How to figure CPI?

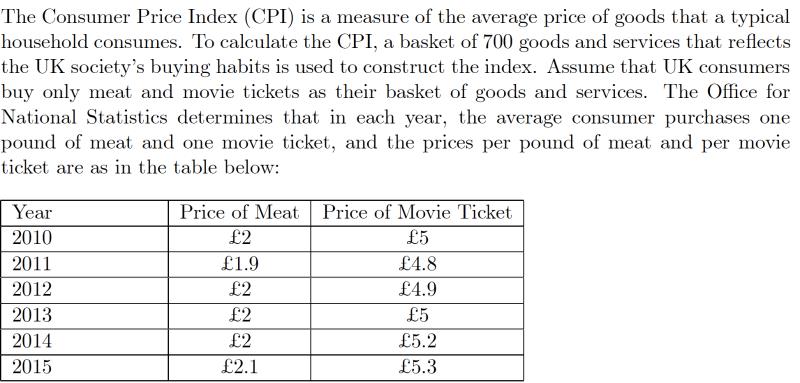

The Consumer Price Index (CPI) is a measure that examines the average change in prices paid by consumers for goods and services over time. Calculating the CPI involves several steps, and here's a simplified explanation of the process:

Formula for CPI:

The basic formula for calculating CPI is:

Where:

- is the total cost of goods and services in the current year.

- is the total cost of goods and services in the base (reference) year.

Step-by-Step Calculation:

Select a Base Year:

- Choose a specific year as the base year against which other years will be compared.

Define the Basket of Goods and Services:

- Create a representative basket of goods and services that consumers typically purchase. This basket should reflect the spending habits of the average consumer.

Determine Prices:

- Collect price data for each item in the basket for both the base year and the current year. Prices are typically obtained from surveys and market data.

Calculate the Cost of the Basket:

- Multiply the quantity of each item in the basket by its respective price. Sum these values to get the total cost of the basket for both the base year and the current year.

Apply the CPI Formula:

- Use the formula mentioned earlier to calculate the CPI.

Interpret the CPI:

- A CPI value of 100 indicates no change in prices compared to the base year. Values above 100 indicate inflation (rising prices), while values below 100 indicate deflation (falling prices).

Example:

Let's assume the base year is 2020. In 2020, the cost of the basket was $1,000, and in 2021, the cost rose to $1,050.

This means prices, on average, have increased by 5% compared to the base year.

Note: The actual calculation involves more considerations, such as adjusting for changes in quality and accounting for substitutions when prices change. Professional statistical agencies use sophisticated methodologies to ensure accuracy in CPI calculations.

Calculating the Consumer Price Index (CPI) involves a complex and multifaceted process that encompasses gathering data on prices of various goods and services, analyzing and weighting these prices, and compiling them into a single index that represents the overall change in consumer prices over time. Here's a simplified overview of the steps involved:

Data Collection: The Bureau of Labor Statistics (BLS) collects data on prices of a wide range of goods and services from various sources, including retail stores, supermarkets, online retailers, and service providers. This data is gathered through surveys, scanner data, and direct observation.

Market Basket: The BLS constructs a representative market basket that reflects the typical consumption patterns of urban wage earners and clerical workers. This market basket includes hundreds of items, such as food, housing, transportation, clothing, and healthcare.

Price Indexing: For each item in the market basket, the BLS calculates a price index, which measures the change in the price of that item over time. The price index is typically calculated using a geometric mean of price relatives, which compare the current price of an item to its price in a base period.

Item Weighting: Each item in the market basket is assigned a weight based on its relative importance in the consumption patterns of urban wage earners and clerical workers. These weights are determined using data from consumer expenditure surveys.

Index Aggregation: The price indices for all items in the market basket are aggregated using their respective weights to calculate the overall CPI. This aggregation process ensures that the CPI accurately reflects the relative importance of different items in the consumption basket.

Base Period: The CPI is usually expressed as a percentage change from a designated base period, which is typically a year in the recent past. This allows for comparisons of the CPI over time and provides a measure of inflation.

Publication and Dissemination: The BLS publishes the CPI monthly and disseminates it to various stakeholders, including government agencies, businesses, and the general public. The CPI is widely used as an economic indicator and is used for various purposes, such as adjusting wages, pensions, and social security benefits.