What is the penalty for withdrawing early?

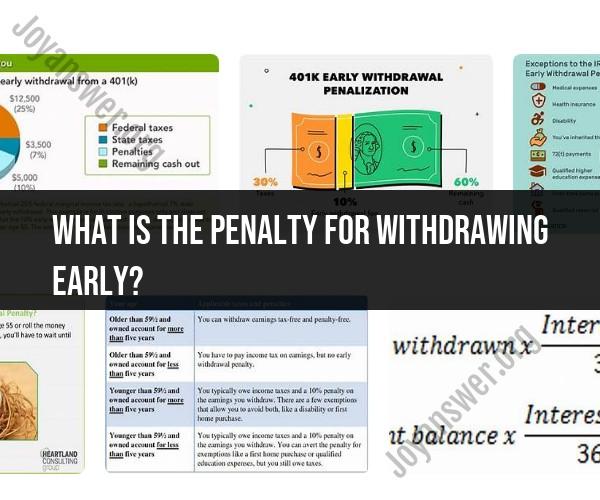

The penalty for withdrawing early from a retirement account, such as a 401(k) or Individual Retirement Account (IRA), in the United States is typically a 10% early withdrawal penalty on the taxable portion of the distribution. This penalty is imposed in addition to any regular income taxes that may apply to the withdrawal. Here are some key points to understand about the early withdrawal penalty:

Age Requirement: The penalty is generally applied if you make a withdrawal from a retirement account before you reach the age of 59½. This age threshold is known as the "age of 59½ rule."

Taxable Portion: The penalty is assessed on the portion of the withdrawal that is considered taxable income. In the case of traditional IRAs and 401(k) accounts, this includes both your contributions (on which you may have received a tax deduction) and any earnings or growth on those contributions.

Exceptions: There are some exceptions to the early withdrawal penalty. If you qualify for one of these exceptions, you may be able to avoid the 10% penalty. Common exceptions include:

- Disability: If you become permanently disabled, you may be exempt from the penalty.

- Medical Expenses: You may avoid the penalty if you have unreimbursed medical expenses that exceed a certain threshold.

- Higher Education: Using the funds for qualified higher education expenses for yourself, your spouse, children, or grandchildren may exempt you from the penalty.

- First-Time Home Purchase: A penalty exception applies if you use the funds (up to a limit) to purchase a first home.

Income Tax Implications: In addition to the early withdrawal penalty, the distribution is generally subject to regular income taxes for the year in which it is taken. This means that the withdrawal can increase your overall income tax liability.

Form 1099-R: When you make an early withdrawal, the financial institution that manages your retirement account will typically issue a Form 1099-R. This form reports the distribution, any applicable penalties, and the taxable amount. You will use this form when filing your federal income tax return.

Roth IRAs: Roth IRAs have different rules regarding withdrawals. Contributions to a Roth IRA can typically be withdrawn at any time without penalty, but early withdrawals of earnings may be subject to the 10% penalty unless an exception applies.

It's crucial to consult with a qualified tax advisor or financial planner before making an early withdrawal from a retirement account. They can help you understand the potential consequences, explore available exceptions, and consider alternative financial strategies to avoid the penalty and minimize the tax impact of the withdrawal. Early withdrawals from retirement accounts can have significant financial implications, so careful planning is essential.