What is a snowball debt spreadsheet?

A snowball debt spreadsheet is a financial management tool designed to help individuals pay off their debts in a systematic and strategic manner. The snowball debt repayment method focuses on paying off smaller debts first, gaining momentum, and then applying the freed-up funds to larger debts.

Here's how it generally works:

List Debts: Create a list of all your debts, including the outstanding balance and interest rates.

Order by Size: Arrange the debts from smallest to largest based on the outstanding balance.

Minimum Payments: Make the minimum payments on all debts.

Extra Payments: Allocate any additional funds you have for debt repayment to the smallest debt on the list.

Snowball Effect: Once the smallest debt is paid off, take the amount you were paying on that debt and apply it to the next smallest debt. This creates a "snowball" effect as you move on to larger debts.

Repeat: Continue this process until all debts are paid off.

The spreadsheet helps you track your progress, visualize your debt situation, and stay organized in your repayment strategy. It's a motivational approach that provides a sense of accomplishment as you eliminate smaller debts, making it easier to tackle larger ones over time.

Understanding the concept of a debt snowball spreadsheet

A debt snowball spreadsheet is a tool that helps you track your progress towards paying off your debts using the debt snowball method. The debt snowball method is a popular debt payoff strategy that involves focusing on paying off your smallest debts first, regardless of their interest rate.

Here's how it works:

- List all of your debts: This includes credit cards, student loans, personal loans, car loans, and any other debts you have.

- Order your debts from smallest to largest: This is the key step in the debt snowball method.

- Make the minimum payments on all of your debts: Except for the smallest debt.

- Put any extra money you have towards paying off the smallest debt: This includes extra income, such as bonuses or tax refunds, as well as any money you can save from your budget.

- Once you pay off the smallest debt, roll the minimum payment you were making on that debt into the next smallest debt: This is what creates the snowball effect.

- Continue making minimum payments on all of your debts and putting extra money towards the smallest debt: Repeat this process until all of your debts are paid off.

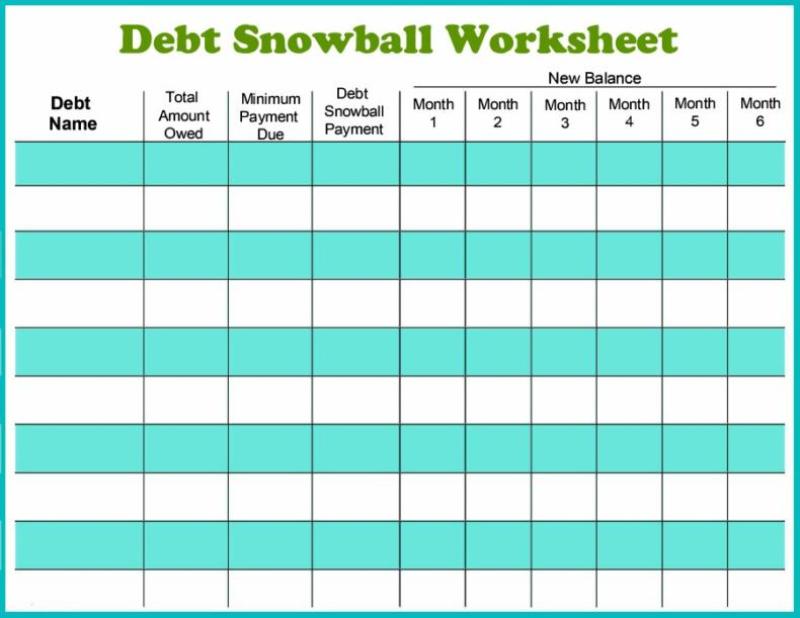

A debt snowball spreadsheet can help you track your progress in several ways:

- It can help you keep track of your balances: You can enter your starting balances for each debt and then track how much you pay off each month.

- It can help you see how much interest you are paying: You can enter your interest rates for each debt and then see how much interest you are paying each month.

- It can help you project your payoff dates: The spreadsheet can calculate how long it will take you to pay off each debt based on your current payment amounts.

- It can help you stay motivated: Seeing your progress can help you stay motivated to keep going.

There are many free debt snowball spreadsheets available online. You can also create your own spreadsheet using a program like Microsoft Excel or Google Sheets.

Here are some of the benefits of using a debt snowball spreadsheet:

- It is easy to use: Even if you are not very good with spreadsheets, you can still use a debt snowball spreadsheet.

- It is free: There are many free debt snowball spreadsheets available online.

- It can help you stay on track: A debt snowball spreadsheet can help you track your progress and stay motivated to reach your goal of becoming debt-free.

Here are some additional tips for using a debt snowball spreadsheet:

- Be consistent with your payments: The more consistent you are with your payments, the faster you will pay off your debt.

- Set realistic goals: Don't try to pay off too much debt too quickly. Start with a small goal, such as paying off one debt within six months.

- Don't give up: Paying off debt takes time and effort, but it is definitely possible.