What is an amortization schedule calculator?

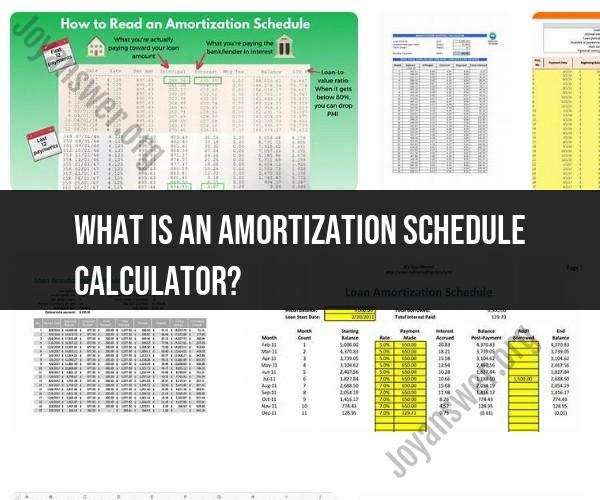

An amortization schedule calculator is a financial tool or spreadsheet program that helps individuals and businesses understand how a loan or mortgage is paid off over time. It provides a detailed breakdown of each payment, showing how much of each installment goes toward the principal amount and how much goes toward the interest. Here's what you can typically find in an amortization schedule:

Payment Number: This is a sequential number assigned to each payment, starting with 1 for the first payment.

Payment Amount: The total amount of the monthly or periodic payment.

Principal Payment: The portion of the payment that goes toward reducing the loan's principal balance.

Interest Payment: The portion of the payment that covers the interest on the remaining loan balance.

Total Payment: The sum of the principal and interest payments for that period.

Remaining Balance: The outstanding loan balance after each payment is made.

Cumulative Payments: The total payments made over the life of the loan.

An amortization schedule is especially useful for understanding how much interest you'll pay over the life of a loan, how much you'll pay toward the principal, and when the loan will be paid off in full. It can also help borrowers make informed financial decisions, such as adjusting their monthly payments or making extra payments to pay off the loan sooner.

Here are some common scenarios where an amortization schedule calculator can be helpful:

Mortgages: Homebuyers can use an amortization schedule to see how their monthly mortgage payments will be distributed between interest and principal and to understand when they will have built up sufficient equity in their homes.

Auto Loans: Car buyers can use an amortization schedule to plan their auto loan payments and decide on the best loan term for their budget.

Personal Loans: Borrowers with personal loans can use the schedule to track their progress in paying down the loan and plan for future payments.

Business Loans: Small business owners and entrepreneurs can use an amortization schedule to manage their business loan payments.

Student Loans: Graduates with student loans can use the schedule to see how long it will take to pay off their loans and how much interest they will ultimately pay.

Amortization schedule calculators are widely available online, and many financial software programs, including spreadsheet software like Microsoft Excel and Google Sheets, have built-in functions or templates to create amortization schedules for different types of loans. Using such a tool can help borrowers make informed financial decisions and manage their debt more effectively.

Exploring Amortization Schedule Calculators: What Are They?

An amortization schedule calculator is a tool that can be used to calculate the monthly payments and interest on a loan over time. Amortization is the process of paying off a loan in installments that include both principal and interest. Amortization schedules can be used for a variety of loans, including mortgages, car loans, and student loans.

How to Use an Amortization Schedule Calculator: A Comprehensive Guide

To use an amortization schedule calculator, you will need to enter the following information:

- The loan amount

- The interest rate

- The loan term (in months or years)

Once you have entered this information, the calculator will generate a table that shows the following for each payment:

- The payment amount

- The principal payment

- The interest payment

- The remaining balance

Managing Your Finances with an Amortization Schedule Calculator

Amortization schedule calculators can be a valuable tool for managing your finances. By understanding how your loan is amortized, you can make sure that you are making affordable monthly payments and that you are on track to pay off your loan on time.

Here are some ways that you can use an amortization schedule calculator to manage your finances:

- Set a budget: An amortization schedule calculator can help you to set a budget for your monthly loan payments. By knowing how much your monthly payments will be, you can make sure to allocate enough money in your budget to cover them.

- Track your progress: An amortization schedule calculator can help you to track your progress towards paying off your loan. By reviewing your amortization schedule regularly, you can see how much of your loan principal you have paid off and how much interest you have paid.

- Make extra payments: If you are able to make extra payments on your loan, you can use an amortization schedule calculator to see how much time and money you can save. By making extra payments, you can pay off your loan sooner and save money on interest.

Overall, amortization schedule calculators are a valuable tool for managing your finances. By understanding how your loan is amortized, you can make sure that you are making affordable monthly payments and that you are on track to pay off your loan on time.