What percentage of my income should go to retirement?

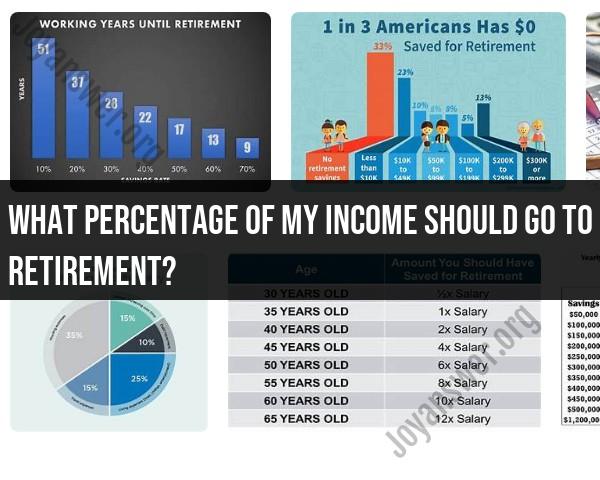

The percentage of your income that should go toward retirement savings can vary depending on several factors, including your age, retirement goals, current financial situation, and other financial responsibilities. However, a common guideline is to aim for saving at least 15% of your pre-tax income for retirement. Here are some factors to consider when determining your retirement savings percentage:

Age and Time Horizon:

- The earlier you start saving for retirement, the lower the percentage of your income you may need to save. This is because your money has more time to grow through compound interest. If you're starting to save later in life, you may need to save a higher percentage of your income.

Retirement Goals:

- Your retirement lifestyle and goals play a significant role. If you plan to travel extensively or have expensive hobbies in retirement, you may need to save a higher percentage of your income. On the other hand, if you have more modest retirement expectations, you might be able to save less.

Employer Contributions:

- Take into account any retirement contributions made by your employer. If your employer offers a matching contribution to your retirement plan, try to take full advantage of this, as it effectively increases your savings rate.

Debt and Expenses:

- Consider your current debt obligations and living expenses. If you have high-interest debt (like credit card debt), it's generally a good idea to pay that off before increasing your retirement savings. Reducing non-mortgage debt can free up more funds for saving.

Emergency Fund:

- Ensure you have an adequate emergency fund in place. Having three to six months' worth of living expenses saved in an easily accessible account can help prevent you from dipping into your retirement savings during unexpected financial setbacks.

Other Financial Goals:

- Consider other financial goals you may have, such as buying a home, funding your children's education, or starting a business. Balancing these goals with retirement savings is important.

Social Security and Other Income Sources:

- Take into account potential sources of retirement income, such as Social Security, pensions, and any other investments or income streams. These sources can reduce the percentage of your income you need to save.

Inflation and Investment Returns:

- Consider the impact of inflation and the expected rate of return on your investments. Over time, your savings will need to keep up with the rising cost of living.

Regularly Review and Adjust:

- It's important to regularly review your financial situation and adjust your savings rate as needed. Life circumstances change, and your retirement savings strategy should adapt accordingly.

Keep in mind that the 15% guideline is a general recommendation. Your specific situation may require a higher or lower savings rate. The key is to create a detailed retirement plan that considers your individual circumstances and financial goals. Consulting with a financial advisor can help you create a personalized retirement savings strategy that aligns with your needs and aspirations.

What is the recommended percentage of income to save for retirement?

A general rule of thumb is to save 10-15% of your income for retirement. However, the recommended percentage of income to save for retirement will vary depending on your individual circumstances, such as your age, financial goals, and risk tolerance.

How do your age and financial goals affect the percentage of income you should save?

The earlier you start saving for retirement, the more time your money has to grow. This is because of the power of compound interest. Compound interest is when your earnings start to earn their own earnings.

If you have financial goals such as retiring early or traveling the world, you may need to save more than 10-15% of your income.

What are some practical ways to increase your retirement savings rate?

Here are some practical ways to increase your retirement savings rate:

- Create a budget and track your spending. This will help you identify areas where you can cut back on your expenses.

- Set up automatic transfers from your checking account to your retirement savings account. This way, you'll save money without even having to think about it.

- Increase your income. This could mean getting a raise at your current job, starting a side hustle, or investing in your education to qualify for a higher-paying job.

- Reduce your debt. Debt payments can eat into your savings, so it's important to pay down your debt as quickly as possible.

How to create a retirement budget to determine your savings target?

To create a retirement budget, you'll need to estimate your retirement expenses. This will include things like housing, food, healthcare, and travel. Once you have a good understanding of your retirement expenses, you can start to save accordingly.

A good rule of thumb is to aim to save 70-80% of your pre-retirement income. This will ensure that you have a comfortable standard of living in retirement.

Are there tax-advantaged retirement accounts that can help you save more?

Yes, there are a number of tax-advantaged retirement accounts that can help you save more for retirement. These accounts include:

- 401(k) plans: 401(k) plans are offered by many employers. They allow you to save a portion of your paycheck before taxes are taken out.

- Individual retirement accounts (IRAs): IRAs are available to anyone, regardless of whether they have an employer-sponsored retirement plan. There are two main types of IRAs: traditional IRAs and Roth IRAs.

- Health savings accounts (HSAs): HSAs are available to people who have high-deductible health insurance plans. They allow you to save money on a tax-free basis to pay for qualified medical expenses.

Tax-advantaged retirement accounts can help you save more for retirement because they allow you to defer or avoid paying taxes on your savings. This means that your money has more time to grow.

If you are serious about saving for retirement, it is important to start early and to take advantage of tax-advantaged retirement accounts. By following these tips, you can reach your retirement goals and enjoy a comfortable retirement.