What is the primary objective of financial management?

The primary objective of financial management is to maximize the wealth or value of the shareholders or owners of a firm. This objective is commonly known as shareholder wealth maximization.

Shareholder wealth maximization means that the financial manager should make decisions that increase the current value of the firm's common stock and, by extension, the wealth of the firm's shareholders. This objective is based on the idea that the primary goal of a business is to create value for its owners.

To achieve shareholder wealth maximization, financial managers are involved in various activities, including:

Capital Budgeting: Making investment decisions to maximize the value of the firm by choosing projects that yield positive net present value (NPV).

Capital Structure Management: Deciding on the appropriate mix of debt and equity to minimize the cost of capital and maximize the value of the firm.

Working Capital Management: Efficiently managing short-term assets and liabilities to ensure the smooth operation of the business while maximizing profitability.

Dividend Policy: Deciding on the distribution of profits to shareholders through dividends, with the aim of balancing current income for shareholders and reinvestment for future growth.

While shareholder wealth maximization is the primary objective, it is essential for financial managers to consider other stakeholders' interests, ethical considerations, and legal obligations in their decision-making process. However, these considerations are typically seen as secondary to the overarching goal of maximizing shareholder wealth.

Key Goals and Aims of Financial Management in a Corporate Setting:

The primary goals of financial management in a corporate setting can be summarized as follows:

1. Maximize Profitability: This involves generating sufficient revenue to cover expenses and create a surplus for reinvestment and shareholder returns. Financial managers achieve this by optimizing pricing strategies, managing costs, and allocating resources efficiently.

2. Ensure Financial Stability: This involves maintaining a healthy balance sheet, managing debt levels effectively, and ensuring sufficient liquidity to meet short-term obligations. This includes managing cash flow effectively and maintaining access to credit.

3. Promote Long-Term Growth: This involves investing in strategic initiatives that will generate future value for the company. Financial managers achieve this by allocating capital to profitable projects, managing risks effectively, and pursuing mergers and acquisitions strategically.

4. Comply with Regulations: Financial managers must ensure the organization complies with all relevant financial regulations and reporting requirements. This includes maintaining accurate financial records, filing timely reports, and adhering to ethical business practices.

5. Optimize Capital Structure: This involves determining the optimal mix of debt and equity financing to maximize shareholder value. This requires careful consideration of risk tolerance, cost of capital, and financing options available.

6. Manage Risk: Financial managers are responsible for identifying, assessing, and mitigating various financial risks the company faces. This includes market risk, credit risk, operational risk, and liquidity risk.

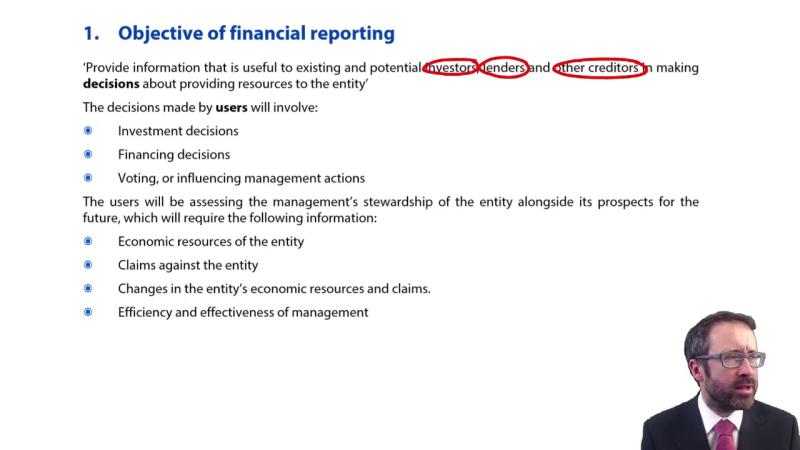

7. Improve Financial Reporting and Analysis: Financial managers provide accurate and timely financial information to stakeholders such as investors, creditors, and management. This helps them make informed decisions about the company's financial health and future prospects.

Alignment with Strategic Planning:

Financial management plays a critical role in aligning with and supporting an organization's strategic plan. Here's how:

1. Resource Allocation: Financial managers allocate resources to initiatives that support the strategic plan's objectives. They prioritize investments and ensure that the organization's financial resources are used effectively to achieve its strategic goals.

2. Performance Measurement: Financial managers develop and implement financial metrics to track progress towards strategic objectives. This helps the organization measure its success and identify areas for improvement.

3. Risk Management: Financial managers identify and assess risks associated with implementing the strategic plan. They implement risk mitigation strategies to minimize potential negative impacts on the organization's financial performance.

4. Financial Modeling: Financial managers use financial models to forecast the financial impact of strategic decisions. This helps the organization make informed decisions about investing, pricing, and other financial matters.

5. Capital Acquisition: Financial managers secure the necessary capital to finance the strategic plan's implementation. They evaluate various financing options and choose the most cost-effective and strategic method to raise capital.

6. Investor Relations: Financial managers communicate the organization's financial performance and strategic plans to investors. This helps build trust and confidence in the organization's future prospects.

By effectively aligning financial management with strategic planning, organizations can ensure that their financial resources are used effectively to achieve their long-term goals and objectives.