How much does social security really cover in retirement?

Social Security is an important source of income for many retirees in the United States, but it is not intended to be the sole source of retirement income. The amount that Social Security covers in retirement varies widely from person to person and depends on various factors. Here are some key points to consider regarding the role of Social Security in retirement:

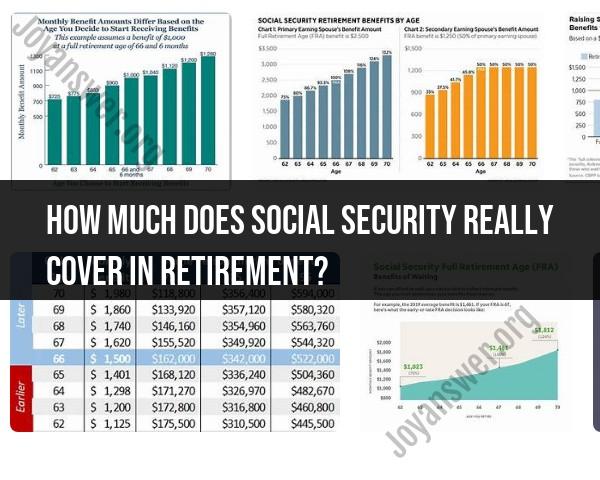

Percentage of Pre-Retirement Income: Social Security benefits are designed to replace a portion of your pre-retirement income, not the entirety. On average, Social Security benefits typically replace around 40% of the average worker's pre-retirement income. However, this percentage can be higher or lower depending on your earnings history and when you claim benefits.

Earnings History: The amount of Social Security benefits you receive is based on your earnings history, specifically your 35 highest-earning years (adjusted for inflation). If you had higher income throughout your working years, your Social Security benefits will be higher.

Full Retirement Age (FRA): Your full retirement age is the age at which you can claim your full Social Security benefits. For those born in 1960 or later, the FRA is 67. Claiming benefits before your FRA will result in reduced monthly benefits, while waiting until after your FRA can increase your benefits.

Timing of Benefits: When you choose to start receiving Social Security benefits significantly impacts the amount you receive. You can start as early as age 62, but your benefits will be reduced compared to what you would receive if you wait until your FRA or even later.

Other Retirement Income: Social Security is meant to complement other sources of retirement income, such as personal savings (e.g., 401(k), IRAs), pensions, and investment income. The more diversified your income sources, the less reliant you'll be on Social Security.

Cost of Living Adjustments (COLA): Social Security benefits receive periodic cost of living adjustments to keep pace with inflation. However, these adjustments may not fully cover the increasing costs of healthcare, housing, and other essential expenses in retirement.

Healthcare Costs: Medicare, the federal health insurance program for retirees, is often funded in part by Social Security benefits. While Medicare covers a significant portion of medical expenses, retirees may still need supplemental insurance and should budget for healthcare costs.

Lifestyle and Expenses: Your lifestyle and retirement expenses play a crucial role in determining how much Social Security covers. If you have modest living expenses, Social Security may cover a larger percentage of your needs. However, if you have high living costs or plan to travel extensively, you'll need additional sources of income.

Savings and Investments: Personal savings and investments provide a financial cushion in retirement. Having savings in addition to Social Security benefits can make a significant difference in maintaining your desired standard of living.

In summary, while Social Security is an important source of income for retirees, it is not designed to fully cover all expenses in retirement. The percentage of income it replaces varies from person to person based on factors like earnings history, timing of benefits, and other income sources. Planning for retirement should include a diversified approach that incorporates savings, investments, pensions, and Social Security to ensure financial security and a comfortable retirement lifestyle. Consulting with a financial advisor can help you create a retirement plan tailored to your specific needs and goals.

How does Social Security work as a retirement income source?

Social Security is a federal program that provides retirement, disability, and survivor benefits to eligible workers and their families. Social Security is funded by payroll taxes that are paid by workers and their employers.

To be eligible for Social Security benefits, you must have worked and paid Social Security taxes for a certain period of time. The amount of your Social Security benefits is based on your lifetime earnings.

What portion of your retirement income does Social Security typically cover?

Social Security benefits are designed to replace a portion of your pre-retirement income. The amount of Social Security benefits you receive will vary depending on your lifetime earnings.

According to the Social Security Administration, Social Security benefits replace about 40% of pre-retirement income for the average worker. However, Social Security benefits can replace a larger portion of pre-retirement income for lower-income workers.

How can you maximize your Social Security benefits?

There are a few things you can do to maximize your Social Security benefits:

- Work for at least 35 years. The longer you work, the higher your Social Security benefits will be.

- Earn as much as you can throughout your career. Your Social Security benefits are based on your lifetime earnings, so the more you earn, the higher your benefits will be.

- Delay claiming your benefits. You can start claiming Social Security benefits as early as age 62. However, your benefits will be reduced if you claim before your full retirement age. Your full retirement age is 67 for people born in 1960 or later.

Are there potential changes to Social Security that may impact retirement planning?

Yes, there are potential changes to Social Security that may impact retirement planning. For example, the Social Security Administration has projected that the Social Security Trust Fund will be depleted by 2037. This means that Social Security benefits may be reduced or eliminated in the future.

It is important to be aware of the potential changes to Social Security and to plan accordingly. You may want to consider saving more for retirement and/or working longer to reduce your reliance on Social Security benefits.

What other sources of retirement income should you consider besides Social Security?

In addition to Social Security, there are a number of other sources of retirement income that you should consider, such as:

- Employer-sponsored retirement plans: Many employers offer retirement plans such as 401(k)s and pension plans. These plans can provide a significant source of retirement income.

- Personal savings and investments: You can save for retirement on your own by investing in stocks, bonds, and other financial products.

- Annuities: Annuities can provide guaranteed income for life.

It is important to have a diversified retirement income stream. This will help to ensure that you have a stable source of income in retirement.

You should also consider working with a financial advisor to develop a retirement plan that is tailored to your individual needs and goals.