Understanding the Present Worth Formula

An interactive guide to one of the most fundamental concepts in economics and finance: the time value of money.

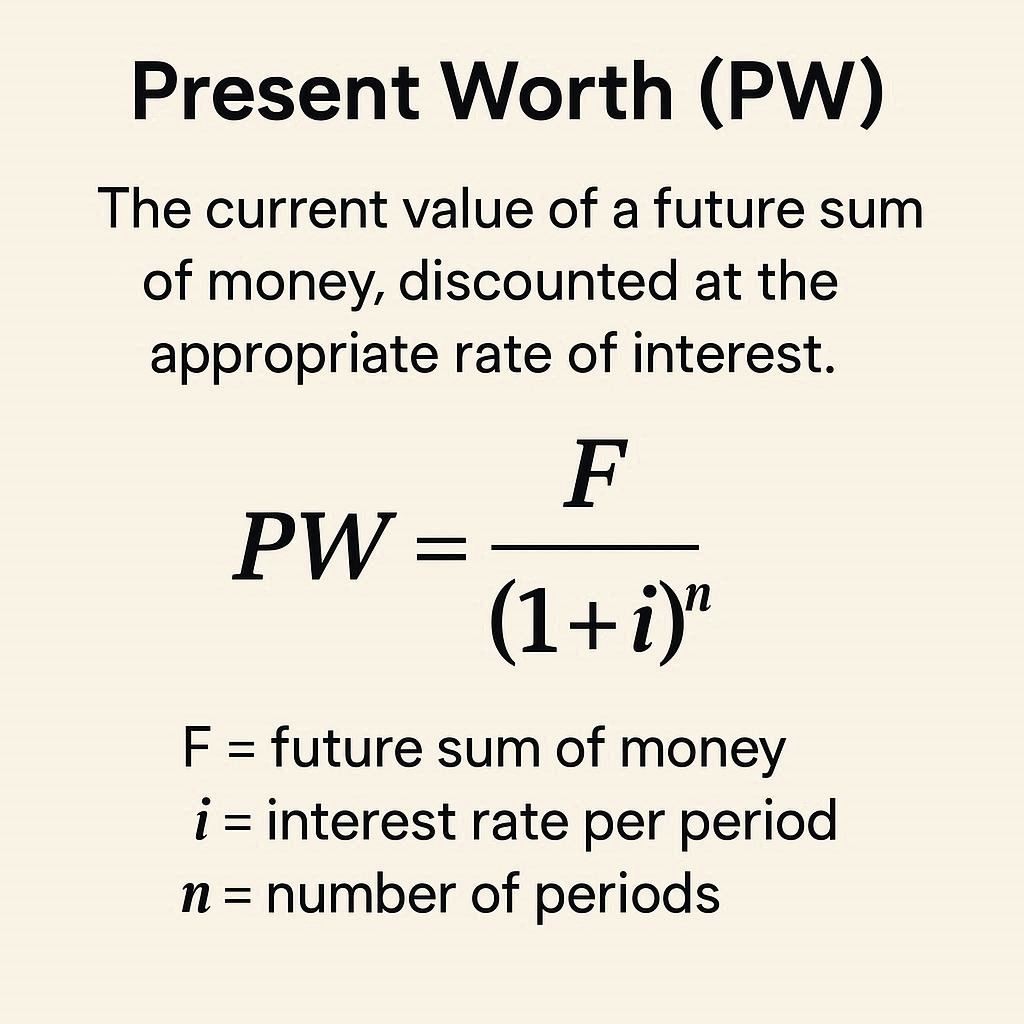

What Is the Present Worth Formula?

Present Worth (PW), also known as Present Value (PV), calculates the current value of a future sum of money or stream of cash flows given a specified rate of return. It's based on the core principle that a dollar today is worth more than a dollar tomorrow due to its potential earning capacity. This principle is often referred to as the time value of money.

PW = FW / (1 + i)n

PW: Present Worth - The value of a future cash flow in today's dollars.

FW: Future Worth - The value of a cash flow at a specified date in the future.

i: Interest Rate - The discount rate or rate of return that could be earned on an investment (expressed as a decimal).

n: Number of Periods - The number of time periods between the present and the future date.

Interactive Present Worth Calculator

Use the sliders and inputs below to see how changes in future value, interest rates, and time periods affect the present worth. This section provides a hands-on way to understand the calculation and the sensitivity of PW to its components.

Calculated Present Worth:

$6,139.13

Value of $10,000 over time at a 5% discount rate

Present Worth vs. Future Worth

Present Worth (PW)

Focuses on the value of future money today. It answers the question: "What do I need to invest today to have a certain amount in the future?" or "What is a future cash flow actually worth to me right now?"

- Values money at the beginning of the period (t=0).

- Uses a "discount rate" to bring future cash flows back to the present.

- Key for investment decisions and project valuation.

- Accounts for the opportunity cost of money.

Future Worth (FW)

Focuses on the value of today's money at a future date. It answers the question: "If I invest a certain amount today, what will it grow to in the future?"

- Values money at the end of a period (t=n).

- Uses a "compounding rate" to grow a present sum over time.

- Useful for retirement planning and savings goals.

- Demonstrates the power of compound interest.

Why Is Present Worth Important?

The concept of Present Worth is critical for making sound financial and economic decisions. By converting all future cash flows to their present-day value, it allows for a fair, apples-to-apples comparison of different investment opportunities or projects.

Investment Analysis

Allows investors to compare investments with different cash flow patterns and time horizons. The investment with the higher Net Present Value (NPV) is generally preferred.

Capital Budgeting

Companies use PW to decide whether to proceed with a project. If the present value of future cash inflows exceeds the initial investment, the project is considered financially viable.

Valuation of Assets

The intrinsic value of assets like stocks and bonds is often estimated by discounting their expected future cash flows (dividends, coupon payments) back to the present.

Loan and Mortgage Decisions

Understanding PW helps in comprehending the actual cost of a loan. The loan amount you receive is the present value of all your future payments.

Retirement Planning

Helps individuals determine how much they need to save today to achieve their desired income level in retirement.

Legal Settlements

Used to calculate the lump-sum payout for future lost earnings in legal cases, ensuring a fair present-day compensation.

Common Mistakes to Avoid

The discount rate is the most sensitive variable. Using a rate that is too high will undervalue future cash flows, while a rate that is too low will overvalue them. The rate should accurately reflect the risk and opportunity cost of the investment.

The interest rate (i) and the number of periods (n) must be consistent. If you are using a monthly interest rate, the number of periods must also be in months. A common mistake is using an annual rate with monthly periods, which drastically skews the result.

For long-term calculations, it's crucial to use a "real" discount rate that accounts for inflation. Using a "nominal" rate (which doesn't account for inflation) will overstate the present value of future cash flows, as their purchasing power will be eroded by inflation.

The standard formula assumes compounding occurs once per period (e.g., annually). If compounding is more frequent (e.g., semi-annually or monthly), the formula must be adjusted. The interest rate per period becomes (i / compounding frequency) and the number of periods becomes (n * compounding frequency).