What are the best high yield dividend stocks?

Determining the "best" high-yield dividend stocks is subjective and depends on various factors, including your investment goals, risk tolerance, and time horizon. High-yield dividend stocks can be attractive for income-focused investors, but it's important to conduct thorough research and consider your individual financial situation. Here are some steps to help you find potentially good high-yield dividend stocks:

Define Your Investment Goals:

- Consider why you want to invest in high-yield dividend stocks. Are you seeking regular income, capital preservation, or long-term growth? Your goals will influence your investment strategy.

Assess Your Risk Tolerance:

- High-yield dividend stocks often come with higher risks, especially if the yield is significantly above the market average. Assess how comfortable you are with potential fluctuations in the stock's price.

Diversify Your Portfolio:

- Avoid putting all your funds into a single high-yield dividend stock. Diversifying across multiple stocks and sectors can help reduce risk.

Research Companies:

- Conduct thorough research on companies before investing. Look for companies with strong fundamentals, a history of consistent dividend payments, and a sustainable business model.

Analyze Dividend Metrics:

- Examine dividend-related metrics, such as the dividend yield (the annual dividend payment divided by the stock's price) and the dividend payout ratio (the percentage of earnings paid out as dividends). A very high yield could be a red flag if it's not sustainable.

Evaluate Dividend Sustainability:

- Assess whether the company can maintain its dividend payments over the long term. Look at factors like cash flow, earnings growth, and the company's debt level.

Consider Industry and Sector Trends:

- Some sectors, like utilities and consumer staples, tend to have more stable dividend-paying stocks. Analyze industry trends to identify sectors with potential opportunities.

Review Historical Performance:

- Examine the stock's historical performance, including dividend growth and stock price appreciation. A consistent track record of increasing dividends can be a positive sign.

Read Analyst Reports and News:

- Stay informed by reading analyst reports, financial news, and company announcements. This can provide insights into a company's outlook and potential risks.

Use Screening Tools:

- Utilize stock screening tools or financial websites to filter for high-yield dividend stocks based on your criteria. Many brokerage platforms offer screening tools.

Seek Professional Advice:

- Consider consulting with a financial advisor or investment professional who can provide personalized guidance based on your financial situation and goals.

Stay Informed and Monitor Investments:

- After investing, stay informed about your portfolio and make adjustments as needed. Companies can change their dividend policies, and economic conditions can affect the performance of high-yield dividend stocks.

Remember that high-yield dividend stocks may come with higher volatility and risks, so it's crucial to balance your portfolio and diversify your investments to manage risk effectively. Additionally, past performance is not a guarantee of future results, so thorough due diligence is essential.

Investing in High-Yield Dividend Stocks: Top Picks and Strategies

High-yield dividend stocks are stocks that pay a high dividend yield, which is the percentage of the stock price that is paid out in dividends each year. High-yield dividend stocks can be a good investment for income investors who are looking for a regular stream of income from their investments.

However, it is important to note that high-yield dividend stocks can also be riskier than other types of stocks. This is because companies that pay high dividends often have less room for growth and may be more likely to cut their dividends if they face financial difficulties.

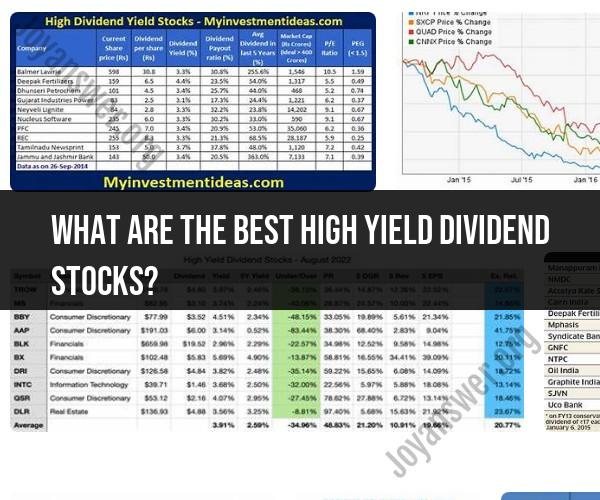

Top Picks for High-Yield Dividend Stocks

Here are a few top picks for high-yield dividend stocks:

- Real estate investment trusts (REITs): REITs are companies that own and operate income-producing real estate. REITs are required by law to pay out at least 90% of their taxable income to shareholders in dividends.

- Utilities: Utilities are companies that provide essential services such as electricity, water, and gas. Utilities tend to have stable earnings and dividends, which makes them a good choice for income investors.

- Telecoms: Telecom companies are companies that provide telecommunications services such as phone service, internet service, and cable TV. Telecom companies also tend to have stable earnings and dividends.

- Consumer staples: Consumer staples are companies that produce and sell essential goods such as food, beverages, and household products. Consumer staples companies tend to have stable earnings and dividends, even during economic downturns.

Strategies for Investing in High-Yield Dividend Stocks

When investing in high-yield dividend stocks, it is important to consider the following strategies:

- Diversify your portfolio: Don't put all your eggs in one basket. Spread your investment across a variety of different high-yield dividend stocks to reduce your risk.

- Reinvest your dividends: When you receive dividends from your high-yield dividend stocks, reinvest them in the company to buy more shares. This will help you to grow your investment over time.

- Hold for the long term: High-yield dividend stocks are best suited for long-term investors. Don't expect to get rich quick by investing in high-yield dividend stocks. Instead, focus on building wealth over time by reinvesting your dividends and holding your investments for the long term.

Conclusion

Investing in high-yield dividend stocks can be a good way to generate a regular stream of income from your investments. However, it is important to note that high-yield dividend stocks can also be riskier than other types of stocks. When investing in high-yield dividend stocks, it is important to diversify your portfolio, reinvest your dividends, and hold for the long term.