What are the major types of financial decisions?

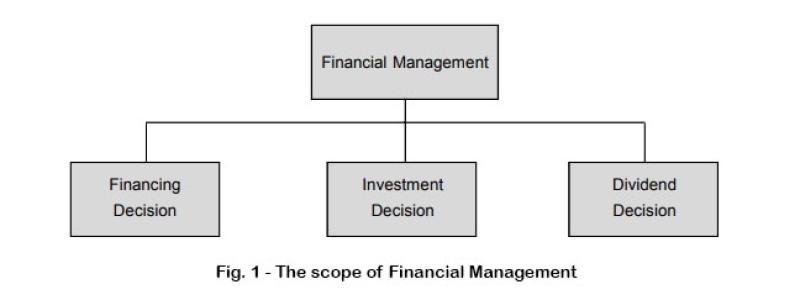

Financial decisions encompass a wide range of choices made by individuals, businesses, and organizations to manage their financial resources effectively. The major types of financial decisions include:

Investment Decisions (Capital Budgeting):

- Investment decisions involve allocating funds to different investment opportunities. Businesses evaluate potential projects or assets to determine which ones are worth pursuing. Key aspects include estimating cash flows, assessing risks, and selecting projects that align with the company's objectives.

Financing Decisions:

- Financing decisions revolve around how an entity raises capital to fund its operations and investments. Organizations must determine the optimal mix of debt and equity financing to meet their financial needs while maintaining financial stability. Key considerations include the cost of capital, leverage, and risk tolerance.

Dividend Decisions:

- Dividend decisions concern the distribution of profits to shareholders. Companies must decide how much of their earnings to distribute as dividends and how much to retain for reinvestment. These decisions impact shareholder returns and a company's financial health.

Working Capital Management Decisions:

- Working capital management decisions focus on short-term assets and liabilities. Companies must manage their current assets (e.g., cash, accounts receivable, inventory) and current liabilities (e.g., accounts payable) to ensure liquidity, operational efficiency, and the ability to meet short-term financial obligations.

Risk Management Decisions:

- Risk management decisions involve identifying, assessing, and mitigating financial risks. This includes managing risks related to interest rates, exchange rates, commodities, credit, and other financial instruments. Risk management strategies may involve hedging, diversification, or insurance.

Capital Structure Decisions:

- Capital structure decisions deal with the composition of a company's financing, specifically the balance between debt and equity. Companies must determine the most appropriate capital structure to optimize cost of capital, financial stability, and flexibility.

Liquidity Management Decisions:

- Liquidity management decisions are focused on maintaining sufficient liquid assets (e.g., cash or assets that can be quickly converted to cash) to meet short-term financial obligations. Effective liquidity management ensures that a company can cover unexpected expenses or take advantage of opportunities.

Asset Management Decisions:

- Asset management decisions involve the efficient utilization and allocation of assets to generate revenue and profits. This includes managing fixed assets, optimizing inventory levels, and ensuring the productivity of physical and financial assets.

Tax Planning Decisions:

- Tax planning decisions aim to minimize tax liabilities while complying with tax laws. This may involve strategies such as tax credits, deductions, and tax-efficient investment choices.

Mergers and Acquisitions (M&A) Decisions:

- M&A decisions encompass acquiring or merging with other businesses. Organizations evaluate potential targets, negotiate terms, and assess the financial and strategic implications of such transactions.

Financial Reporting and Disclosure Decisions:

- Financial reporting decisions involve preparing and disclosing financial statements in accordance with accounting standards and regulations. Ensuring accurate, transparent, and timely financial reporting is crucial for stakeholders.

Strategic Financial Decisions:

- Strategic financial decisions relate to the overall financial strategy of an organization. This may include defining long-term financial goals, establishing financial policies, and aligning financial decisions with the organization's strategic plan.

The specific financial decisions made by individuals, businesses, and organizations will vary based on their objectives, circumstances, and the economic environment in which they operate. These decisions play a vital role in achieving financial stability, growth, and sustainability.

1. Key Factors Influencing Investment Decisions in Finance

Investment decisions in finance are influenced by a complex interplay of factors, both internal and external to the firm. These factors can be broadly categorized into three main groups:

1. Risk and Return:

Risk: Investors typically demand a higher return for accepting higher levels of risk. This risk-return trade-off is a fundamental principle of investment decision-making.

Return: Investors seek to maximize their returns on investments. Expected returns are influenced by various factors, including the firm's financial performance, industry outlook, and overall market conditions.

2. Financial Analysis:

Financial Statements: Investors analyze a firm's financial statements, such as balance sheets, income statements, and cash flow statements, to assess its financial health, profitability, and liquidity.

Ratios and Metrics: Investors use financial ratios and metrics to evaluate a firm's performance and compare it to industry benchmarks or peers. Common ratios include debt-to-equity ratio, earnings per share (EPS), and price-to-earnings ratio (P/E ratio).

3. Market Conditions and Economic Factors:

Market Conditions: Overall market sentiment, economic indicators, and interest rates can significantly impact investment decisions. Favorable market conditions may encourage more risk-taking investments, while adverse conditions may lead to a more cautious approach.

Economic Factors: Economic growth, inflation, and exchange rates can influence the performance of different asset classes and investment strategies.

How do financial decisions impact a company's long-term success?

Financial decisions play a crucial role in shaping a company's long-term success by influencing its financial health, growth trajectory, and overall competitiveness. Sound financial decision-making can contribute to:

Sustainable Growth: Financial decisions that support strategic investments, efficient resource allocation, and a balanced capital structure can fuel sustainable growth and expansion.

Enhanced Profitability: Financial decisions that optimize pricing strategies, manage costs effectively, and implement profitable business models can enhance a company's profitability and financial performance.

Improved Financial Stability: Financial decisions that maintain adequate liquidity, manage debt levels responsibly, and build financial reserves can improve a company's financial stability and resilience in the face of economic challenges.

Increased Shareholder Value: Financial decisions that maximize shareholder value through optimal capital allocation, dividend policies, and share repurchases can enhance shareholder satisfaction and attract long-term investors.

What role does risk management play in financial decision-making?

Risk management plays a critical role in financial decision-making by identifying, assessing, and mitigating financial risks associated with various business activities and investment strategies. Effective risk management practices can:

Protect Assets: Risk management helps safeguard a company's assets and financial resources by identifying and mitigating potential losses from events such as market fluctuations, operational failures, or credit defaults.

Enhance Decision-Making: Risk management provides a framework for informed decision-making by quantifying and evaluating potential risks associated with different investment or business strategies.

Promote Financial Stability: Risk management helps maintain a company's financial stability by preventing excessive risk exposure that could lead to financial distress or insolvency.

Improve Regulatory Compliance: Risk management practices can help companies comply with financial regulations and industry standards, reducing legal and reputational risks.

Support Strategic Planning: Risk management integrates risk considerations into strategic planning, ensuring that potential risks are factored into long-term business objectives.