How much does extra principal reduce mortgage?

The amount by which extra principal payments reduce your mortgage can vary significantly depending on several factors, including the size of the extra payment, the interest rate on your mortgage, the remaining term of your loan, and the frequency of the extra payments. Here are some general principles to consider:

Larger Extra Payments: Making larger extra principal payments will reduce your mortgage balance more quickly. For example, making an extra payment of $100 or $200 per month will have a more significant impact than making a one-time extra payment of $100.

Interest Savings: Every dollar you put towards your mortgage's principal reduces the amount of interest you will pay over the life of the loan. The sooner you make extra payments, the more interest you'll save. For example, paying an extra $100 per month from the beginning of your mortgage will result in more interest savings compared to starting those extra payments later in the loan term.

Frequency of Payments: Making extra payments more frequently, such as monthly or biweekly, can accelerate the reduction of your mortgage balance. More frequent payments mean you're reducing the principal more often, which saves you interest.

Remaining Term: The earlier you start making extra principal payments, the greater the reduction in the overall term of your mortgage. This is because your monthly payment is applied to interest and principal, and any extra payment reduces the principal balance, which, in turn, reduces the interest paid on subsequent payments.

Interest Rate: The higher your mortgage interest rate, the more impact extra principal payments will have in terms of reducing the total interest paid. High-interest mortgages accumulate more interest over time, so extra payments can lead to significant savings.

Loan Type: The impact of extra principal payments may also vary depending on the type of mortgage you have. For example, fixed-rate mortgages have consistent monthly payments, making it easier to plan for extra payments, while adjustable-rate mortgages may have changing monthly payments.

To see the specific impact of extra principal payments on your mortgage, you can use a mortgage calculator or speak with your lender. Mortgage calculators can help you estimate how extra payments will affect your remaining balance, interest savings, and loan term. Keep in mind that some mortgages may have prepayment penalties or specific terms regarding extra payments, so it's advisable to review your loan agreement and discuss your strategy with your lender.

How Much Extra Principal Payments Reduce Your Mortgage

Making extra principal payments on your mortgage can significantly reduce the amount of interest you pay over the life of the loan. The amount of savings will depend on the amount of the extra payments, the interest rate on the loan, and the remaining loan term.

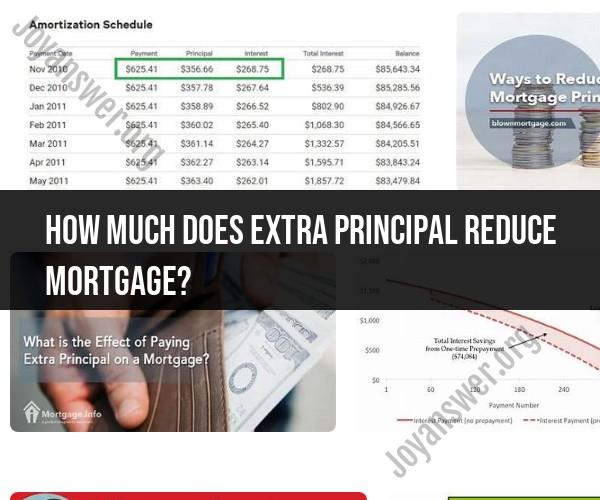

For example, let's say you have a $300,000 mortgage with a 5% interest rate and a 30-year term. If you make an extra $100 payment each month, you will save over $36,000 in interest and pay off your mortgage in 25 years instead of 30 years.

Accelerating Home Loan Payoff with Additional Principal

Making extra principal payments on your mortgage can help you pay off your loan faster. This can save you money on interest and give you more financial flexibility.

There are a few different ways to make extra principal payments. You can make a one-time payment, such as when you get a tax refund or bonus. You can also increase your monthly mortgage payment by a small amount. Or, you can make a biweekly mortgage payment, which is equal to one-half of your monthly payment made every two weeks.

Calculating the Savings and Timeline of Extra Mortgage Payments

There are a number of online calculators that can help you calculate the savings and timeline of extra mortgage payments. These calculators typically take into account the following factors:

- The amount of the extra payments

- The interest rate on the loan

- The remaining loan term

- The type of mortgage (e.g., fixed-rate, adjustable-rate)

Long-Term Financial Benefits of Reducing Mortgage Principal

Reducing your mortgage principal has a number of long-term financial benefits, including:

- Lower monthly mortgage payments: When you pay down your mortgage principal, your monthly payments will decrease. This can free up cash flow for other expenses, such as saving for retirement or investing.

- Increased equity: Equity is the difference between the value of your home and the amount you owe on your mortgage. As you pay down your mortgage principal, your equity in your home increases. This can give you more financial flexibility, such as the ability to borrow against your home equity to finance a major purchase.

- Earlier payoff: If you make extra principal payments, you can pay off your mortgage early. This can save you a significant amount of money in interest over the life of the loan.

Success Stories and Financial Freedom Achieved through Extra Payments

There are many stories of people who have achieved financial freedom by making extra principal payments on their mortgages. For example, one couple was able to pay off their mortgage in 10 years by making extra payments each month. This allowed them to retire early and live debt-free.

Another couple was able to use their home equity to finance a business venture. This venture was successful, and the couple was able to pay off their mortgage early and retire comfortably.

Making extra principal payments on your mortgage can be a great way to save money and achieve your financial goals. If you are considering making extra principal payments, be sure to talk to your lender to learn more about your options.