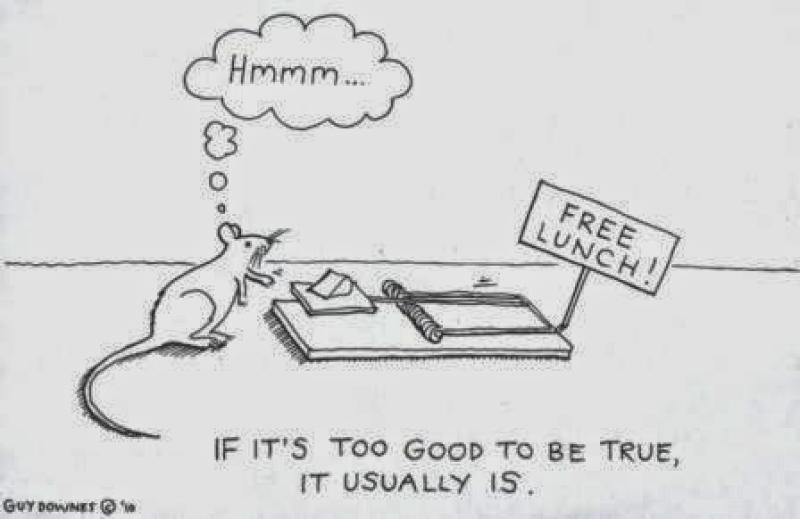

Are guaranteed auto loans too good to be true?

Guaranteed auto loans, like any financial product, should be carefully evaluated to determine if they are a good fit for your individual circumstances. While the term "guaranteed" may sound appealing, it's essential to understand the terms and conditions associated with these loans. Here are some key factors to consider when assessing guaranteed auto loans:

Interest Rates:

- Check the interest rates associated with the guaranteed auto loan. In some cases, these loans may come with higher interest rates compared to traditional auto loans. Make sure the interest rates are reasonable and competitive.

Fees and Charges:

- Examine the fine print for any hidden fees or charges. Some lenders may impose additional fees that can significantly impact the overall cost of the loan. Look for transparency in the fee structure.

Credit Requirements:

- Evaluate the credit requirements for guaranteed auto loans. While they may be marketed as "guaranteed," some lenders may still have minimum credit score requirements. Be aware of your own credit situation and ensure you meet the lender's criteria.

Loan Terms:

- Review the terms of the loan, including the repayment period. Longer loan terms may result in lower monthly payments but can also lead to higher overall interest costs. Consider what works best for your budget and financial goals.

Down Payment:

- Find out if a down payment is required. Some guaranteed auto loans may still ask for a down payment, and the amount can vary. A higher down payment may lead to more favorable loan terms.

Lender Reputation:

- Research the reputation of the lender. Look for reviews and testimonials from other borrowers to gauge the lender's reliability and customer service. A reputable lender is more likely to offer fair terms and provide a positive borrowing experience.

Loan Terms and Conditions:

- Carefully read and understand the terms and conditions of the loan agreement. Pay attention to any clauses that may affect your ability to refinance, make early payments, or modify the loan terms.

Alternative Options:

- Compare guaranteed auto loans with other financing options. Explore traditional auto loans, credit union loans, or other lenders to ensure you are getting the best possible terms for your situation.

Legal Protections:

- Be aware of your legal rights as a borrower. Understand the recourse available to you in case of any disputes or issues with the lender.

Financial Readiness:

- Assess your own financial readiness to take on an auto loan. Consider factors such as your income stability, employment situation, and overall financial health.

In conclusion, while guaranteed auto loans can be a viable option for some individuals, it's crucial to conduct thorough research and carefully evaluate the terms and conditions associated with these loans. If a deal seems too good to be true, it's essential to exercise caution and consider alternative financing options.

What are the potential risks associated with guaranteed auto loans?

While guaranteed auto loans can seem like an attractive option for borrowers with poor credit or limited credit history, they come with several potential risks:

High interest rates: Guaranteed auto loans typically have significantly higher interest rates than traditional auto loans, often exceeding 20%. This means you'll pay much more over the life of the loan, potentially thousands of dollars extra.

Affordability issues: High interest rates translate to higher monthly payments, which can be difficult to afford, especially for borrowers with limited income. This can lead to missed payments, late fees, and potential loan default.

Increased debt burden: The high cost of guaranteed auto loans can lead to a significant debt burden, making it harder to manage other financial obligations and potentially impacting your credit score negatively.

Limited vehicle options: Lenders offering guaranteed auto loans may limit your options in terms of the car you can purchase. They may only approve loans for specific makes and models, which may not be the most reliable or fuel-efficient options.

Prepayment penalties: Some guaranteed auto loans come with prepayment penalties, discouraging you from paying off the loan early and saving money on interest.

Limited credit score improvement: Although guaranteed auto loans involve making monthly payments, they may not be reported to credit bureaus, meaning they won't help you build or improve your credit score.

Additional fees: Besides high interest rates, guaranteed auto loans may come with hefty upfront fees and origination charges, further increasing the overall cost of the loan.

Negative equity: Due to the rapid depreciation of cars, the high interest rates of guaranteed loans can easily lead to negative equity, where you owe more on the car than it's worth. This can make it difficult to sell the car or trade it in for a new one.

Reliance on collateral: Guaranteed auto loans often require the borrower to put up collateral, such as the car itself or another asset. This means you could lose your collateral if you default on the loan.

Predatory lending practices: Some lenders offering guaranteed auto loans may engage in predatory lending practices, taking advantage of borrowers with limited financial knowledge or desperation.

Before taking out a guaranteed auto loan, it's crucial to carefully consider the potential risks and compare them to the benefits. It's always advisable to explore other financing options, such as working with a credit union or improving your credit score before applying for a guaranteed auto loan.