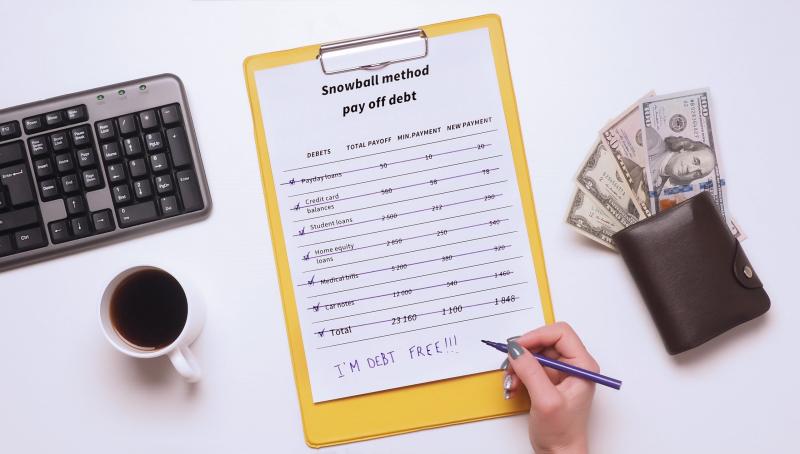

How to pay off debt using the debt snowball?

Implementing the Debt Snowball Method involves a step-by-step process to systematically pay off your debts. Here's a guide on how to pay off debt using the debt snowball method:

List Your Debts:

- Create a comprehensive list of all your debts, including credit cards, loans, and any other outstanding balances.

- Include the outstanding balance, interest rates, and minimum monthly payments for each debt.

Order Your Debts:

- Arrange your debts in ascending order based on the outstanding balance, from the smallest to the largest.

- Ignore the interest rates at this stage; the focus is on the total amount owed.

Make Minimum Payments:

- Ensure you make the minimum required payments on all your debts to avoid penalties and late fees.

Allocate Extra Funds:

- Identify any additional funds you can allocate toward debt repayment. This could come from cutting expenses, increasing income, or reallocating existing budget items.

Attack the Smallest Debt:

- Focus on paying off the smallest debt first while making the minimum payments on the larger debts.

- Use any extra funds you identified to accelerate the repayment of the smallest debt.

Celebrate Small Wins:

- As you pay off each debt, celebrate the achievement. This psychological boost can motivate you to continue the debt repayment journey.

Snowball Effect:

- Once the smallest debt is paid off, take the amount you were paying on that debt (including the minimum payment) and apply it to the next smallest debt on the list.

- This creates a snowball effect, as the amount you can put towards each debt increases with every debt paid off.

Repeat the Process:

- Continue this process, tackling debts one by one in ascending order.

- As you pay off each debt, the cumulative amount available for repayment increases, accelerating your progress.

Tackle Larger Debts:

- As you move on to larger debts, you'll have more financial resources available to pay them off more quickly.

Stay Disciplined:

- Maintain discipline in adhering to your budget and debt repayment plan.

- Keep track of your progress using a debt snowball spreadsheet or financial management tool.

By following these steps, you can systematically pay off your debts using the debt snowball method, gaining momentum as you eliminate each obligation.

Steps to effectively utilize the debt snowball method for debt repayment

Here are the steps to effectively utilize the debt snowball method for debt repayment:

Preparation:

- Gather your debts: Make a comprehensive list of all your debts, including credit cards, loans (student, personal, car, etc.), medical bills, and any other outstanding balance. Include the current balance, interest rate, and minimum payment for each debt.

- Calculate your extra money: Assess your monthly budget and determine how much you can consistently put towards debt repayment beyond the minimum payments.

Action:

- Order your debts: Arrange your debts from smallest balance to largest, regardless of interest rate. This is the core principle of the snowball method.

- Make minimum payments on all debts except the smallest: Continue making minimum payments on all your debts to avoid late fees and penalties.

- Attack the smallest debt: Put all your extra money towards paying off the smallest debt as quickly as possible. This might involve cutting back on unnecessary expenses or using windfalls like bonuses or tax refunds.

- Snowball the momentum: Once you pay off the smallest debt, take the minimum payment you were making on that debt and add it to the minimum payment of the next smallest debt. This increases the amount you're throwing at your debts, accelerating the snowball effect.

- Repeat and progress: Keep repeating steps 3 and 4 for each debt, rolling over the freed-up payment amount every time you conquer a debt. Celebrate your milestones to stay motivated!

Tips for Maximizing Effectiveness:

- Track your progress: Use a debt snowball spreadsheet or debt tracker app to monitor your balances, payments, and projected payoff dates. Seeing your progress can be highly motivating.

- Increase your snowball: Find ways to boost your extra payments through side hustles, selling unused items, or negotiating lower bills.

- Avoid new debt: Resist the temptation to take on new loans while tackling existing ones.

- Stay committed: Paying off debt requires discipline and perseverance. Don't get discouraged by setbacks, learn from them and keep moving forward.

Remember, the snowball method is not always the mathematically optimal strategy. In some cases, prioritizing debts with the highest interest rates can save you more money in the long run. However, the snowball method often proves more effective for many people due to the psychological boost of seeing debts disappear quickly, which can improve motivation and keep you on track.

Ultimately, the best debt repayment strategy is the one you can stick with consistently. Choose the method that aligns with your financial goals, personality, and risk tolerance.

I hope this helps!