What is the difference between mortgage points and discount points?

Mortgage Points vs. Discount Points: Understanding the Difference

When obtaining a mortgage, you may come across the terms "mortgage points" and "discount points." These terms refer to upfront fees paid to a lender at closing in exchange for specific benefits, often related to the interest rate on your mortgage. While both types of points can help reduce your long-term mortgage costs, they serve different purposes. Here's a breakdown of the difference between mortgage points and discount points:

Mortgage Points:

Mortgage points, also known as origination points, are fees that lenders charge to cover the cost of originating the loan. Each mortgage point is typically equal to 1% of the loan amount. These points are essentially a way for lenders to make money upfront on the mortgage.

Purpose of Mortgage Points:

The primary purpose of mortgage points is to compensate the lender for the administrative and processing costs associated with originating the loan. Paying mortgage points can help reduce the interest rate on your mortgage, which could result in lower monthly payments over the life of the loan.

Discount Points:

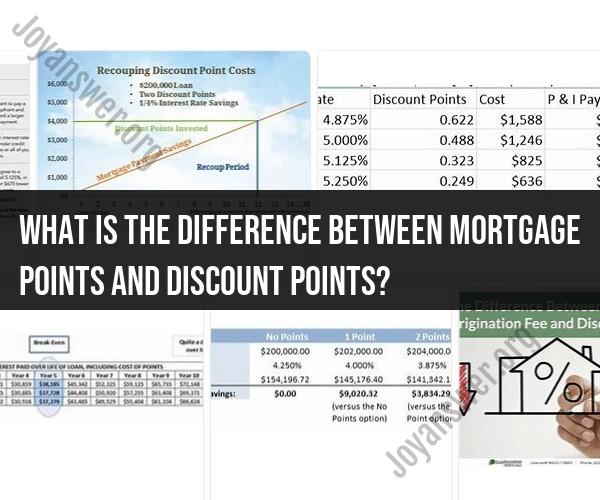

Discount points, on the other hand, are prepaid interest payments made at closing to "buy down" your interest rate. Each discount point also represents 1% of the loan amount. By paying discount points, you effectively purchase a lower interest rate for the duration of your mortgage.

Purpose of Discount Points:

The main purpose of discount points is to lower your monthly mortgage payments and the overall cost of borrowing over time. The more discount points you pay upfront, the lower your interest rate will be, which can save you money on interest payments throughout the life of the loan.

Key Differences:

Purpose:

- Mortgage points cover origination costs for the lender.

- Discount points are used to lower the interest rate and reduce the long-term cost of the loan for the borrower.

Effect on Interest Rate:

- Mortgage points do not directly affect the interest rate.

- Discount points directly lower the interest rate.

Cost and Benefit:

- Mortgage points can be paid by the borrower, the seller, or shared between both parties.

- Discount points are paid by the borrower and provide a long-term financial benefit in the form of reduced interest payments.

Calculation:

- Mortgage points are usually a fixed fee determined by the lender.

- Discount points are calculated based on the loan amount, with each point equal to 1% of the loan amount.

Decision Considerations:

- Paying mortgage points may make sense if you plan to stay in your home for a short period and want to reduce upfront costs.

- Paying discount points may make sense if you plan to stay in your home long-term and want to save on interest payments over the life of the loan.

Conclusion:

Mortgage points and discount points offer different ways to manage your upfront and long-term mortgage costs. Before deciding whether to pay points, consider your financial situation, how long you plan to stay in the home, and whether the upfront cost aligns with your long-term financial goals. It's important to carefully review the terms of your mortgage agreement and consult with a financial advisor or mortgage professional to make an informed decision.