How to invest in Fidelity Mutual Funds?

Investing in Fidelity Mutual Funds is a straightforward process, and Fidelity provides a user-friendly platform for investors. Here's a beginner's guide on how to invest in Fidelity Mutual Funds:

Step 1: Open a Fidelity Account

Visit the Fidelity Website:

- Go to the Fidelity Investments website (www.fidelity.com).

Create an Account:

- Click on the "Open an Account" or "Get Started" button.

- Follow the prompts to create a new account. You will need to provide personal information, financial details, and choose the type of account you want to open (individual, joint, retirement, etc.).

Complete Verification:

- Fidelity may require identity verification. Follow the instructions to complete this process.

Step 2: Research Fidelity Mutual Funds

Explore Fidelity Mutual Funds:

- Once your account is set up, navigate to the "Research" or "Investment" section of the Fidelity website.

- Use the fund screener tool to explore the various mutual funds offered by Fidelity. You can filter funds based on your investment goals, risk tolerance, and other criteria.

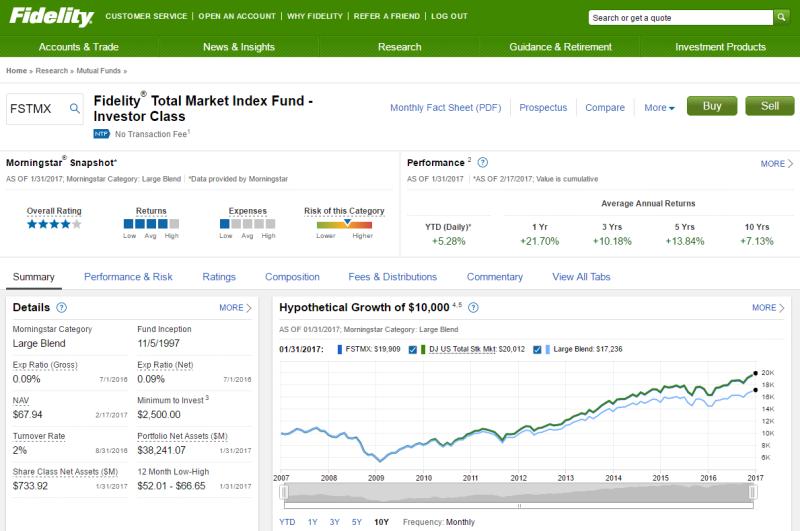

Review Fund Details:

- Click on the individual funds to access detailed information. This includes the fund's objective, performance history, fees, and the minimum initial investment required.

Step 3: Select Mutual Funds

Consider Your Investment Goals:

- Choose mutual funds that align with your investment objectives. Fidelity offers funds across various asset classes, including stocks, bonds, and a combination of both.

Diversify Your Portfolio:

- Consider diversifying your investments across different types of funds to spread risk. Fidelity offers a wide range of funds catering to different risk profiles and investment strategies.

Step 4: Invest in Fidelity Mutual Funds

Access Your Account:

- Log in to your Fidelity account.

Navigate to the Trading Section:

- Look for the "Trade" or "Buy/Sell" section on the website.

Enter Fund Information:

- Specify the mutual fund you want to invest in. Enter the fund name or ticker symbol.

Select Investment Amount:

- Determine the amount you want to invest in the selected fund.

Place Your Order:

- Review your order details and, if everything is accurate, submit your investment order.

Step 5: Monitor and Manage Your Investments

Track Your Portfolio:

- Keep an eye on your Fidelity account to monitor the performance of your mutual fund investments.

Rebalance Your Portfolio:

- Periodically review your portfolio and consider rebalancing if needed. This involves adjusting your holdings to maintain your desired asset allocation.

Explore Additional Tools:

- Fidelity provides tools and resources for investors, including performance analysis, research reports, and educational materials. Take advantage of these to enhance your investment knowledge.

Always remember that investing involves risk, and it's important to do thorough research or consult with a financial advisor before making investment decisions. Additionally, review the specific terms and conditions, fees, and minimum investment requirements associated with each mutual fund you are interested in.

Investing in Fidelity Mutual Funds can be a straightforward process, allowing you to participate in various investment strategies and potentially grow your wealth over time. Follow these steps to get started:

Step 1: Open a Fidelity Account

Visit the Fidelity Investments website (https://www.fidelity.com/) and click on the "Open an Account" button.

Choose the type of account you want to open, such as an Individual Retirement Acco

Investing in Fidelity Mutual Funds can be a straightforward process, allowing you to participate in various investment strategies and potentially grow your wealth over time. Follow these steps to get started:

Step 1: Open a Fidelity Account

Visit the Fidelity Investments website (https://www.fidelity.com/) and click on the "Open an Account" button.

Choose the type of account you want to open, such as an Individual Retirement Account (IRA) or a brokerage account.

Provide your personal information, including your name, address, Social Security number, and employment details.

Review and agree to the account terms and conditions.

Fund your account by linking your bank account or transferring funds electronically.

Step 2: Research and Select Mutual Funds

Explore Fidelity's vast selection of mutual funds, categorized by investment objectives, asset classes, and risk profiles.

Utilize Fidelity's online tools, such as the Mutual Fund Screener and the Fund Comparison Tool, to narrow down your choices.

Read the prospectus and Morningstar reports of the funds you're considering to gain a deeper understanding of their investment strategies, fees, and historical performance.

Consult with a financial advisor if you need personalized recommendations based on your risk tolerance, investment goals, and time horizon.

Step 3: Purchase Mutual Fund Shares

Once you've selected the mutual funds you want to invest in, log in to your Fidelity account.

Navigate to the "Trade" section and choose the "Buy Mutual Funds" option.

Enter the fund's ticker symbol or search for it by name.

Specify the dollar amount or number of shares you want to purchase.

Review the order details carefully and click "Place Order" to execute the trade.

Step 4: Monitor and Rebalance Your Portfolio

Regularly review your portfolio's performance and make adjustments as needed.

Rebalance your portfolio periodically to maintain your desired asset allocation and risk profile.

Seek guidance from a financial advisor if you have concerns about your investment strategy or market conditions.

Provide your personal information, including your name, address, Social Security number, and employment details.

Review and agree to the account terms and conditions.

Fund your account by linking your bank account or transferring funds electronically.

Step 2: Research and Select Mutual Funds

Explore Fidelity's vast selection of mutual funds, categorized by investment objectives, asset classes, and risk profiles.

Utilize Fidelity's online tools, such as the Mutual Fund Screener and the Fund Comparison Tool, to narrow down your choices.

Read the prospectus and Morningstar reports of the funds you're considering to gain a deeper understanding of their investment strategies, fees, and historical performance.

Consult with a financial advisor if you need personalized recommendations based on your risk tolerance, investment goals, and time horizon.

Step 3: Purchase Mutual Fund Shares

Once you've selected the mutual funds you want to invest in, log in to your Fidelity account.

Navigate to the "Trade" section and choose the "Buy Mutual Funds" option.

Enter the fund's ticker symbol or search for it by name.

Specify the dollar amount or number of shares you want to purchase.

Review the order details carefully and click "Place Order" to execute the trade.

Step 4: Monitor and Rebalance Your Portfolio

Regularly review your portfolio's performance and make adjustments as needed.

Rebalance your portfolio periodically to maintain your desired asset allocation and risk profile.

Seek guidance from a financial advisor if you have concerns about your investment strategy or market conditions.