Which is an example of fiscal policy?

An example of fiscal policy involves either adjustments to government spending or taxation to influence the overall health and direction of the economy. Fiscal policy aims to achieve macroeconomic goals such as economic growth, full employment, price stability, and more. Here are two examples of fiscal policy:

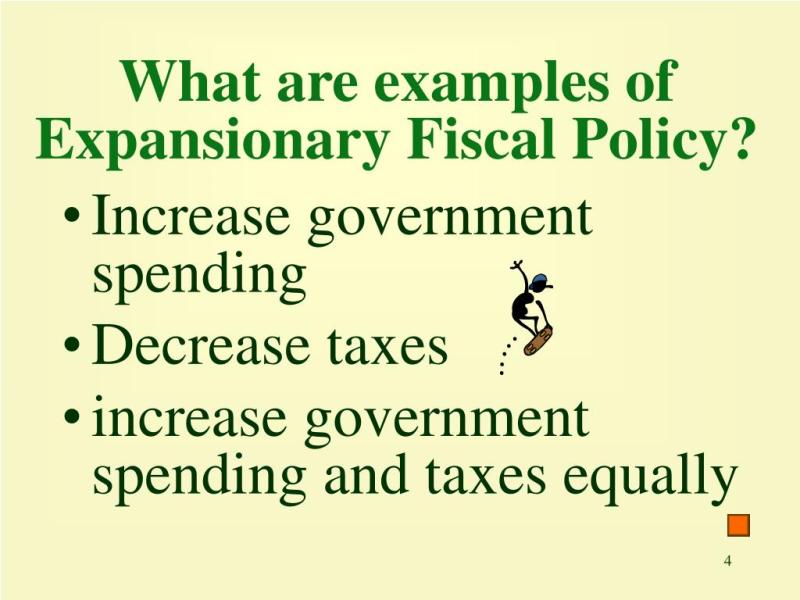

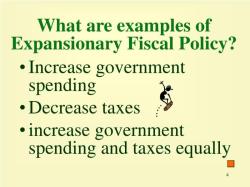

Expansionary Fiscal Policy:

Objective: Stimulating Economic Growth and Employment during a Recession

Measures:

- Increase in Government Spending: The government decides to invest in infrastructure projects, such as building roads, bridges, and schools, to create jobs and stimulate economic activity.

- Tax Cuts: To boost consumer spending and encourage business investment, the government implements tax cuts, putting more money in the hands of individuals and businesses.

Rationale: By increasing government spending and cutting taxes, the government aims to boost aggregate demand, leading to increased production, employment, and economic growth. This type of fiscal policy is typically used during economic downturns or recessions.

Contractionary Fiscal Policy:

Objective: Controlling Inflation during an Economic Boom

Measures:

- Decrease in Government Spending: In response to an overheated economy with rising inflation, the government decides to reduce spending on public projects and programs.

- Tax Increases: To reduce disposable income and curb excessive spending, the government may increase taxes on individuals and businesses.

Rationale: Contractionary fiscal policy aims to cool down an overheated economy to prevent excessive inflation. By reducing government spending and increasing taxes, the government seeks to decrease aggregate demand, slow down economic growth, and maintain price stability.

These examples illustrate how fiscal policy tools—government spending and taxation adjustments—are used to influence the overall level of economic activity. The choice between expansionary and contractionary fiscal policies depends on the prevailing economic conditions and the specific macroeconomic goals policymakers aim to achieve.

It's important to note that the effectiveness of fiscal policy depends on various factors, including the timing of implementation, the magnitude of the policy changes, and the overall economic context. Additionally, fiscal policy is often used in conjunction with monetary policy to achieve comprehensive economic stabilization.

Can you provide an example of fiscal policy and its impact?

Certainly! Here's an example of a recent fiscal policy and its impact, focusing on the American Rescue Plan Act (ARPA) of 2021:

Policy: The American Rescue Plan Act (ARPA) was a massive fiscal stimulus package passed by the US government in 2021 under the Biden administration. The key elements of the policy included:

- Direct payments to individuals: $1,400 checks were sent to most Americans to provide immediate financial relief during the COVID-19 pandemic.

- Expanded unemployment benefits: Enhanced unemployment benefits were extended to help those who lost their jobs due to the pandemic.

- State and local government aid: Billions were allocated to state and local governments to support essential services and address budget deficits.

- Tax credits for small businesses: Tax breaks and subsidies were provided to small businesses to help them cope with the economic downturn.

Impacts: The ARPA had a significant impact on the US economy, both positive and negative:

Positive Impacts:

- Reduced poverty and income inequality: Direct payments and unemployment benefits helped lift millions out of poverty and narrowed the income gap.

- Boosted economic growth: The increased spending injected into the economy stimulated consumer spending and business investment, leading to higher GDP growth.

- Prevented deeper economic recession: The ARPA is credited with preventing a deeper economic recession by supporting struggling individuals and businesses.

- Improved healthcare access: Expanded subsidies for health insurance under the Affordable Care Act provided coverage to millions more Americans.

Negative Impacts:

- Increased national debt: The ARPA added significantly to the US national debt, raising concerns about long-term economic stability.

- Inflationary pressures: The increased spending contributed to rising inflation, leading to higher prices for goods and services.

- Labor shortages: Some argue that the enhanced unemployment benefits may have discouraged some people from returning to work, exacerbating labor shortages in certain sectors.

Overall, the ARPA is a complex policy with both positive and negative impacts. While it provided necessary relief and helped avert a deeper economic crisis, it also raised concerns about fiscal sustainability and inflationary pressures. This example highlights the intricate nature of fiscal policy and the trade-offs that often come with its implementation.

I hope this provides a clear example of a fiscal policy and its impact. Feel free to ask if you'd like to explore other policies or specific aspects of the ARPA in more detail!