What do private equity firms do?

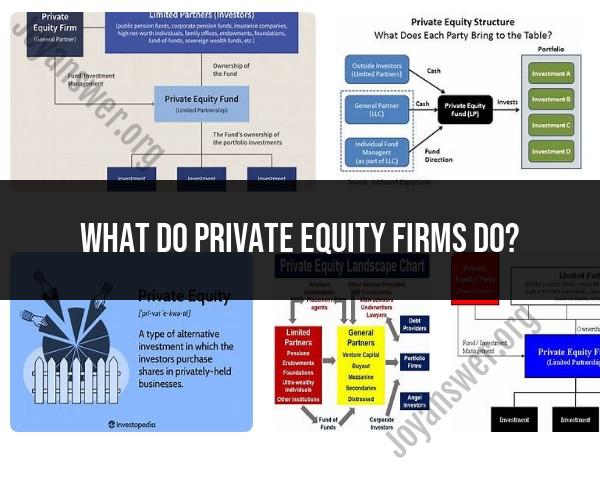

Private equity firms are financial institutions that specialize in investing in privately held companies, typically with the goal of achieving substantial returns on their investments. Their primary activities include:

Investment: Private equity firms raise capital from various sources, including institutional investors, high-net-worth individuals, and their own funds. They use this capital to acquire ownership stakes in private companies. These investments can take various forms, such as equity ownership, mezzanine debt, or a combination of both.

Value Creation: Private equity firms actively work with the companies they invest in to enhance their operational efficiency, growth potential, and profitability. This often involves providing strategic guidance, restructuring, and implementing cost-saving measures.

Exit Strategy: Private equity firms typically have a set investment horizon, often around 3 to 7 years. During this period, they work to increase the value of their portfolio companies. The ultimate goal is to exit these investments and realize significant returns. Common exit strategies include selling the company to a strategic buyer, conducting an initial public offering (IPO), or selling to another private equity firm.

Risk Management: Private equity firms generally take on a higher level of risk compared to traditional investments. To manage this risk, they often diversify their investments across various sectors, industries, and stages of development. Additionally, they may use financial engineering techniques to enhance returns while managing risk.

Fundraising: Private equity firms frequently raise new funds to invest in additional companies. The fundraising process involves convincing institutional investors and other sources to commit capital to the firm's next fund.

Due Diligence: Before making an investment, private equity firms conduct thorough due diligence to assess the financial health, operational potential, and risks associated with a target company. This involves analyzing financial statements, market conditions, competition, and the overall industry landscape.

Management and Governance: Private equity firms often take an active role in the management and governance of their portfolio companies. They may appoint board members or executives to help guide the company's strategic direction.

Debt Financing: Private equity firms may use debt financing to leverage their investments, which can amplify returns if the investments perform well. However, it also increases risk.

Capital Allocation: They decide how to allocate their investors' capital among various investment opportunities, aiming to generate the highest possible returns for their investors.

Monitoring and Reporting: Private equity firms continuously monitor the performance of their portfolio companies and provide regular updates and reports to their investors.

Private equity firms play a significant role in the financial markets by providing capital and expertise to help companies grow and improve, and they can have a substantial impact on the companies they invest in. However, their activities can also be subject to criticism, particularly when their strategies involve significant leverage or aggressive cost-cutting measures that may impact employees and stakeholders.

Private Equity Firms: Their Role and Functions

Private equity firms are investment firms that raise capital from institutional investors, such as pension funds, endowments, and insurance companies, and use that capital to invest in private companies. Private companies are companies that are not publicly traded on a stock exchange.

Private equity firms play a number of important roles in the economy. First, they provide a source of capital for private companies. This capital can be used to finance growth, acquisitions, or other strategic initiatives. Second, private equity firms often provide management expertise and support to the companies they invest in. This can help companies to improve their operations and profitability. Third, private equity firms can help to create jobs and economic growth.

Unpacking the Operations of Private Equity Companies

Private equity firms typically operate through a series of investment funds. Each fund has a specific investment strategy and a fixed investment horizon. Once a fund is closed, the private equity firm will begin to identify and invest in companies that meet its investment criteria.

The investment process typically begins with the private equity firm's investment professionals sourcing potential investment opportunities. This involves identifying companies that are for sale or that may be interested in raising capital. Once a potential investment opportunity has been identified, the investment professionals will conduct a thorough due diligence process to assess the company's financial performance, management team, and competitive landscape.

If the private equity firm decides to invest in a company, it will typically negotiate a deal with the company's current owners. This deal may involve the private equity firm acquiring a controlling interest in the company or a minority stake. Once the deal has been closed, the private equity firm will work with the company's management team to implement its investment plan.

The private equity firm's investment plan will typically focus on improving the company's operations and profitability. This may involve making changes to the company's management team, product portfolio, or marketing strategy. The private equity firm may also provide the company with additional capital to support its growth initiatives.

After a period of time, the private equity firm will typically sell its investment in the company. This may be done through an IPO, a secondary sale to another private equity firm, or a sale to a strategic buyer. The proceeds from the sale are then returned to the private equity firm's investors.

Investment Strategies of Private Equity Firms

Private equity firms employ a variety of different investment strategies. Some of the most common investment strategies include:

- Buyouts: Private equity firms may acquire controlling interests in private companies or public companies that they believe are undervalued. The private equity firm will then work with the company's management team to improve its operations and profitability. Once the company's performance has improved, the private equity firm will typically sell its investment at a profit.

- Venture capital: Private equity firms may also invest in early-stage companies that have high growth potential. These investments are typically more risky than buyouts, but they also have the potential to generate higher returns.

- Growth capital: Private equity firms may also invest in established companies that are looking to expand their operations or enter new markets. Growth capital investments typically have lower risk than venture capital investments, but they also have the potential to generate lower returns.

Private Equity's Impact on Businesses and Industries

Private equity has a significant impact on businesses and industries. Private equity firms can help to improve the efficiency and profitability of companies. They can also help to create jobs and economic growth. However, private equity firms have also been criticized for their aggressive investment strategies and their focus on short-term profits.

Navigating Opportunities and Challenges in Private Equity

The private equity industry is a highly competitive industry. Private equity firms need to be able to identify and execute on investment opportunities quickly and efficiently. They also need to be able to manage their portfolio companies effectively in order to generate superior returns for their investors.

Some of the key opportunities in the private equity industry include:

- The growing global economy is creating new investment opportunities in emerging markets.

- The aging population in developed countries is creating new investment opportunities in healthcare and other sectors that cater to the needs of the elderly.

- The technological revolution is creating new investment opportunities in sectors such as artificial intelligence, cybersecurity, and e-commerce.

Some of the key challenges in the private equity industry include:

- The increasing competition from other private equity firms and other types of investors.

- The increasing scrutiny from regulators.

- The increasing economic and geopolitical uncertainty.

Despite the challenges, the private equity industry is expected to continue to grow in the coming years