Tariff Policy and Its Effect on Consumer Prices

Tariffs are taxes imposed by one country on goods and services imported from another country.

The economic implications of tariffs extend far beyond government ledgers and corporate trade balances.

This article provides an analytical yet relatable exploration of how tariffs influence the cost of living. We'll trace the price increase through the supply chain, highlight which everyday products become pricier, examine how retailers adjust their strategies, and analyze the macroeconomic relationship between tariffs and inflation. Finally, we'll consider whether governments can effectively use tariff cuts as a tool to ease cost pressures on households, providing practical insights into the true cost of protectionist trade policies.

How Do Tariffs Directly Influence Consumer Goods Prices?

The fundamental economic mechanism by which tariffs affect consumer goods prices is straightforward: they increase the cost of imports, which inevitably raises wholesale and retail prices.

The Cost Pass-Through

This increased cost is rarely absorbed fully by the importer. Instead, it is passed down the supply chain in a process called "tariff pass-through":

Importer: Pays the tariff to the government.

To maintain profit margins, they raise their wholesale price. Distributor/Wholesaler: Buys the goods at the higher wholesale price and, in turn, increases the price charged to retailers.

Retailer: Purchases the product at an elevated cost and sets a higher final price for the buyer.

Consumer: Ultimately pays the full, tariff-inclusive, marked-up price.

This cascading effect ensures that the consumer, though a few steps removed from the border tax, is the final party to bear the economic burden.

Sensitivity and Elasticity

The impact of a tariff on the final price depends heavily on the elasticity of demand for the product.

Inelastic Goods: For essential goods or products with few domestic substitutes (like specialized electronics components), demand is inelastic. Importers and retailers can confidently pass the entire tariff cost, and sometimes more, directly to the consumer because they know demand will not drop significantly.

Elastic Goods: For products where consumers have many choices (like a basic t-shirt or a generic piece of furniture), demand is elastic. In these cases, importers and retailers may absorb a larger portion of the tariff to remain competitive, resulting in smaller, though still present, price increases for the consumer.

Which Everyday Products Become More Expensive Due to Tariffs?

Tariffs disproportionately affect a wide array of common, everyday products that are either largely imported or rely heavily on imported components.

Common Affected Goods

Products frequently targeted by import tariffs include:

Electronics: Smartphones, computers, smart home devices, and televisions.

Automobiles and Parts: Vehicles, tires, and specialized engine components.

Apparel and Footwear: Clothing, shoes, and textiles, which are often sourced globally.

Furniture and Household Appliances: Couches, beds, washing machines, and refrigerators.

Groceries: Certain imported produce, seafood, and specialty foods.

Even domestic goods can rise in price due to tariffs. For example, a "Made in the USA" smartphone still likely uses microchips, rare-earth metals, or specialized screens that are imported.

Real-World Examples from Trade Disputes

The US–China trade war beginning in 2018 provided a stark, real-world laboratory for tariff pass-through. Tariffs were imposed on thousands of Chinese-made goods, directly increasing the cost of goods for American importers.

Price Increase Example: A study following the tariffs found that for an imported, tariffed consumer good, the price to the U.S. importer often rose by the full amount of the tariff.

This meant a $1,000 laptop with a 10% tariff on certain components could see its final retail price rise by $50 to $100 after all the markups were added down the supply chain. Broader Impact: Products like washing machines and solar panels saw significant, immediate price hikes after targeted tariffs were imposed, demonstrating how quickly these taxes can translate into consumer expense.

How Do Retailers Pass Tariff Costs to Consumers?

Retailers, operating at the end of the supply chain, employ several pricing strategies to navigate rising import costs driven by tariffs.

Pricing and Cost Shifting Strategies

Direct Markup Adjustment: The most direct method is raising the final retail price.

In categories like household goods and electronics, which were heavily targeted during the US-China trade war, import prices were observed to be as much as 5% higher, with a clear tendency for retailers to raise prices gradually rather than in a single, large jump. Product Downsizing (Shrinkflation): To avoid a noticeable price hike, some companies engage in product downsizing, a form of hidden inflation. They keep the price the same but reduce the quantity, quality, or features of the product. For instance, a food item might slightly shrink in size, or a piece of furniture might use a cheaper internal component.

Shifting to Cheaper Alternatives: Retailers may strategically shift their inventory to less-expensive, non-tariffed goods or products from non-tariffed countries (trade diversion).

This can limit the direct tariff impact but may lead to a reduction in quality or consumer choice.

Timing and Absorption

Retailers rarely pass on 100% of a tariff cost instantly. In the short term, many choose to absorb a portion of the costs through reduced profit margins, especially when tariffs are first announced or perceived as temporary.

Supply Chain Resilience

In the face of persistent tariffs, larger multinational companies invest in supply chain resilience. This includes:

Diversifying Sourcing: Moving manufacturing or procurement from a tariffed country (e.g., China) to a non-tariffed country (e.g., Vietnam, Mexico).

Automating Production: Investing in domestic or near-shore automation to reduce reliance on foreign components or labor.

While these shifts can offset future tariff costs, the investment often involves significant initial expenses, which can also contribute to a temporary or permanent increase in the final price of the goods.

What Is the Inflationary Impact of Global Tariff Policies?

Widespread tariffs, particularly when implemented by major economies and met with retaliation, are a significant contributor to inflation by increasing both input costs and the price of final consumer goods.

The Mechanism of Cost-Push Inflation

Tariffs contribute to a phenomenon known as cost-push inflation. This occurs when the overall price of goods and services increases due to increases in the cost of production.

Increased Input Costs: Tariffs on raw materials (like lumber, chemicals, or metals) or intermediate goods (like microchips or machinery) act as a tax on the production process.

Companies pay more for their inputs and must raise the price of their finished products to maintain their margins. Reduced Competition: Tariffs reduce competition from lower-priced imports, giving domestic producers more pricing power.

Even if their costs haven't risen, they can raise their prices to match the now-higher price of the imported alternative.

Economists who studied the 2018 tariffs estimated they caused the average price of US manufacturing to rise by approximately 1%.

Global Ripple Effects and Macroeconomic Data

Protectionist trade policies rarely occur in isolation; they trigger global ripple effects.

Retaliation: When one country imposes a tariff, affected trading partners often retaliate with tariffs of their own on the initiating country's exports.

This amplifies the inflationary pressure across both economies, as both nations' businesses face higher input costs and reduced market access. Trade Uncertainty: Policy uncertainty related to trade wars discourages business investment and makes supply chains less efficient, which is inherently inflationary.

The International Monetary Fund (IMF) and similar organizations have referenced the macroeconomic consequences, noting that sustained high tariffs significantly slow global growth and raise inflation forecasts.

Can Governments Use Tariff Reductions to Control Prices?

Given their role in driving up costs, lowering or removing tariffs appears to be a logical and effective tool for governments seeking to combat inflation and ease consumer cost pressures. In theory, a tariff cut is a direct reduction in a tax on imports, which should immediately lower the cost for importers and be passed on to the consumer.

Real-World Easing and Limitations

There are real-world instances where tariff relief has provided temporary economic relief:

Targeted Cuts: When the US government temporarily lowered or granted exclusions for specific Chinese-made goods, the prices of those items for importers immediately declined, temporarily easing some cost burdens on businesses.

Macroeconomic Shift: The removal of punitive tariffs can reduce geopolitical tensions and stabilize global supply chains, addressing the inflationary uncertainty that tariffs create.

However, the effectiveness of tariff reduction as an anti-inflation tool has significant limitations:

Lag Time: Tariff cuts don't instantly translate into lower retail prices.

They take months to fully work through the supply chain, as retailers must first sell off existing, higher-cost inventory. Retailer Choice: Retailers might choose to use the cost savings from the tariff cut to restore their profit margins, which they had compressed while absorbing the tariff, rather than immediately lowering consumer prices.

Other Factors Dominate: Inflation is a complex phenomenon driven by many factors, including monetary policy (interest rates), fiscal policy (government spending), energy costs, and global demand. Tariff cuts, while helpful, are just one tool and may be overwhelmed by other, stronger inflationary forces.

A balanced view suggests that while tariff reductions can provide a helpful deflationary impulse, they are not a silver bullet for controlling prices. They are best deployed as part of a coordinated strategy that includes prudent monetary and fiscal policies.

Conclusion

Tariffs are a powerful form of trade tax designed to achieve economic and political goals, primarily to protect domestic industries and create a more favorable trade balance.

While tariffs are levied at the border, they quickly translate into higher retail prices for everything from smartphones and appliances to key manufacturing components.

For policymakers, the challenge lies in balancing global competitiveness with the well-being of the domestic population. Sustainable trade policies must be crafted with an understanding that while tariffs may support some domestic sectors, their ultimate economic burden often falls on the wallets of everyday consumers, making a high cost of living the hidden price of protectionism.

FAQ Section

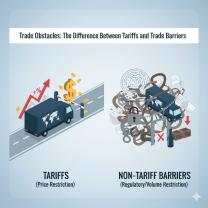

What’s the difference between a tariff and a trade quota?

A tariff is a tax imposed on imported goods, increasing their price.

Do tariffs always make domestic goods cheaper?

No, tariffs do not always make domestic goods cheaper; in fact, they often make them more expensive.

Increased Input Costs: Domestic goods that use imported components (e.g., US cars using imported steel) become more costly to produce.

Reduced Competition: Tariffs reduce competition from foreign goods, allowing domestic producers to raise their prices without fear of being undercut, essentially raising the ceiling for all prices in that market.

How fast do tariff changes affect consumer prices?

The effect is not immediate. It generally takes several months (3 to 6 months) for tariff changes to fully work through the inventory cycles and supply chain. Retailers first sell off existing inventory, which was purchased at the old price. Only when new, tariff-adjusted inventory is purchased and stocked do the price changes appear on the shelves.

What are non-tariff barriers and how do they impact consumers?

Non-tariff barriers (NTBs) are trade restrictions other than tariffs, such as import quotas, strict licensing requirements, overly complex customs procedures, or arbitrary product standards (e.g., food safety or environmental rules).

IMF_Reader

on October 14, 2025Solid reference to the IMF findings on tariff-induced inflation. The 'global ripple effects' from retaliation are crucial—a beggar-thy-neighbor policy that just makes everyone's inputs more expensive.

SmartShopper_AZ

on October 14, 2025I noticed this when I bought my new refrigerator. The price jumped unexpectedly, and it makes sense now that tariffs on steel and components were the real culprits. It's the hidden cost of protectionism.