What is the purpose of financial management?

The purpose of financial management is to efficiently and effectively manage an organization's financial resources in order to achieve its goals and objectives. Financial management involves planning, organizing, directing, and controlling an organization's financial activities to ensure financial stability and long-term sustainability. Here are some key purposes of financial management:

Optimizing Resource Utilization:

- Financial management aims to allocate financial resources (capital, funds, assets) in the most efficient manner to achieve the organization's goals. This involves making decisions about investments, expenses, and financing.

Ensuring Liquidity:

- Financial managers work to maintain an appropriate level of liquidity to meet short-term financial obligations. This involves managing cash flow, current assets, and current liabilities to ensure the organization can cover its day-to-day expenses.

Maximizing Profitability:

- Financial management seeks to enhance the organization's profitability by making informed decisions about pricing, cost control, and revenue generation. Maximizing profit is crucial for long-term sustainability and growth.

Risk Management:

- Financial managers assess and manage financial risks, including market risk, credit risk, and operational risk. This involves developing strategies to mitigate potential threats to the organization's financial health.

Capital Budgeting:

- Financial management involves evaluating and selecting investment projects that align with the organization's strategic objectives. This process, known as capital budgeting, helps determine where to allocate funds for the highest return.

Capital Structure Decisions:

- Financial managers decide on the mix of debt and equity that makes up the organization's capital structure. This decision influences the cost of capital and, ultimately, the organization's value.

Financial Reporting and Analysis:

- Financial management includes the preparation and analysis of financial statements, which provide insights into the organization's financial health. This information is essential for decision-making by both internal and external stakeholders.

Dividend Decisions:

- Financial managers make decisions regarding the distribution of profits to shareholders in the form of dividends. This involves balancing the interests of shareholders with the need for retained earnings for future growth.

Compliance and Accountability:

- Financial management ensures compliance with financial regulations and standards. It also involves maintaining transparency and accountability in financial reporting to stakeholders, including shareholders, creditors, and regulatory authorities.

In essence, the purpose of financial management is to create value for the organization and its stakeholders by making sound financial decisions that contribute to the achievement of strategic objectives and long-term sustainability.

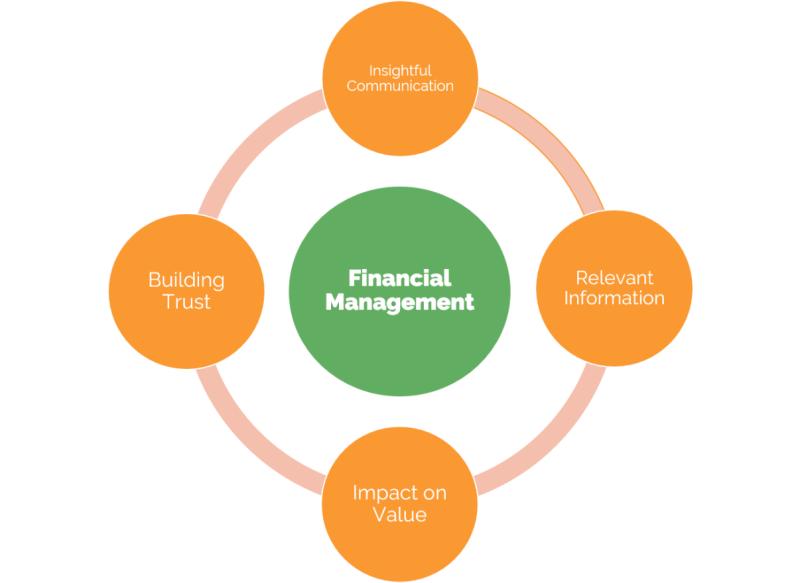

Role of Financial Management:

Financial management plays a vital role in both personal and business contexts, guiding individuals and organizations towards achieving their financial goals.

1. Personal Context:

- Budgeting and Saving: Financial management helps individuals create and track budgets, manage debt, and save for future goals like retirement, education, and major purchases.

- Financial Security: It helps individuals build financial stability by creating an emergency fund, managing risk through insurance, and making informed investment decisions.

- Financial Decision-Making: It equips individuals with the knowledge and tools to make informed financial decisions about spending, borrowing, and investing.

- Financial Wellbeing: Effective financial management contributes to overall financial wellbeing, reducing stress and anxiety related to financial matters.

2. Business Context:

- Resource Allocation: Financial management helps businesses allocate resources efficiently, ensuring sufficient capital for operational expenses, investments, and growth initiatives.

- Profitability and Growth: It assists businesses in maximizing profitability, controlling costs, and identifying opportunities for profitable expansion.

- Risk Management: Businesses can identify, assess, and mitigate financial risks through effective financial management, protecting their financial stability and ensuring long-term sustainability.

- Compliance and Reporting: Financial management ensures compliance with financial regulations and accurate financial reporting, building trust with stakeholders and investors.

- Investment Analysis: Businesses can evaluate investment opportunities and make informed decisions about capital allocation through financial analysis techniques.

Contribution to Organizational Success:

Effective financial management contributes significantly to organizational success in several ways:

- Enhanced Profitability: By optimizing resource allocation, controlling costs, and maximizing revenue, financial management leads to increased profitability and shareholder value.

- Financial Stability: Sound financial management practices ensure financial stability, allowing organizations to navigate economic downturns and unexpected events more effectively.

- Strategic Growth: Financial management supports strategic growth initiatives by providing insights into investment opportunities, managing risks associated with expansion, and securing necessary funding.

- Improved Decision-Making: By providing accurate financial data and analysis, financial management empowers leaders to make informed decisions about investments, pricing, and other critical business matters.

- Investor Confidence: Effective financial management fosters transparency and accountability, building trust and confidence with investors, creditors, and other stakeholders.

Therefore, both individuals and organizations benefit from prioritizing financial management practices, leading to greater financial security, stability, and ultimately, success.