What is the formula for compounded growth rate?

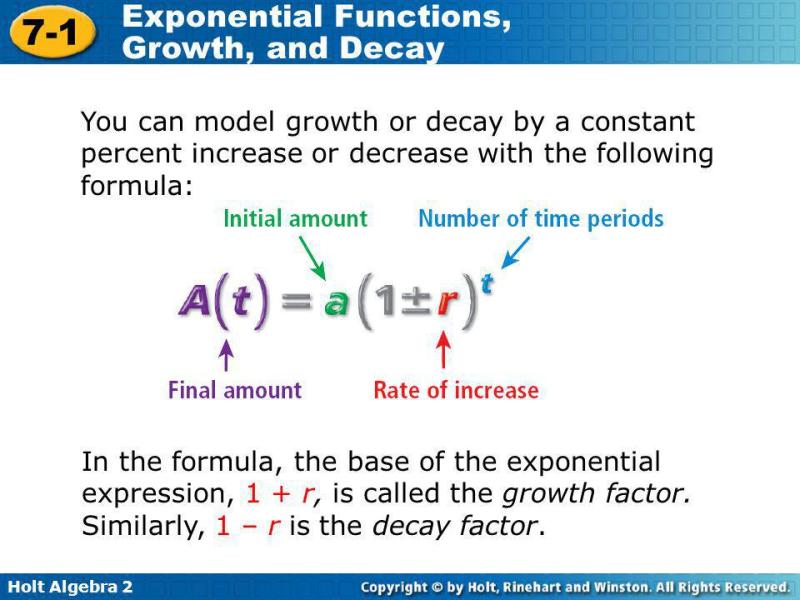

The formula for compounded annual growth rate (CAGR) is a mathematical representation used to calculate the mean annual growth rate of an investment over a specified time period, assuming that the investment has been compounding over that time. The formula is as follows:

Where:

- is the value of the investment at the end of the specified period.

- is the initial value of the investment.

- is the total number of years over which the investment has grown.

This formula provides the average annual growth rate that, when applied to the initial value, would result in the ending value over the specified time period.

It's important to note that the CAGR assumes a steady rate of growth over the entire period, which may not always reflect the actual fluctuations that might occur in an investment. Additionally, the CAGR doesn't account for volatility or the timing of returns.

The compounded growth rate (CAGR) is a measure of the average growth rate of an investment over a specified period of time, taking into account the effect of compounding. Compounding is the process of earning interest on interest, which can significantly increase the overall growth of an investment over time.

Formula for Calculating Compounded Growth Rate

The formula for calculating CAGR is:

CAGR = (Ending Value / Beginning Value)^(1/n) - 1

where:

- CAGR is the compounded annual growth rate

- Ending Value is the value of the investment at the end of the period

- Beginning Value is the value of the investment at the beginning of the period

- n is the number of years in the period

Calculating CAGR in Finance or Economics

In finance and economics, CAGR is often used to compare the performance of different investments or to assess the overall growth of an economy or market. It is a useful metric for understanding the long-term growth trajectory of an investment or economic indicator.

Step-by-Step Guide to Compute Compounded Growth Rate

Here's a step-by-step guide to compute the compounded growth rate (CAGR) for a given investment or economic indicator:

Gather the necessary data: Collect the investment's beginning value and ending value for the specified period. If calculating CAGR for an economic indicator, obtain the relevant data points for the start and end of the period.

Apply the CAGR formula: Substitute the ending value, beginning value, and the number of years (period) into the CAGR formula.

CAGR = (Ending Value / Beginning Value)^(1/n) - 1

- Calculate the CAGR: Evaluate the expression using a calculator or spreadsheet software. The result will be the compounded annual growth rate (CAGR) for the investment or economic indicator.

For example, if an investment's value increased from $10,000 to $20,000 over a period of 5 years, the CAGR would be:

CAGR = ($20,000 / $10,000)^(1/5) - 1 = 1.487 ≈ 14.9%

This indicates that the investment's average annual growth rate over the 5-year period was approximately 14.9%.