What are the fees paid by mutual funds?

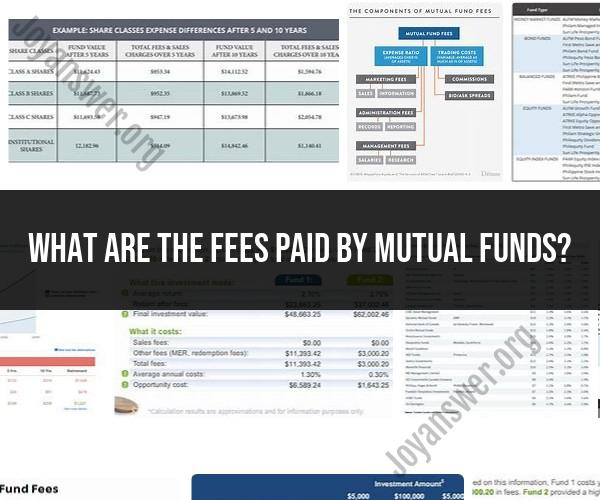

Mutual funds charge various fees and expenses, which investors should be aware of when considering an investment. These fees can impact the overall return on your investment. Here are the common fees associated with mutual funds:

Expense Ratio: The expense ratio is one of the most critical fees to understand. It represents the annual cost of operating the mutual fund, expressed as a percentage of the fund's average assets under management (AUM). The expense ratio covers various costs, including management fees, administrative expenses, and marketing costs. Lower expense ratios are generally more favorable for investors because they result in lower ongoing costs.

Front-End Load (Sales Load): Some mutual funds charge a front-end load, which is a one-time fee that investors pay when they purchase shares of the fund. This fee is typically a percentage of the amount invested and is deducted from the initial investment. Front-end loads are associated with "Class A" shares.

Back-End Load (Deferred Sales Load): Back-end loads, also known as deferred sales loads, are fees charged when investors redeem (sell) their mutual fund shares. The fee is a percentage of the redemption amount and is usually highest in the early years of ownership, gradually declining over time. These are associated with "Class B" shares.

No-Load Funds: Some mutual funds do not charge front-end or back-end loads. These are known as "no-load" funds, and investors can buy or sell shares without incurring sales-related charges. However, no-load funds may still have expense ratios.

Management Fees: The management fee is paid to the fund's investment manager or advisor for managing the fund's portfolio. This fee is usually a percentage of the fund's AUM and is included in the expense ratio.

12b-1 Fees: These fees are used for marketing and distribution expenses, such as advertising and paying brokers' commissions. They are named after a section of the Investment Company Act of 1940. These fees are also included in the expense ratio.

Exchange Fees: Some funds may charge fees for exchanging shares between different funds within the same fund family. These fees are typically lower than front-end or back-end loads.

Account Fees: Some funds charge account maintenance fees, which are fees for maintaining your account with the fund company. These fees are separate from the fund's expense ratio.

Redemption Fees: In some cases, if you redeem your shares shortly after purchasing them (typically within a specified holding period), a fund may charge a redemption fee to discourage short-term trading.

Other Fees: There may be other miscellaneous fees, such as wire transfer fees, check writing fees, and fees for requesting paper statements.

It's essential to carefully review a mutual fund's prospectus before investing to understand its fee structure. The total costs associated with a fund can significantly affect your investment returns over time. Additionally, different share classes (e.g., Class A, Class B, Class C) within the same mutual fund may have different fee structures, so it's crucial to choose