:

Let's say you invested $1,000 in a stock, and after 5 years, it has grown to $1,500. To calculate the CAGR:

- Beginning Value (BV) = $1,000

- Ending Value (EV) = $1,500

- Number of Years (n) = 5

Using the CAGR formula:

- Calculate the expression inside the parentheses:

- Calculate the CAGR:

Now, calculate the CAGR:

So, the CAGR for this investment over 5 years is approximately 14.87%.

CAGR is a valuable metric for evaluating the annualized growth rate of investments, particularly when comparing different investments or assessing the performance of assets over time. It provides a more accurate representation of the annual growth, accounting for the compounding effect.