What is a business bank statement?

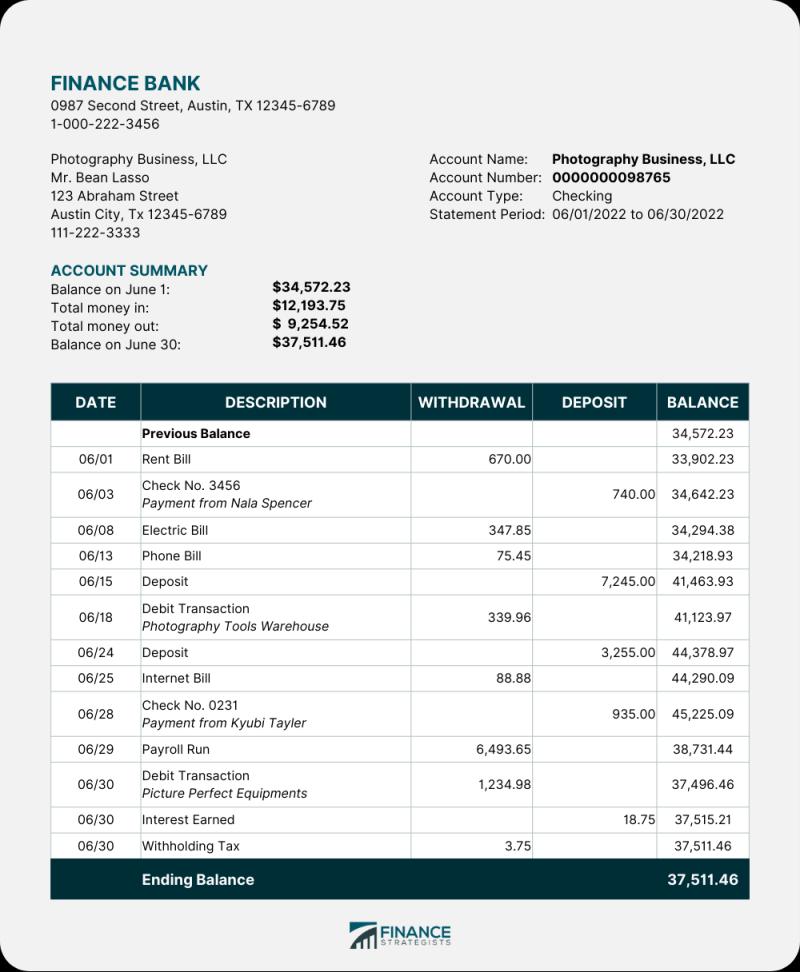

A business bank statement is a document provided by a financial institution that details the financial transactions of a business's bank account over a specific period. It serves as a record of the inflows and outflows of money, allowing business owners, accountants, and financial professionals to monitor and manage the company's financial activities. Here are some key insights and components typically found in a business bank statement:

Account Information:

- The business bank statement typically includes information about the business's bank account, such as the account number, account holder's name, and the bank's contact details.

Statement Period:

- It specifies the time frame for which the transactions are reported. Business bank statements are usually issued on a monthly basis, providing a snapshot of financial activity over that period.

Beginning and Ending Balances:

- The statement shows the opening balance at the beginning of the statement period and the closing balance at the end. The closing balance represents the amount of money in the account after all transactions have been accounted for.

Transaction Details:

- Each transaction is listed individually and includes details such as the date, description, and amount. Transactions may include deposits, withdrawals, checks, electronic transfers, and other activities affecting the account balance.

Deposits:

- Money credited to the account is categorized as deposits. This includes income from sales, loans, or any other sources of funds.

Withdrawals:

- Money debited from the account is categorized as withdrawals. This includes payments to suppliers, employee salaries, operating expenses, and other outflows.

Checks Issued:

- If the business writes checks for payments, these transactions will be listed separately, providing details about the payee and the check amount.

Electronic Transactions:

- Transactions made electronically, such as wire transfers, online payments, or automatic debits, are typically included in the statement with relevant details.

Service Charges and Fees:

- Any fees or service charges imposed by the bank, such as maintenance fees or transaction fees, are detailed in the statement.

Reconciling Information:

- The statement may include information to assist in reconciling the account, such as an ending balance, which should match the balance in the business's accounting records.

Business owners and financial professionals use bank statements to reconcile accounts, track cash flow, monitor expenses, and ensure accuracy in financial records. Regularly reviewing these statements is essential for managing the financial health of a business and making informed decisions.

Business Bank Statements: Key Information and Insights

1. Information in a Business Bank Statement:

A business bank statement typically includes sections with the following information:

- Account summary: Beginning and ending balance, statement period, account activity summary (total deposits, withdrawals, fees).

- Transaction details: Individual deposits, withdrawals, transfers, checks cleared, debit/credit card transactions, ATM charges, fees, etc., each with date, amount, description, and reference number.

- Reconciliation tools: Check register for manual reconciliation, electronic file for import into accounting software.

- Account information: Bank and account details, contact information.

2. Differences from Personal Statements:

Compared to personal statements, business statements may have:

- Multiple transactions: Reflecting various business activities like sales, purchases, payroll, taxes, etc.

- Separate accounts: Different accounts for checking, savings, payroll, credit cards, etc.

- More complex transactions: Merchant payments, business loan activity, wire transfers, etc.

- Focus on cash flow: Emphasizing income and expenses for financial analysis.

3. Insights for Business Owners:

By reviewing their bank statements, business owners can gain valuable insights:

- Financial health: Track cash flow, identify spending patterns, monitor account balances.

- Sales and expenses: Analyze income sources, categorize expenses, identify cost-saving opportunities.

- Tax preparation: Gather transaction details for accurate tax reporting.

- Fraud detection: Spot unauthorized transactions and potential fraud attempts.

- Payment terms: Monitor adherence to payment terms with vendors and customers.

- Inventory management: Analyze purchase patterns to optimize inventory levels.

Additional Notes:

- Business bank statements are crucial for financial recordkeeping and meeting legal requirements.

- Regularly reviewing and reconciling statements ensures accuracy and timely detection of errors or fraud.

- Advanced bank statements offer features like categorization, budgeting tools, and custom reports for deeper analysis.

By understanding the information contained within and utilizing it effectively, business owners can gain valuable insights into their financial health and make informed decisions for their business growth.