What percentage of your gross pay is allotted to deductions?

The percentage of your gross pay that is allotted to deductions can vary significantly depending on various factors, including your location, employment terms, and personal circumstances. Deductions from your gross pay are typically made to cover various expenses and obligations, such as taxes, retirement contributions, insurance premiums, and more. Here are some common deductions and factors that can influence the percentage of your gross pay allocated to deductions:

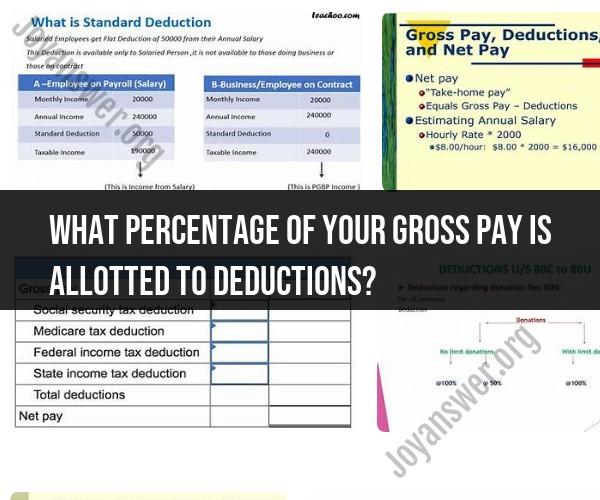

Taxes:

- Federal, state, and local income taxes can significantly impact the percentage of deductions from your gross pay. The tax rate varies depending on your income level, tax jurisdiction, and the tax credits or deductions you are eligible for.

Social Security and Medicare (FICA):

- In the United States, employees and employers contribute to Social Security (6.2% each) and Medicare (1.45% each) through payroll taxes, which are deducted from your gross pay. If you are self-employed, you may pay both the employee and employer portions.

Retirement Contributions:

- If you participate in a retirement plan, such as a 401(k) or a pension plan, a portion of your gross pay is deducted and contributed to the plan. The percentage can vary based on your contribution rate and employer match, if applicable.

Health Insurance Premiums:

- If you have employer-sponsored health insurance, a portion of your gross pay may be deducted to cover your health insurance premiums. The percentage depends on the cost of the insurance plan and the level of coverage you choose.

Other Insurance Premiums:

- Deductions may also include premiums for other insurance coverage, such as life insurance, disability insurance, or dental and vision insurance. The percentage varies based on the type and coverage level.

Union Dues:

- If you are a member of a labor union, you may have union dues deducted from your gross pay. The percentage depends on the union's policies and agreements.

Garnishments:

- If you have outstanding debts or legal obligations, such as child support or creditor garnishments, a portion of your gross pay may be withheld to satisfy these obligations. The percentage varies based on the court order or legal agreement.

Voluntary Deductions:

- Some deductions are voluntary and depend on your choices. This includes contributions to flexible spending accounts (FSAs), health savings accounts (HSAs), and charitable contributions.

Other Deductions:

- Miscellaneous deductions may include commuter benefits, education loan repayments, or employee stock purchase plan deductions.

The total percentage of deductions from your gross pay can vary widely, but it's essential to review your pay stub or earnings statement to understand the specific deductions applicable to your situation. Additionally, tax laws and deduction rates can change over time, so it's important to stay informed about current regulations and seek guidance from your employer's HR department or a financial advisor to understand the impact of deductions on your net pay.