How do you calculate sinking fund?

A sinking fund is a financial planning tool used to set aside money regularly to cover future expenses or liabilities. To calculate the amount you need to contribute to a sinking fund, you can use the following formula:

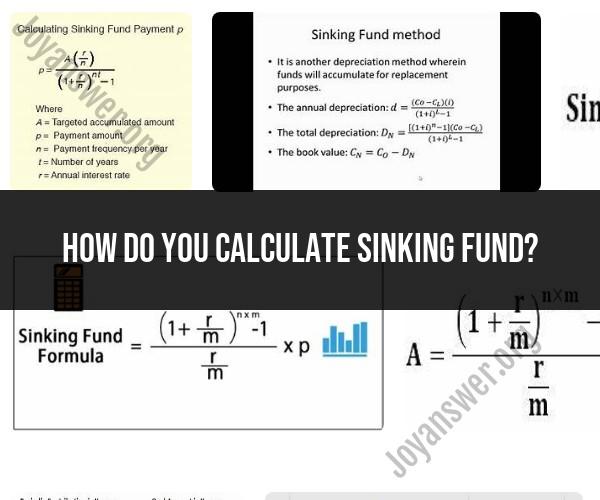

Sinking Fund Calculation Formula:

Where:

- Sinking Fund Contribution: This is the amount you need to contribute regularly to the sinking fund.

- Future Value: This is the total amount you want to accumulate in the sinking fund by a specific future date. It represents the amount needed to cover future expenses or liabilities.

- Existing Fund Balance: If you already have some money in the sinking fund, you can subtract this amount from the future value. It represents the current balance in the fund.

- r: This is the interest rate or expected rate of return on the investments in the sinking fund. It should be expressed as a decimal. For example, if the annual rate is 5%, you would use .

- n: This is the number of periods or the number of times you will make contributions to the sinking fund each year. It should match the frequency of contributions. For example, if you make monthly contributions, would be 12 for a year with 12 months.

Here's a step-by-step guide to calculate a sinking fund contribution:

Determine the Future Value: Decide how much money you need to have in the sinking fund at a specific future date to cover your expenses or liabilities.

Check the Existing Fund Balance: If you already have some money in the sinking fund, subtract it from the future value to determine how much additional money you need to save.

Identify the Interest Rate (r): Determine the expected rate of return or interest rate you expect to earn on the investments within the sinking fund.

Determine the Number of Periods (n): Decide how often you will make contributions to the sinking fund (e.g., monthly, quarterly) and determine the number of times you will contribute each year.

Use the Formula: Plug the values into the formula mentioned above to calculate the sinking fund contribution.

Calculate Regular Contributions: The result will be the amount you need to contribute regularly to the sinking fund to reach your future value goal.

Keep in mind that this formula assumes that your contributions are made at regular intervals and that the interest is compounded at the same frequency as your contributions. Additionally, it's important to choose appropriate investments for the sinking fund that align with your risk tolerance and expected rate of return. Regularly review and adjust your contributions to ensure you stay on track to meet your financial goals.

Sinking Fund Calculation Methods: A Comprehensive Guide

A sinking fund is a savings account that you set aside money for specific future expenses, such as a down payment on a house, a new car, or a vacation. Sinking funds can help you avoid having to go into debt or tap into your emergency fund for unexpected expenses.

There are a few different ways to calculate your sinking fund. One simple way is to divide your total goal amount by the number of months you have to save. For example, if you need to save $10,000 for a down payment on a house in 12 months, you would need to save $833 per month.

Another way to calculate your sinking fund is to use the following formula:

Sinking fund payment = (Total goal amount / Number of months) * (1 + Interest rate)^Number of months

This formula takes into account the interest that your money will earn over time. For example, if you are saving $10,000 for a down payment on a house in 12 months at an interest rate of 2%, your sinking fund payment would be $818.29 per month.

If you are not sure which sinking fund calculation method to use, you can use a sinking fund calculator. There are a number of sinking fund calculators available online that can help you determine how much money you need to save each month to reach your goal.

Crunching the Numbers: How to Calculate Your Sinking Fund

To calculate your sinking fund, you will need to know the following:

- Total goal amount: How much money do you need to save for your goal?

- Number of months: How many months do you have to save?

- Interest rate: What is the interest rate that your money will earn over time?

Once you have this information, you can use one of the sinking fund calculation methods described above to determine how much money you need to save each month to reach your goal.

Financial Planning Essentials: Determining the Size of Your Sinking Fund

The size of your sinking fund will depend on your individual needs and goals. Some common sinking fund goals include:

- Down payment on a house

- New car

- Vacation

- Emergency repairs

- Holiday expenses

- Medical expenses

When determining the size of your sinking fund, it is important to consider the following factors:

- The cost of your goal: How much money do you need to save for your goal?

- The time frame you have to save: How many months do you have to save?

- Your financial situation: How much money can you afford to save each month?

It is also important to be realistic when setting your sinking fund goals. If you set your goals too high, you may become discouraged and give up. If you set your goals too low, you may not have enough money saved when you need it.

If you are not sure how to determine the size of your sinking fund, you can speak with a financial advisor. They can help you create a budget and savings plan that meets your individual needs and goals.

Here are some additional tips for calculating and managing your sinking fund:

- Set realistic goals. Don't set your goals too high or too low.

- Review your sinking fund regularly. As your financial situation changes, be sure to review your sinking fund goals and budget.

- Automate your savings. Set up a recurring transfer from your checking account to your sinking fund each month. This will help you save money consistently, even if you forget.

- Don't be afraid to adjust your goals. If your financial situation changes or if you have unexpected expenses, don't be afraid to adjust your sinking fund goals.

By following these tips, you can calculate and manage your sinking fund effectively.