How to read amortization table?

Reading an amortization table can help you understand how a loan is paid down over time, including the distribution of principal and interest in each payment. Here's a step-by-step guide on how to read an amortization table:

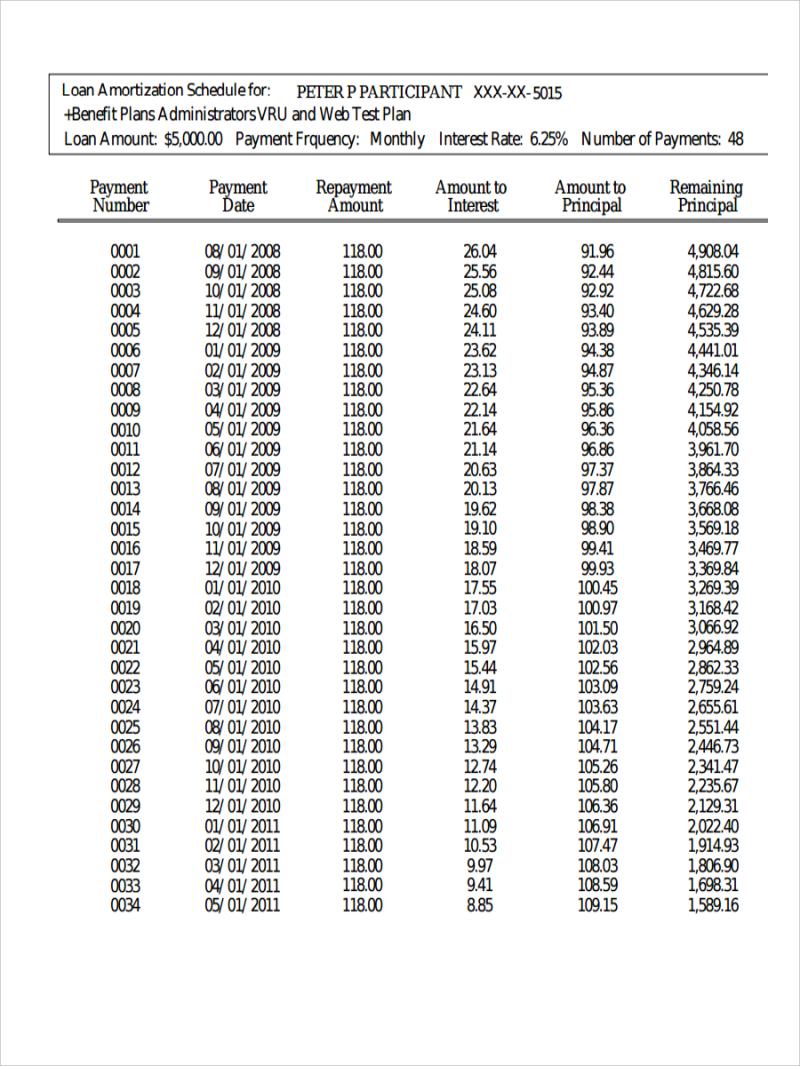

Column Headings:

- Payment Number (Payment #): This column indicates the order of each payment, starting from the first payment.

- Payment Amount: The total payment due for each period, including both principal and interest.

- Principal: The portion of the payment that goes toward reducing the loan balance.

- Interest: The interest charged on the remaining loan balance.

- Remaining Balance: The outstanding loan balance after each payment.

Initial Loan Information:

- Look for the initial loan amount (Principal) and the interest rate. These values are used to calculate the payments.

Monthly Payments:

- Examine how the total payment is divided between principal and interest. In the early stages of the loan, a larger portion goes toward interest.

Principal Repayment:

- Notice how the principal amount increases with each payment. This reflects the reduction in the outstanding loan balance.

Interest Payments:

- Observe how the interest amount decreases over time as the loan balance decreases. More of the payment goes toward principal as the loan is paid down.

Total Payments:

- Sum the Principal and Interest columns to get the total payment for each period.

Remaining Balance:

- Pay attention to the Remaining Balance column. It shows the amount still owed on the loan after each payment.

End of Amortization:

- The amortization table typically extends until the final payment. At this point, the remaining balance should be zero, indicating that the loan has been fully paid off.

Understanding Interest and Principal Distribution:

- Note the shift in the distribution of payments over time. Initially, more money goes toward interest, but as the loan progresses, a larger portion is applied to principal.

Optional Columns:

- Some amortization tables may include additional columns, such as taxes and insurance if they are escrowed with the loan.

Reading and understanding the amortization table can be valuable for borrowers, as it provides insights into the repayment process and helps them see how each payment contributes to reducing the overall loan balance. This understanding is particularly important for long-term loans like mortgages.

Understanding Amortization Tables: A Guide to Loan Repayment

1. Interpreting an Amortization Table:

- Purpose: An amortization table outlines a loan's repayment plan, detailing how each payment is divided between principal (the original borrowed amount) and interest (the cost of borrowing).

- Structure: The table typically includes columns for payment number, payment amount, principal paid, interest paid, and remaining balance.

2. Information Presented:

- Payment Number: Indicates the chronological order of payments.

- Payment Amount: The total amount due for each payment, usually fixed for fixed-rate loans.

- Principal Paid: The portion of each payment that reduces the outstanding loan balance.

- Interest Paid: The portion of each payment that goes towards the lender's interest charges.

- Remaining Balance: The outstanding loan amount after each payment is applied.

3. Key Terms and Calculations:

- Principal: The initial amount borrowed.

- Interest Rate: The annual percentage charged by the lender for borrowing.

- Loan Term: The length of time, in months or years, over which the loan is repaid.

- Monthly Payment: Calculated using a loan amortization formula that considers principal, interest rate, and loan term.

- Total Interest Paid: The cumulative amount of interest paid over the entire loan term.

4. Insights from Amortization Tables:

- Tracking Progress: Visualize how each payment gradually reduces the principal balance.

- Interest vs. Principal: Observe how the proportion of interest paid decreases over time, while principal payments increase.

- Impact of Extra Payments: Assess the effect of additional payments on reducing interest costs and shortening the repayment period.

- Refinancing Considerations: Evaluate the potential savings from refinancing to a lower interest rate.

5. Online Tools and Resources:

- Lender Websites: Many lenders provide amortization calculators or tables within their online platforms.

- Financial Websites: Reputable sources like NerdWallet, Bankrate, and MortgageCalculator offer free amortization calculators.

- Personal Finance Software: Programs like Quicken or Mint often include amortization features.

Tips for Using Amortization Tables:

- Review Before Signing: Ask for an amortization table before finalizing a loan to understand the repayment terms fully.

- Monitor Progress: Regularly check the table to track your progress and make informed financial decisions.

- Explore Repayment Strategies: Use the table to evaluate the impact of extra payments or refinancing.

- Seek Clarification: Consult a financial advisor if you have questions or need assistance interpreting the table.