Which Fidelity Mutual Fund should I invest in?

Choosing the right Fidelity Mutual Fund for investment depends on several factors, including your financial goals, risk tolerance, investment time horizon, and personal preferences. Fidelity offers a wide range of mutual funds, so it's important to carefully evaluate your needs and consider various fund characteristics. Here are some steps to help you in the decision-making process:

1. Define Your Investment Goals:

- Clarify your financial objectives. Are you investing for retirement, education, a major purchase, or general wealth-building? Your goals will influence the type of funds you should consider.

2. Determine Your Risk Tolerance:

- Assess how comfortable you are with the potential for fluctuations in the value of your investment. Fidelity offers funds with varying levels of risk, from conservative bond funds to more aggressive equity funds.

3. Understand Your Time Horizon:

- Consider how long you plan to keep your money invested. Longer time horizons may allow you to take on more risk, while shorter time frames might require a more conservative approach.

4. Asset Allocation:

- Determine the appropriate mix of asset classes (stocks, bonds, and cash) based on your risk tolerance and investment goals. Fidelity offers funds across different asset classes and investment styles.

5. Explore Fund Types:

- Fidelity provides various types of mutual funds, including:

- Equity Funds: Invest in stocks and aim for capital appreciation.

- Bond Funds: Focus on fixed-income securities and provide income.

- Hybrid Funds: Blend stocks and bonds for a diversified approach.

- Sector Funds: Concentrate on specific industry sectors.

- Index Funds: Track a specific market index.

6. Review Fund Performance and History:

- Examine the historical performance of the funds you're considering. While past performance doesn't guarantee future results, it can provide insights into a fund's track record.

7. Consider Fees and Expenses:

- Understand the fees associated with each fund, including expense ratios and any other charges. Lower expense ratios can contribute to higher returns over time.

8. Minimum Investment Requirements:

- Check the minimum investment requirements for each fund. Some funds may have higher initial investment thresholds.

9. Research Fund Managers:

- Consider the experience and track record of the fund manager. A skilled and experienced manager can play a crucial role in a fund's success.

10. Diversify Your Portfolio:

- Avoid putting all your money into one fund. Diversification can help manage risk. Consider a mix of funds that complement each other.

11. Utilize Fidelity's Tools and Resources:

- Fidelity provides tools like the fund screener, research reports, and educational materials. Use these resources to gather information and make informed decisions.

12. Seek Professional Advice:

- If you're uncertain about which funds to choose, consider consulting with a financial advisor. They can provide personalized advice based on your individual financial situation.

Remember, the right Fidelity Mutual Fund for you depends on your unique circumstances and financial objectives. Regularly review your portfolio and make adjustments as needed to stay aligned with your goals.

Choosing the right Fidelity Mutual Fund for your investment depends on your individual financial goals, risk tolerance, and time horizon. It's crucial to carefully assess your investment objectives and risk profile before making any investment decisions.

Here are some general recommendations for Fidelity Mutual Funds based on investment goals and risk tolerance:

Long-Term Growth Investors:

Fidelity 500 Index Fund (FXAIX): Tracks the S&P 500 index, providing broad exposure to large-cap U.S. stocks.

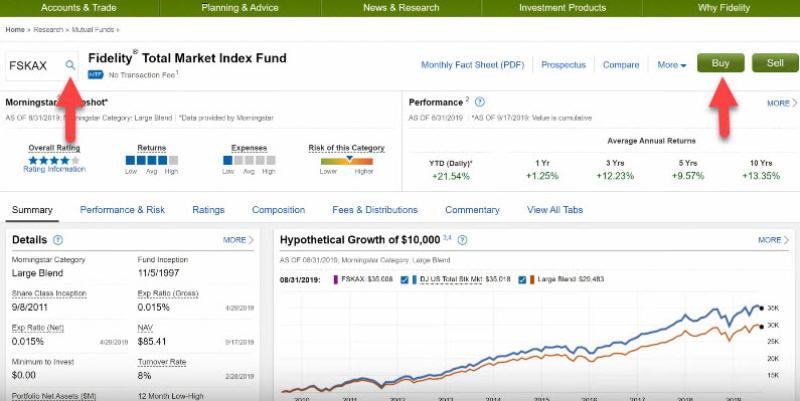

Fidelity Total Market Index Fund (FSKVX): Tracks the CRSP US Total Market Index, offering diversified exposure to U.S. stocks across all market capitalizations.

Fidelity International Index Fund (FSPVX): Tracks the MSCI EAFE Index, providing exposure to developed foreign markets.

Income-Oriented Investors:

Fidelity Corporate Bond Fund (FCBFX): Invests in a diversified portfolio of corporate bonds, aiming for consistent income generation.

Fidelity Government Cash Reserves (FDRXX): Provides low-risk liquidity with a high degree of stability, suitable for short-term cash holdings.

Fidelity Short-Term Bond Fund (FSTBX): Invests in short-term bonds with lower volatility, offering a balance of income and stability.

Balanced Investors Seeking Growth and Income:

Fidelity Balanced Fund (FBALX): Allocates assets between stocks and bonds, providing a moderate risk-return profile.

Fidelity Conservative 60/40 Fund (FCFX): Maintains a 60/40 asset allocation between stocks and bonds, balancing growth potential with income generation.

Fidelity Moderate Growth Fund (FMIDX): Invests in a mix of stocks and bonds, prioritizing growth potential with moderate risk exposure.

Remember, these are just general recommendations, and it's essential to conduct thorough research and consider your specific circumstances before making any investment decisions. Consulting with a financial advisor can provide personalized guidance tailored to your risk tolerance and financial goals.