What is the formula for simple loans?

The formula for calculating the total amount to be repaid on a simple loan is:

Total Repayment = Principal Amount (P) + Interest (I)

Where:

- Principal Amount (P) is the initial amount of money borrowed or the loan amount.

- Interest (I) is the additional amount that the borrower pays for the privilege of using the lender's money. It is typically calculated as a percentage of the principal and is known as the interest rate.

The formula for interest on a simple loan is:

Interest (I) = Principal Amount (P) × Interest Rate (R) × Time (T)

Where:

- Interest Rate (R) is the annual interest rate (expressed as a decimal).

- Time (T) is the length of time the money is borrowed for, usually expressed in years.

So, the total repayment for a simple loan is the principal amount plus the interest accrued on that principal over the loan term:

Total Repayment = Principal (P) + (Principal (P) × Interest Rate (R) × Time (T))

It's important to note that this formula applies to simple interest loans, where interest is calculated only on the initial principal amount and doesn't compound over time. In more complex loan scenarios, such as those involving compounding interest or additional fees, the calculations would be different.

Simple Loans Formula: Understanding the Basics

A simple loan is a type of loan where the interest is calculated only on the principal amount of the loan. The interest rate is fixed for the entire term of the loan, and there are no compounding fees. This makes simple loans a relatively straightforward and easy-to-understand financial product.

The basic formula for calculating the total amount of interest paid on a simple loan is:

Interest = Principal × Interest Rate × Time

Where:

- Principal is the amount of money borrowed

- Interest Rate is the annual percentage rate (APR) of the loan

- Time is the length of the loan in years

How to Calculate Interest and Principal in Simple Loans

To calculate the interest paid on a simple loan, you can use the formula above. For example, if you borrow $1,000 at an interest rate of 5% for two years, the interest paid would be:

Interest = $1,000 × 5% × 2 = $100

To calculate the principal amount of a simple loan, you can rearrange the formula above:

Principal = Interest / (Interest Rate × Time)

For example, if you pay $100 in interest on a loan with an interest rate of 5% for two years, the principal amount of the loan would be:

Principal = $100 / (5% × 2) = $1,000

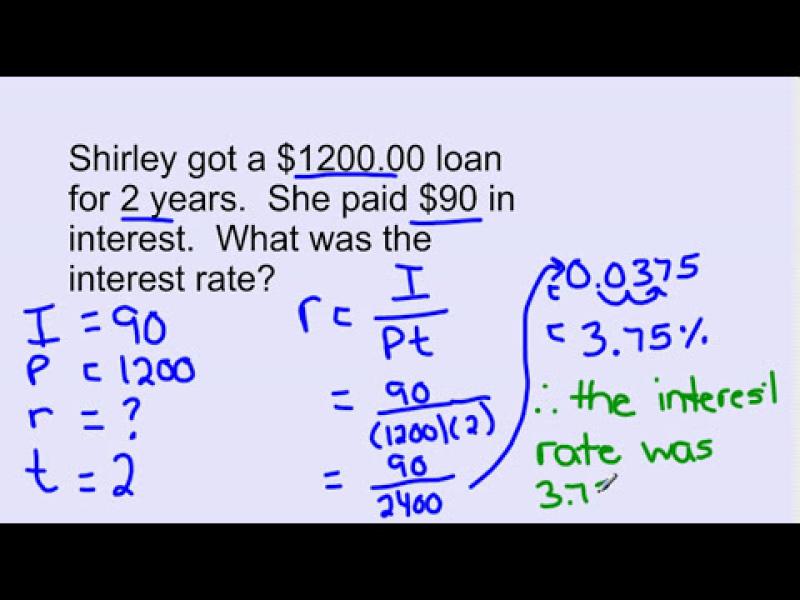

Solving for Loan Amount, Interest Rate, and Time in Simple Loans

You can also use the simple loan formula to solve for the loan amount, interest rate, or time, given the other two values. For example, if you know that you want to borrow $1,000 and you want to pay interest of $100, you can use the formula to solve for the interest rate:

Interest Rate = Interest / (Principal × Time) = $100 / ($1,000 × 2) = 5%

Or, if you know that you want to borrow $1,000 and you have an interest rate of 5%, you can use the formula to solve for the time:

Time = Interest / (Principal × Interest Rate) = $100 / ($1,000 × 5%) = 2 years

Simple loans are a useful financial tool for a variety of purposes, such as consolidating debt, financing a car purchase, or covering unexpected expenses. By understanding the basic formula for calculating interest and principal, you can make informed decisions about borrowing money.