How do you calculate annual interest rate?

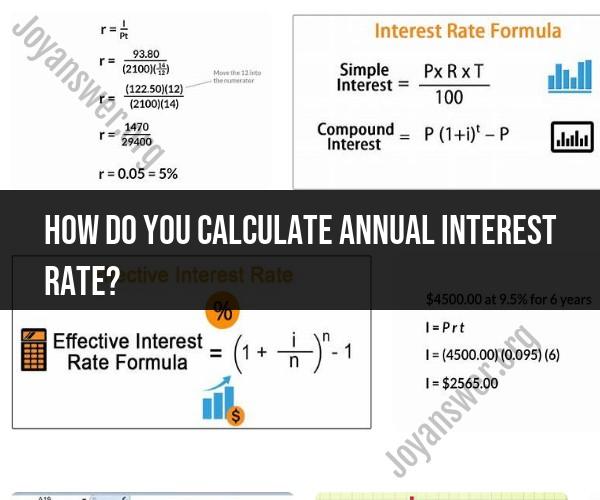

The formula to calculate the annual interest rate, also known as the annual percentage rate (APR), depends on the specific financial product and the compounding frequency. Here are the formulas for calculating the annual interest rate in different contexts:

1. Simple Interest:

- For simple interest, where interest is calculated on the initial principal amount only:

2. Compound Interest:

- For compound interest, where interest is calculated on both the initial principal and previously earned interest, the formula is more complex.

The formula for compound interest is:

Where:

- is the future value of the investment/loan, including interest.

- is the initial principal amount (the initial amount of money).

- is the annual interest rate (expressed as a decimal).

- is the number of times that interest is compounded per year.

- is the number of years the money is invested or borrowed for.

To find the annual interest rate (APR) in the compound interest formula, you would need to rearrange the formula to solve for . This can be a bit complex, and it's often more convenient to use financial calculators or software to compute it.

3. Loans and Mortgages:

- For loans and mortgages, you can calculate the APR using a formula that considers the loan amount, interest rate, loan term, and the number of payments. However, this formula can be quite complex. It's often more practical to use financial calculators, spreadsheets, or specialized software to determine the APR for loans and mortgages.

4. Savings Accounts and Investments:

- For savings accounts and investments, the APR or annual interest rate is typically provided by the financial institution or investment firm. You can find this information in the terms and conditions of the account or investment product.

It's important to understand that the method of compounding (annually, semi-annually, quarterly, monthly, daily, etc.) can have a significant impact on the effective APR. When comparing interest rates or APRs, make sure to consider the compounding frequency, as it affects the total interest you earn or pay.

How to Calculate Annual Interest Rate: A Comprehensive Guide

To calculate annual interest rate, you can use the following formula:

Annual interest rate = (Interest earned / Principal amount) * 100

For example, if you earn $100 in interest on a $1,000 loan over a one-year period, your annual interest rate would be 10%.

The Formula for Determining Annual Interest Rates

The formula for determining annual interest rates is as follows:

Annual interest rate = (Interest rate / Number of compounding periods) ^ Number of compounding periods - 1

Where:

- Interest rate is the nominal interest rate, which is the interest rate that is stated on the loan or investment agreement.

- Number of compounding periods is the number of times per year that the interest is compounded.

- Number of compounding periods - 1 is the number of times per year that the interest is compounded minus one.

Real-Life Applications and Calculations of Annual Interest

Annual interest is used in a variety of real-life applications, including:

- Loans: When you borrow money from a bank or other financial institution, you are charged interest on the loan. The interest rate is typically expressed as an annual percentage rate (APR).

- Investments: When you invest your money in a savings account, certificate of deposit (CD), or other investment product, you earn interest on your investment. The interest rate is typically expressed as an annual percentage yield (APY).

- Credit cards: If you carry a balance on your credit card, you are charged interest on the balance. The interest rate is typically expressed as an annual percentage rate (APR).

To calculate annual interest on a loan, investment, or credit card, you can use the following formula:

Annual interest = (Principal amount) * (Interest rate) * (Time period)

For example, if you have a $10,000 loan at an interest rate of 5% and a term of 5 years, your annual interest payment would be $500.

Financial Literacy and Understanding Interest Rate Calculations

It is important to understand how to calculate annual interest rates in order to make informed financial decisions. For example, when you are comparing different loan offers, you should compare the APRs of the different loans. The APR is the most accurate way to compare loan offers because it takes into account the interest rate and all of the fees associated with the loan.

Personal Insights and Tips on Managing Interest Rates

Here are a few personal insights and tips on managing interest rates:

- Pay your bills on time: Paying your bills on time will help you to avoid late fees and interest charges.

- Keep your credit card balances low: The higher your credit card balances, the more interest you will pay.

- Shop around for the best interest rates: When you are shopping for a loan or investment product, compare the interest rates offered by different lenders and financial institutions.

- Consider refinancing your loans: If you have high-interest loans, you may be able to save money by refinancing them at a lower interest rate.

By understanding and managing interest rates, you can save money and improve your overall financial situation.