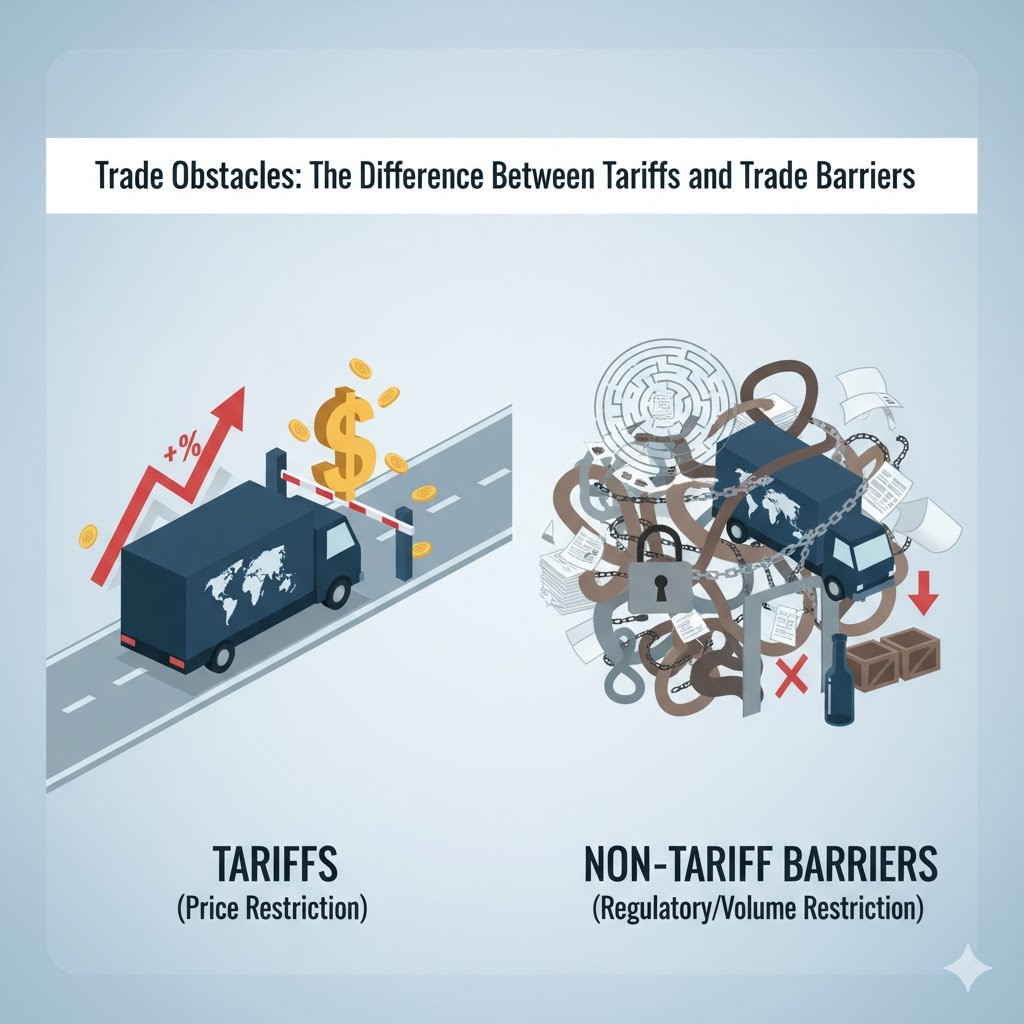

The Distinction: Difference Between Tariffs and Trade Barriers

Introduction

International commerce, the engine of the global economy, is not a frictionless system. Every nation employs a suite of policies to regulate the flow of goods and services across its borders, primarily to protect domestic industries, generate revenue, or influence geopolitical relationships. At the forefront of these tools are tariffs and a wide array of trade barriers. While both mechanisms serve the overarching goal of regulating or restricting international trade, they operate through fundamentally different means.

Tariffs are perhaps the most visible and historically common instruments of trade policy. They are straightforward taxes, their impact immediately felt in the price of imported goods.

This article offers a clear, data-informed breakdown of what differentiates tariffs from other trade barriers. We will explore their specific economic impacts, their role in modern protectionism, and how they affect global competition. Understanding these diverse mechanisms—the taxes, the quotas, the standards, and the subsidies—is crucial for business owners navigating supply chains, economists modeling market behavior, and policymakers setting the course for national prosperity in an interconnected global economy.

What Is the Key Difference Between Tariffs and Non-Tariff Barriers?

The essential difference between tariffs and trade barriers lies in the mechanism of restriction: one is monetary, and the other is regulatory or quantitative. Tariffs are a subset of the broader category of trade barriers.

A tariff is a government-imposed tax or duty levied on imported goods or services.

Non-Tariff Barriers (NTBs), on the other hand, are trade restrictions that are not monetary taxes.

Quotas: Direct limits on the quantity of a product that can be imported.

Import Licenses: Requirements for government permission to import certain goods.

Technical Regulations and Product Standards: Strict safety, health, environmental, or labeling requirements that imported goods must meet. For example, demanding rigorous and costly safety certification requirements for all imported electronics.

Customs Procedures: Lengthy, complex, or non-transparent border-crossing processes.

In essence, tariffs are price-based restrictions, while NTBs are often volume-based or process-based restrictions.

How Do Quotas and Embargoes Differ from Tariffs?

While tariffs, quotas, and embargoes are all powerful types of trade restrictions, they restrict trade using distinct methods that lead to different market outcomes.

Tariffs (Price Restriction)

Tariffs work by making imports more expensive, thereby discouraging demand.

Quotas (Volume Restriction)

Quotas are explicit limits placed on the maximum quantity (or sometimes value) of a product that can be imported during a specific time period.

Contrast with Tariffs: Unlike a tariff, which only raises the price, a quota restricts supply entirely, regardless of price or consumer demand.

A tariff might lead to a smaller volume of imports, but a quota sets a hard cap. Market Impact: Quotas typically raise the market price because they limit supply, but the increased profit (known as "quota rent") often goes to the foreign producer or the domestic importer who holds the valuable import license, not the government.

Case Study: The EU agricultural quotas historically restricted the import volume of certain foreign products to protect local farming, raising domestic food prices.

Embargoes (Total Ban)

An embargo is the most extreme form of trade barrier, representing an official, total ban on the import or export of specific goods, or on all trade with a particular country or region.

Contrast with Tariffs/Quotas: While tariffs make trade expensive and quotas make trade limited, an embargo stops trade entirely.

Purpose and Impact: Embargoes are typically used for political or national security reasons rather than purely economic ones.

Historical Example: The U.S. oil embargoes in the 1970s and the ongoing U.S. embargo on Cuba are examples where foreign policy objectives dictated the complete cessation of trade. The economic impact is a complete distortion of the target market, forcing consumers and producers to find costly, often inefficient, alternatives.

| Type of Barrier | Description | Primary Mechanism | Impact on Trade |

| Tariff | Tax on imports | Monetary (Price) | Raises the price of imports |

| Quota | Quantity limit | Quantitative (Volume) | Restricts supply; often raises price |

| Embargo | Total ban on trade | Political/Regulatory (Total Restriction) | Stops trade entirely |

Which Trade Barriers Have the Greatest Economic Impact?

While tariffs are easier to measure and track, many economists argue that Non-Tariff Barriers (NTBs) have the greatest—and often hidden—economic impact in the modern global economy.

Tariffs' influence is direct and measurable: a 10% tariff is a 10% price increase. However, the economic influence of NTBs is often more subtle, pervasive, and costly. NTBs create substantial hidden costs:

Compliance Challenges: The cost of redesigning a product to meet a foreign country's obscure packaging, labeling, or technical standards can be enormous.

Delays: Complex, opaque customs procedures or lengthy product testing requirements can delay goods at the border, disrupting modern, just-in-time global supply chains and leading to significant demurrage and storage fees.

Reduced Competition: NTBs can be so cumbersome that only the largest multinational corporations can afford to comply, effectively shutting out smaller and medium-sized enterprises (SMEs).

Modern economies increasingly rely on NTBs because, since the establishment of the World Trade Organization (WTO), tariffs have steadily declined due to decades of successful multilateral trade negotiations and the proliferation of free trade agreements (FTAs). This shift has led governments seeking to protect local industries to adopt more sophisticated and subtle forms of protectionism—the NTBs.

Examples of NTBs that subtly shape trade outcomes include:

Subsidies: Government financial aid to domestic producers (e.g., agricultural or high-tech) makes their exports cheaper on the world market or helps them compete against imports at home.

Sanitary and Phytosanitary (SPS) Regulations: Health and safety standards on food, plants, and animals, which, while legitimate, can be intentionally excessive to block imports.

Local Content Requirements: Rules dictating that a certain percentage of a product must be locally manufactured.

These NTBs, while often masked as legitimate health or safety regulations, are complex to navigate and harder for international bodies like the WTO to effectively police, making their cumulative economic drag on global trade potentially far greater than the remaining tariffs.

Can Tariffs Be Considered a Form of Protectionism?

Yes, tariffs are considered one of the purest and most direct forms of protectionism.

Protectionism is a national economic policy aimed at restricting imports from other countries to safeguard local jobs, industries, and national security.

How Tariffs Fit the Definition

Tariffs perfectly fit this definition because they operate by making foreign goods less competitive in the domestic market.

The Trade-Off of Protectionism

Protectionism, whether via tariffs or NTBs, involves a fundamental trade-off:

| When Protectionism Helps (Potential Benefits) | When Protectionism Hurts (Economic Costs) |

| Infant Industry Argument: Supports nascent domestic industries until they achieve efficiency (e.g., historical protection of the U.S. auto industry). | Reduced Efficiency: Domestic industries lack the pressure to innovate and cut costs. |

| National Security: Ensures a reliable domestic supply of critical goods (e.g., defense or medical supplies). | Higher Consumer Prices: Tariffs and barriers are a tax on consumers who pay more for both imports and often the protected domestic substitute. |

| Retaliation Leverage: Used as a bargaining chip to pressure other countries to open their markets. | Trade Retaliation: Other countries often impose counter-tariffs, escalating to trade wars that harm all parties involved. |

Organizations like the World Trade Organization (WTO) and the International Monetary Fund (IMF) generally advocate for freer, rules-based international trade.

How Do Tariffs and Trade Barriers Affect Global Competition?

The imposition of tariffs and trade barriers fundamentally undermines global competition by reducing market efficiency and increasing costs for both producers and consumers worldwide.

Impact on Efficiency and Costs

Trade barriers act as economic sand in the gears of the global economy:

Increased Production Costs: Manufacturers operating in global supply chains often source components from various countries.

Tariffs on these intermediate goods (e.g., microchips, raw materials) directly increase the final product's manufacturing cost. This is particularly evident in modern global manufacturing, technology, and agriculture. Stifled Innovation: When domestic firms are protected from foreign competition, they face less pressure to invest in R&D, improve product quality, or adopt the most efficient production techniques.

Freer trade, conversely, compels firms to be competitive, which is a powerful engine for innovation and economic growth. Distorted Supply Chains: Barriers force companies to make economic decisions based on political borders rather than efficiency. For example, a tariff might force a car manufacturer to source a component from a higher-cost domestic supplier instead of a lower-cost foreign one.

Corporate Adaptation and "Tariff Engineering"

In response to trade barriers, companies adapt their global strategies, sometimes through costly methods:

Shifting Production: Companies may relocate factories to countries outside a trading bloc to avoid an external tariff, a process known as Foreign Direct Investment (FDI) diversion.

Tariff Engineering: Firms may redesign products to classify them under a customs code with a lower tariff rate, or change the level of assembly completed in a final market to satisfy a "local content" or "rules of origin" requirement.

Ultimately, while excessive trade barriers can temporarily shield specific domestic groups, the consensus among economists is that they generally stifle growth, reduce the overall size of the global economic pie, and lead to a less efficient allocation of resources compared to a system of relatively free trade.

FAQ Section

What’s the role of the WTO in reducing trade barriers?

The World Trade Organization (WTO) is the only global international organization dealing with the rules of trade between nations.

Do all countries still use tariffs today?

Yes, all countries still use tariffs today. However, the average level of tariffs, especially for developed nations, has fallen significantly since World War II due to the efforts of the WTO and its predecessor, the GATT.

Are environmental regulations considered trade barriers?

They can be. Legitimate, non-discriminatory environmental regulations (e.g., emissions standards) are generally accepted. However, if a country implements environmental standards that are unduly complex, scientifically unjustifiable, or applied discriminatorily to foreign products but not domestic ones, they can function as non-tariff barriers and be challenged at the WTO.

How do developing countries use tariffs differently from developed ones?

Developing countries often use tariffs for two main reasons:

Revenue Generation: Customs duties can be a substantial and easy-to-collect source of government income, especially where domestic tax collection is inefficient.

Infant Industry Protection: Higher tariffs are often employed to shield new or strategic local industries from fierce international competition until they are strong enough to compete globally.

Developed countries, by contrast, rely less on tariffs for revenue and more on NTBs or subsidies for protection.

Conclusion

The distinction between tariffs and trade barriers is essential for understanding the mechanics of global trade policy. While tariffs represent a specific, measurable tax on imports—a price-based restriction—the term trade barriers is a broader category that includes tariffs but is now dominated by diverse non-tariff barriers (NTBs), which act as regulatory or quantitative restrictions.

Both are powerful tools for shaping national trade policy. Tariffs influence behavior through pricing, making foreign goods expensive; NTBs influence behavior through regulation and supply limits, making trade difficult or impossible.

In a globalized world, policymakers face a continuous challenge: finding the balance between protecting domestic industries—safeguarding jobs and national security—and maintaining healthy global competition and efficiency. The ongoing decline of tariffs, coupled with the rise of increasingly sophisticated NTBs, shows that globalization continues to challenge traditional trade strategies, requiring a nuanced understanding of these complex economic levers to ensure prosperity and stable international relations.

MarketEfficiency

on October 14, 2025The discussion on how trade barriers reduce market efficiency and stifle innovation is crucial. Protectionism might save one job, but it taxes thousands of consumers.

TechExporter

on October 14, 2025We spend more on compliance lawyers for technical regulations than we do on tariffs. That speaks volumes about the current state of global commerce and the power of NTBs.